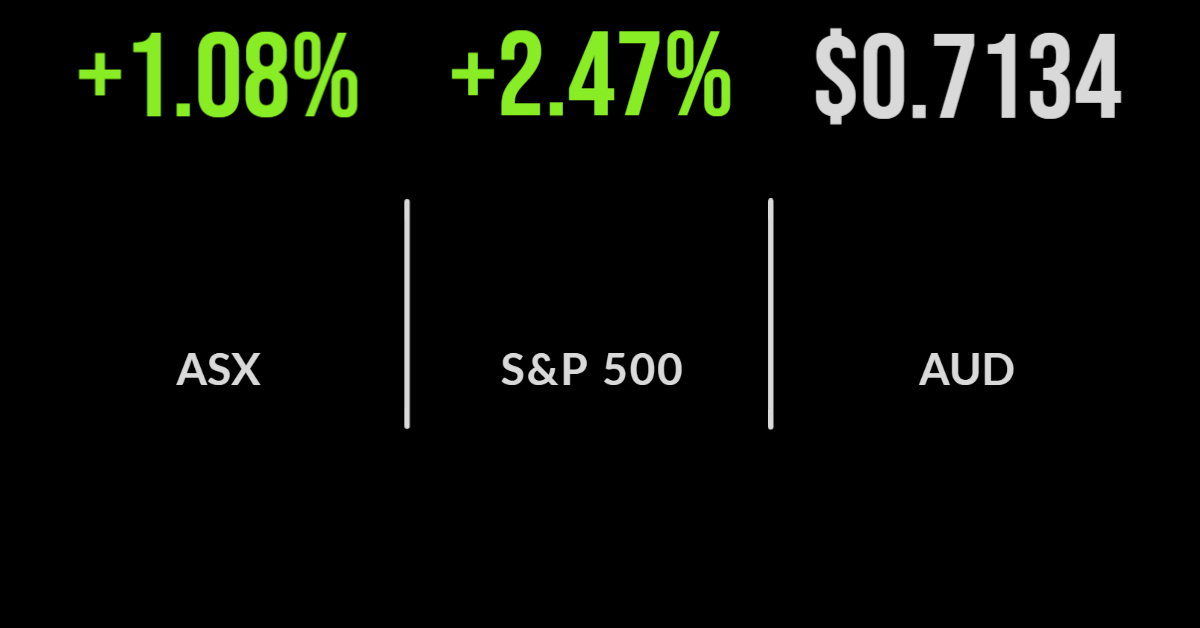

The local market delivered a strong finish to the week, gaining 1.1 per cent on the back of a strong global lead. The primary driver was a weakening of the rhetoric from Chair Powell in relation to the course of rate hikes in the coming months. Energy and discretionary retailers were the standouts, gaining more…

Appen left at the altar A bizarre blink-and-you-missed takeover approach came and seemingly went for one of the local market’s tech leaders Appen, which develops the datasets for machine learning and artificial intelligence. Canadian company Telus International sprang a $9.50 a share bid on the company, which said it would talk to Telus to try to…

Australian portfolios are not appropriately positioned for the risk and reward on offer from the multitude of asset classes and sectors available, contended Nick Cregan of Fairlight Asset Management.

Bond markets have effectively become the ‘freight train’ of a long series of other assets, with a surge in bond yields pulling nearly every other asset class lower.

It appears that regulators around the world are getting more serious on ESG, with the US Securities Exchange Commission, similar to Australia’s ASIC, announcing a number of proposals targeted at the growing trend of ‘greenwashing’.

Aussie market creeps higher Despite a steady diet of news of war, global slowdowns, China lockdowns, inflation and higher rates, the Australian share market managed to rise on Wednesday, as measured by the benchmark indices. The S&P/ASX200 index added 26.4 points, or 0.4 per cent, to finish at 7,155.2, while the broader S&P/ASX All Ordinaries index…

China sniffles hurt market The Australian share market was weighed down on Tuesday by concerns that COVID-19 lockdowns have hurt economic growth in China, the benchmark S&P/ASX 200 index finished down 20.1 points, or 0.3 per cent, to 7,128.8, while the broader S&P/ASX All Ordinaries closed 0.35 per cent, or 25.7 points, lower to 7,373.2. Commonwealth…

Election, what Election? A change of government was yawned-off by the Australian share market on Monday; after being up by 50 points in morning trading, the benchmark S&P/ASX 200 index closed just 3.3 points higher, at 7,148.9. The broader S&P/ASX All Ordinaries rose 7.9 points, or 0.1 per cent, to 7,398.9. All four big banks declined, with…

Given the flood of changes and regulatory oversight that has resulted from the Royal Commission, it likely comes as a surprise to many that the impending Quality of Advice Review, was actually a recommendation of Commissioner Hayne.

Cybersecurity has become the latest battle facing the under pressure, stressed financial advice industry following a landmark court ruling.