The local market finished the week on a high note, gaining 1.9 per cent on the back of an incredible surge in the technology sector. The mid-session turnaround in the Nasdaq pushed the technology sector to a 6.9 per cent gain after the US-listed payment provider and owner of Afterpay, Block (ASX: SQ2) gained 15…

The technology sector all but sunk the local market today with the S&P/ASX200 sinking 1.8 per cent on the back of an 8.2 per cent fall in the sector. Every other sector was lower, with energy and real estate down more than 2 per cent and financials outperforming by falling just 0.8 per cent. Just…

The last few years have seen both massive opportunities and challenges for ethical and ESG-focused investors.

March stands out as being one of the most difficult periods for investors in a generation. On the one hand, bond markets send fixed income to its worst return in more decades, and on the other, equity markets were sold off broadly on valuation concerns as bond yields ended a forty-year downward trend.

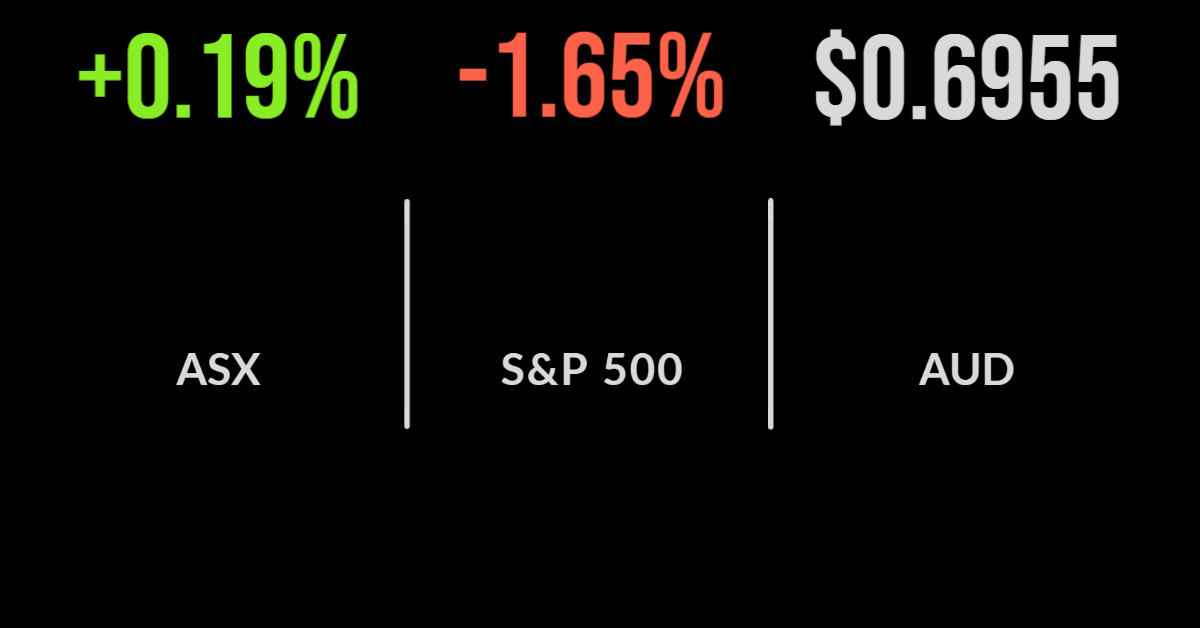

The domestic market managed to eke out a small gain, recovering from as much as 1 per cent down to send the S&P/ASX200 0.2 per cent higher on Wednesday. Positive signs from Asia, including a broadly expected jump in Chinese inflation contributed to the settling of nerves with the materials sector recovering 0.9 per cent….

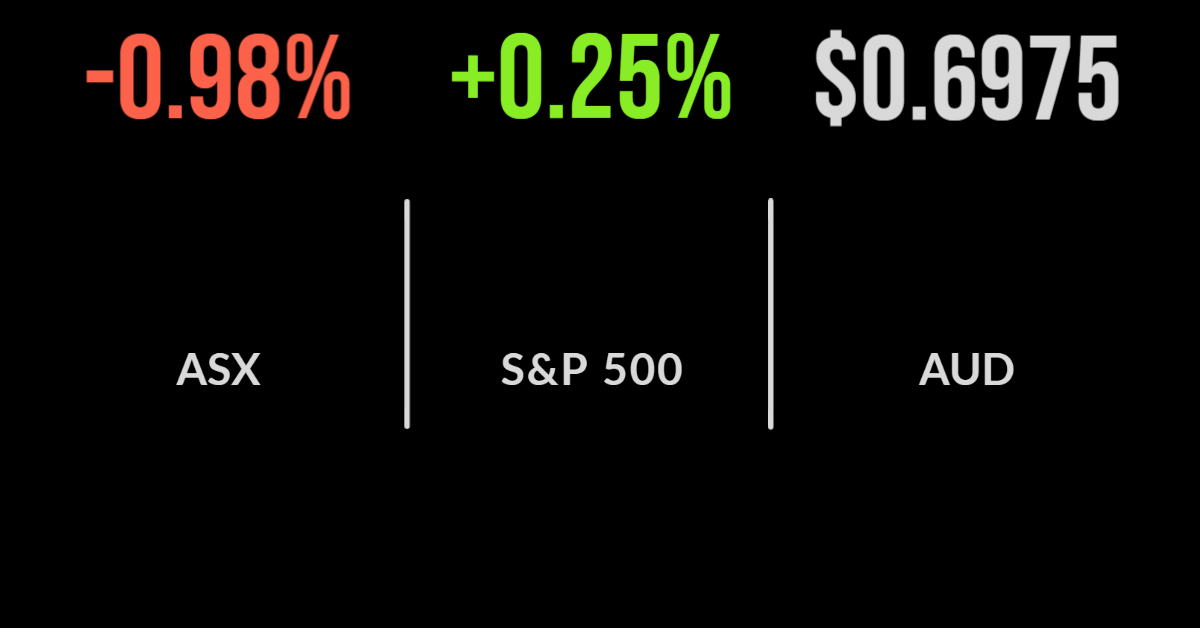

The local sharemarket followed global markets lower, with the S&P/ASX200 opening as much as 2.5 per cent lower. The day’s trade was a story of the weight of numbers, with every sector barring communication finishing lower, but more companies gaining than falling. The size and scale of weakness in energy and commodities, down 2.1 and…

There are few signs that the global selloff is slowing down, with a weak US lead on Friday contributing to another 1.2 per cent fall on the S&P/ASX200. The threat of higher interest rates and inflation are now been compounded by news that the Chinese government had extended lockdowns in key capital cities potentially adding…

The Reserve Bank of Australia officially joined the hiking party this month, and while the implications for Australian homeowners and businesses is important, it has little impact on the global economy.

“Patience is a virtue” may well be the best way to explain the performance of the Australian sharemarket in the March quarter.

The local market closely followed the global lead with the S&P/ASX200 experiencing its worst session since Russia invaded Ukraine. All 11 sectors of the market were lower with technology and real estate the hardest hit, down 4.5 and 3.4 per cent for the day, whilst consumer staples naturally outperformed, falling just 0.2 per cent behind…