Global sharemarkets were shaken by the inevitable news that Russia had finally attacked various targets in Ukraine, all but declaring war on the nation. Whilst the implications are likely to be localised, the impact on the oil price and its role within the global economy will be felt far and wide. In a positive for…

Speak with any financial adviser today, and it’s likely that their biggest investment concern isn’t related to the equity component of their portfolio. After two years of strong markets, most are sitting on strong returns despite the recent uptick in volatility. With the near-consensus view that interest rates are set to move higher sooner rather…

Inflation has remained in the headlines through February and will likely continue to do so throughout the remainder of the year. Yet whilst the headlines suggest both inflation and interest rates are heading higher in a straight line, the real world impact is far more nuanced and uncertain. This was the central focus of a…

Traditional fixed income allocations, whether in the form of corporate or government bonds have been on the nose in 2022 and most of 2021 for that matter. The threat of inflation and associated rate hikes led many to rename the sector as ‘fixed loss’ rather than fixed income. Andrew Canobi, co-Portfolio Manager of the flexible…

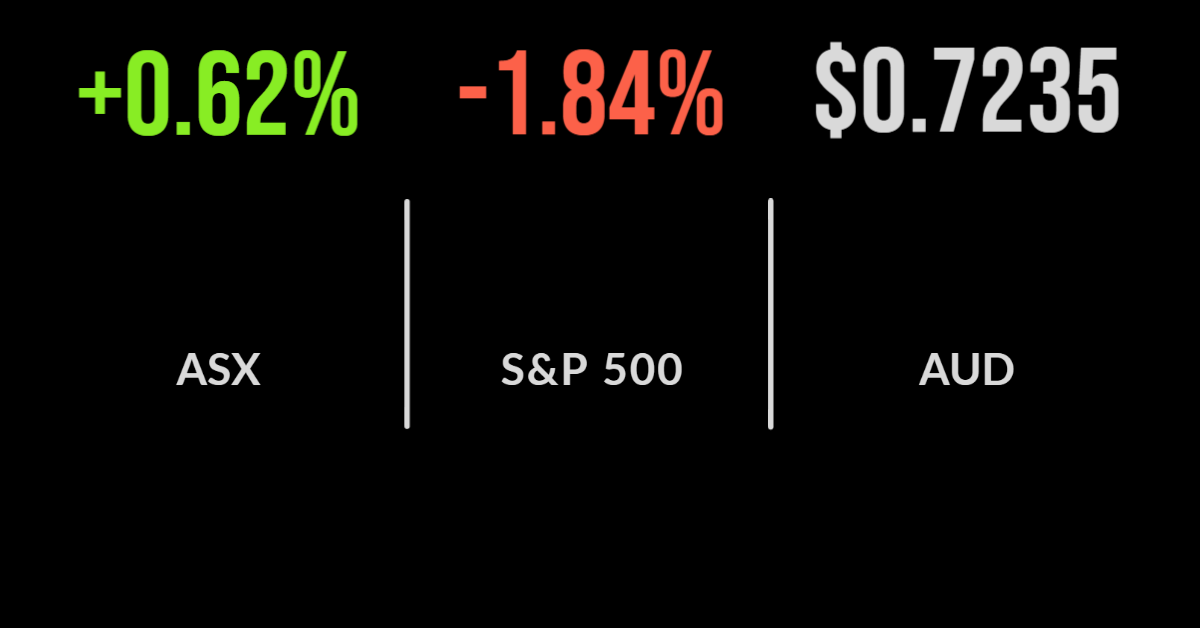

The Australian market overcame increasingly weak global sentiment to post a gain of 0.6 per cent on Wednesday. Whilst the events in Ukraine and associated impacts on the price of energy remain a major concern, another bumper day for reporting season pushed the market higher, with the technology and communication sectors faring best. WiseTech (ASX: WTC)…

The unexpected run of earnings and profit surprises in 2021 wasn’t enough to offset geopolitical concerns from Russia, sending the S&P/ASX200 down 1 per cent on Tuesday. The losses remain focused around the higher valued IT and discretionary sectors, which were down 3.2 and 2.7 per cent respectively. Energy has been the biggest beneficiary given Russia’s key…

The Australian sharemarket looked to be succumbing to overseas weakness on Monday, falling as far as 0.7 per cent before rebounding in the afternoon, to gain 0.2 per cent for the session. On what was a massive day for reporting season all eyes were on Russia, with the US and Russia agreeing to talks in part…

Most financial advisers have likely been inundated with phone calls in recent weeks as markets took a negative turn following another prosperous year for investors. Loss aversion is one of the most basic human instincts, which makes informed and prudent investing incredibly difficult during periods of change. This natural instinct is perfectly leveraged by the…

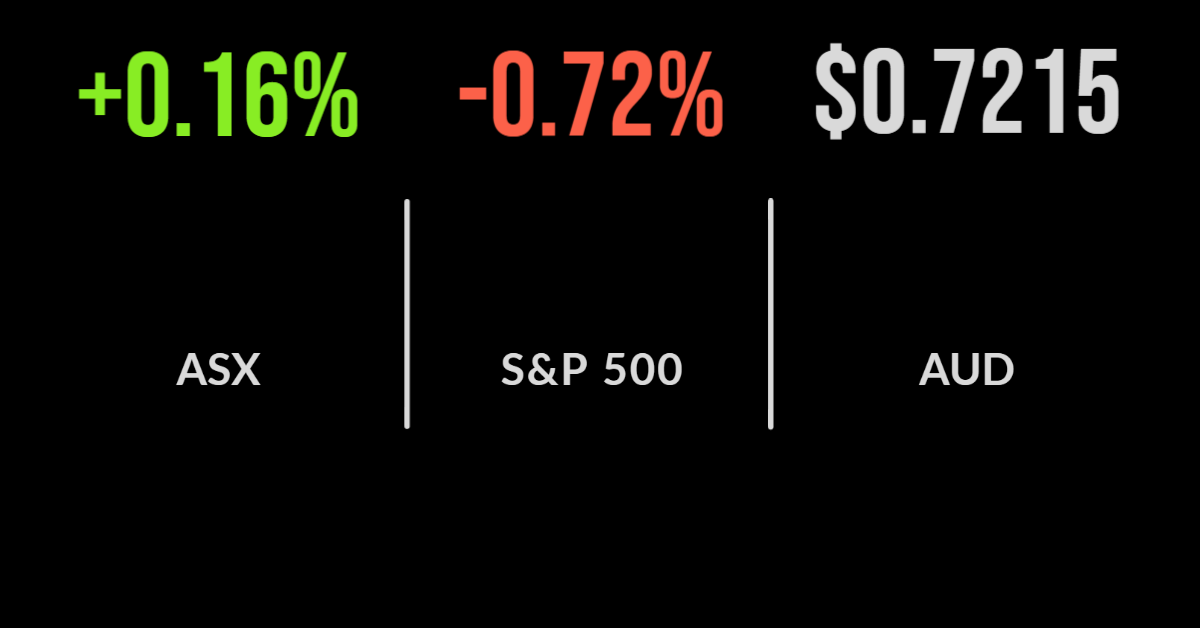

Surges from CSL and BHP powered the Australian sharemarket to a three-week high on Thursday – but the market is likely to struggle today following overnight falls in the US. Australia’s benchmark S&P/ASX 200 Index gained 11.3 points, or 0.2%, to 7296.2, its highest level since January 20. The healthcare sector led the rise, up just under 3%, led by CSL, which saw…

Healthy earnings results from the likes of CSL, Treasury Wine Estates and Pro Medicus helped to push the Australian sharemarket higher on Wednesday, offsetting losses from the major resource stocks as iron ore and oil prices fell. The benchmark S&P/ASX 200 Index gained 78 points, or 1.1%, to 7284.9, following a strong lead from Wall Street on Tuesday night,…