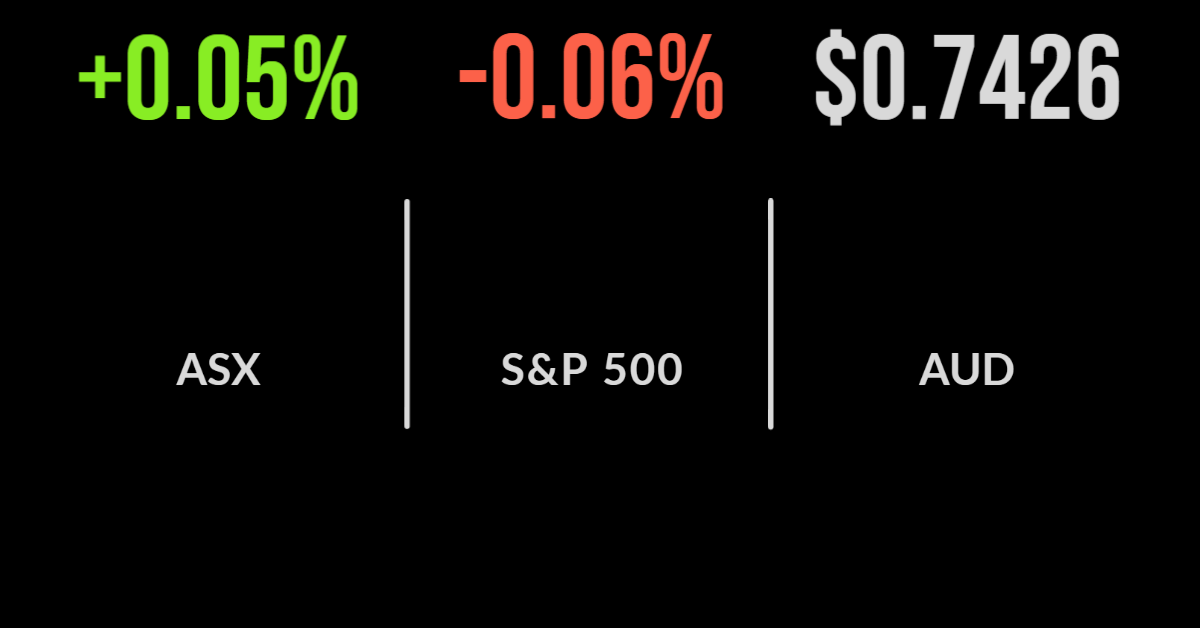

It was a flat day for the local bourse, with the S&P/ASX200 managing to deliver a gain of just four points or 0.05 per cent as the dualling pull of falling commodity prices and a surge in healthcare offset each other. The materials sector was down 1.5 per cent and energy 0.6, with every other…

The shortened week has begun positively with the S&P/ASX200 gaining 0.6 per cent despite lower-than-normal volumes. The release of the RBA’s policy meeting minutes dominated the conversation with commentary around the proximity of rate hikes now suggesting they will come sooner rather than later. The result was the perceived ‘inflation hedges’ within the market outperforming,…

Magellan’s investment in fast growing fintech FinClear is becoming more prescient by the day, with the company this week announcing they will shortly be rolling out a share registry dedicated to private companies. In 2021, the group took over third party clearing house Pershing, which took their technology-driven platform to adminstering some $130 billion in…

“It’s not about forecasting if it is going to rain, one should always carry an umbrella” explained Hugh Selby-Smith when discussing the ‘system challenge’ facing investment advisers as we move deeper into 2022. Speaking at The Inside Network’s Equities and Growth Assets Symposium in Sydney, Selby-Smith delivered a wide-ranging, thought-provoking presentation on the significant challenge…

One of Australia’s fastest growing wealth management and financial advisory firms, Akambo Financial Group, this week announced a merger with Melbourne-based First Financial, effective immediately. The group will combine to manage more than $3 billion on behalf of a diverse range of clients. It marks one of the most significant deals in the financial services…

It was another weak day for the local market with every major sector falling on Tuesday and dragging the S&P/ASX200 down another 0.4 per cent. The primary driver remains the oil price, which fell by 4 per cent, and the surging bond yields impacting valuations. This trend has benefitted the gold mining sector which contributed…

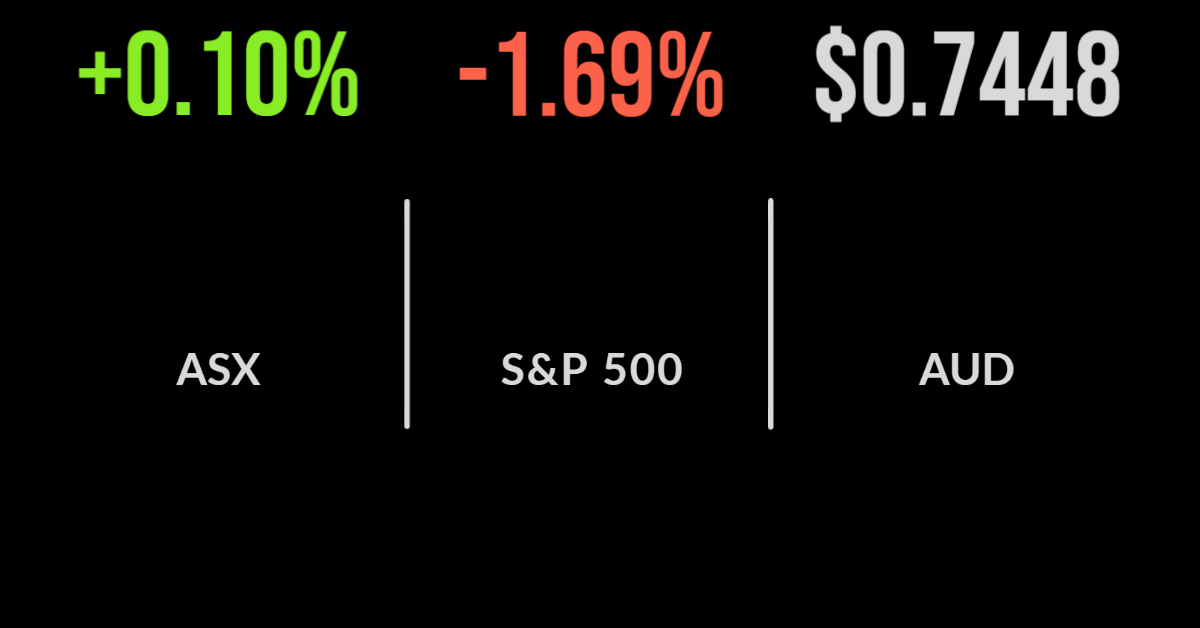

It was another volatile day for the S&P/ASX200, with the market trading significantly higher before reversing gains to finish up just 0.1 per cent. The market and individual sectors continue to diverge on a daily basis as the pressure of the 10-year Australian government bond yield impacts valuations very differently. The financial and banking sector…

To understand where the global economy stands today, we must look to the past and most importantly back to the business cycle, explained Irene Tunkel, Chief US Equity Strategist at BCA Research. Speaking at The Inside Network’s Equities and Growth Assets Symposium last week, Tunkel highlighted the unique challenges facing every investor in the world….

Both houses of Parliament quietly passed what may well be the biggest changes to super contribution rules in a decade. With the Treasury Laws Amendment Bill just only awaiting Royal Assent, 2022 will see retirees and soon to be retirees provided with significantly greater flexibility in putting additional cash into superannuation. The most important and…

A strong rally to close out the week, with the S&P/ASX200 finishing 0.5 per cent higher, wasn’t enough to offset downward pressure during the week, with the market ultimately losing 0.2 per cent. Performance was varied on Friday, with materials and industrials both outperforming, gaining 1.3 and 0.9 per cent amid surging commodity prices and…