Banks hold out as soaring costs force Aussie blue chips to cut dividends

Inflationary pressure, higher costs, dwindling cash flows and a tough economic climate are all pushing big Australian companies to pay shareholders less dividends according to the latest data.

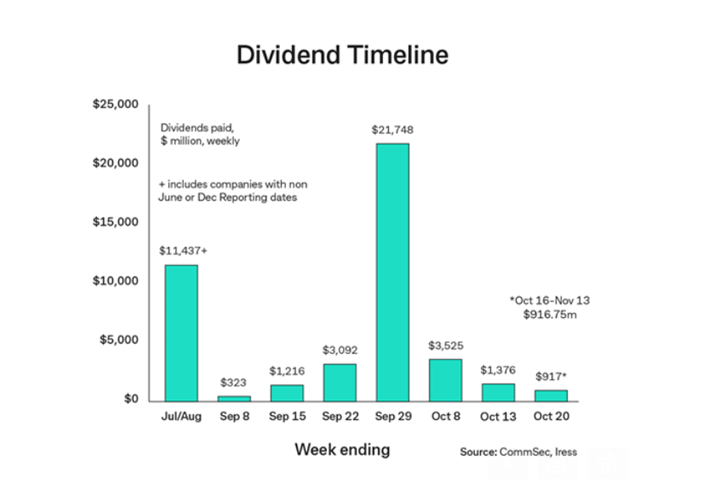

According to Commsec shareholders in total will receive just over $32 billion in dividends between August and October, down 24 per cent from a year ago. If dividends declared by the big banks in July are included, that total rises to $43.6 billion, a more modest 12 per cent drop (see chart).

“Despite the current uncertain environment, around 87 per cent of ASX 200 companies have elected to pay dividends, but a higher proportion have reduced payouts compared with a year ago,” CommSec chief economist Craig James (pictured) explained in the report.

Reflecting the challenge to cash flows, analysts have cut dividend payout estimates at a pace not seen since 2009, excluding the COVID-19 period. The average dividend payout ratio among Australian companies on the S&P/ASX 200 is near decade lows at 62 per cent, compared with 72 per cent prior to the pandemic. And dividend-per-share estimates for the next 12 months have been cut by 14 per cent compared with a year ago.

“The 12-month forward estimated dividend yield for the S&P/ASX 200 index is currently 4.06 per cent, below the long-run average near 4.7 per cent since 2005,” James said.

“Still, returns on Aussie shares remain attractive versus bank deposits, bonds and overseas shares, with grossed-up dividend yields of around 5.7 per cent,” he said. “For the S&P/ASX 200 index, the historic dividend yield stands at 4.5 per cent.”

Miners cut dividends sharply

While the big miners are still paying historically high dividends, they are down significantly from 2022. BHP’s upcoming payout of $6.3 billion is down 51 per cent from a year ago, and the mining giant previously slashed its interim dividend by 40 per cent as its earnings fell, CommSec noted.

Rio Tinto has trimmed dividend payouts by 32 per cent after slashing its interim dividend by 34 per cent, and Fortescue will issue a dividend around 14 per cent lower than a year ago.

“Understandably, companies have to take current and prospective conditions into account when deciding on what dividends to pay,” James said. “Faced with rising costs, slowing consumer demand and a weakening Chinese economy, companies lowered their dividends in the recent reporting season.

“That is especially the case of the large iron ore producers in the latest round of earnings,” he added. “Profits are down over the past year, reflecting lower realised iron ore prices. And the outlook continues to suggest that lower iron ore prices lie ahead.”

Banks in strong position

One sector that is still lifting dividends is financial services, with Commonwealth Bank of Australia’s recent annual dividend payout coming in 17 per cent higher than a year ago. Bendigo & Adelaide Bank’s payout is 21 per cent higher, Suncorp’s is up 59 per cent, and QBE’s payout is up 56 per cent, according to the CommSec data.

Globally, dividend payments are rising, lifting to a new record of US$568.1 billion (including special and one-off dividends) in the second quarter of 2023, up 4.9 per cent from the first quarter on a headline basis, according to the latest Janus Henderson Global Dividend Index. US dividend payments increased 2.6 per cent during the second quarter.

However, as economic growth around the world moderates with higher interest rates, markets now expect global profits to be flat this year, after soaring to record highs in 2022. Ben Lofthouse, head of global equity income at Janus Henderson, said in the report that as a result, companies worldwide are now more cautious about paying dividends – although he expects dividend growth to continue.

“We believe the banking sector in particular will continue to deliver solid growth for the rest of the year, making record payments to shareholders,” Lofthouse (pictured) wrote.

“A weaker economic environment is typically negative for banks, but the positive effect on bank margins from the end of years of ultra-low interest rates is very powerful and is driving dividend payouts. The big banks are very tightly regulated and so enter the downturn in a strong capital position.”