As the FASEA exam deadline of 1 January 2022 nears, the significant impacts on the financial advice industry continue to garner headlines. According to reports, total adviser numbers have now fallen to below 19,000 with many more set to leave in 2022. Similarly, statistics suggest there are as many as 2 million unadvised clients in…

The Responsible Investment Association of Australasia delivered an early Christmas present for ESG investors and trustees alike, confirming the long-debated question as to whether ‘green’ or ‘responsible’ super funds outperform. The answer was a resounding yes for those funds that are categorised as leaders according to the RIAA’s extensive survey and due diligence process. The…

“Undue complexity”. “Byzantine complexity”. “Elephantine proportions”. These are just a few of the superlatives used to describe one of Australia’s most important pieces of legislation, the Corporations Act 2001. The legislation turned 20 years old this year and whilst it has played an important role in simplifying the financial services landscape, few would disagree with…

There has long been a saying in Australian investment circles that shorting the Big Four banks was the “widow maker”. The same could be said for a short selling strategy in general during what has been a near decade long bull market. It takes a different kind of mindset to launch a short selling strategy…

Magellan Financial Group (ASX:MFG) and its founder Hamish Douglass have been a lightning rod for investors, analysts and the media in recent months. After over a decade of outperformance, Magellan’s flagship global fund came back to earth, with Douglass’ unwillingness to chase returns in ‘value’ stocks seeing the fund underperform. Combine that with the decision…

Financial advisers can’t be faulted for feeling pessimistic about the future as another year comes to an end. The last few years have seen the advisery world turned upside down, with those who remain paying for the sins of others. But regulation is only one part of the story, as their primary role providing strategic…

The COVID-19 pandemic and associated market sell-off became an unexpected testing ground for many of the more recent advancements in financial markets and investing. One growth area that has passed with flying colours, according to its predominantly institutional proponents, is factor investing. Defined as an investment approach that seeks to target specific drivers of returns…

There was both despair and positivity when the much-anticipated changes to the transparency of industry super fund proposals was released recently. Both 2020 and 2021 have seen growing pressure on the industry fund sector from the Coalition government and a number of committees as they sought to lift the lid on the massive part of…

Australia’s longest standing responsible investment manager, Australian Ethical, has continued to sustain the top quartile performance of their Australian equity strategies, with a surge in assets under management seemingly having little influence on their returns. In their latest quarterly update, the group highlighted the events of COP26, but with a broader focus suggesting the conference…

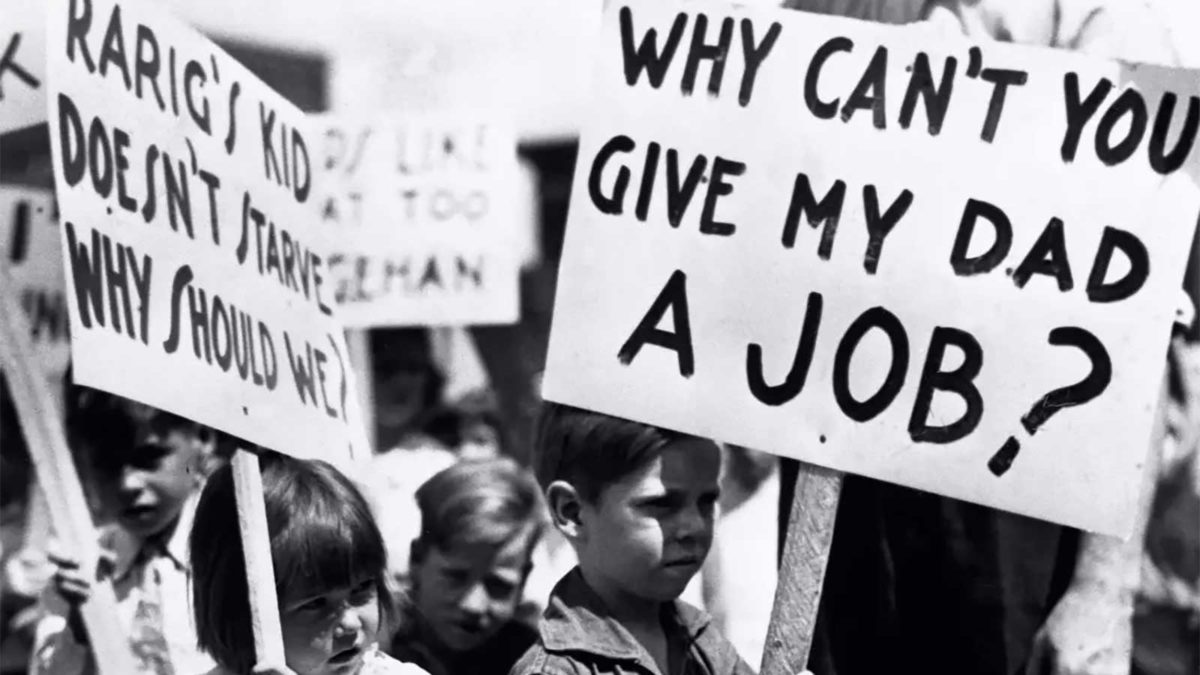

“To work, or not to work” was the title of Franklin Templeton’s Chief Investment Officer of Fixed Income, Sonal Desai’s latest white paper. The detailed analysis on the US labour market offers insights into the future that lies ahead for Australia but also into the unique and difficult conditions the world is in as we…