Whilst there are growing signs that inflation is moderating around the world, whether in the US, UK or Australia, some 125 of the world’s central banks are current in the process of tightening monetary policy.

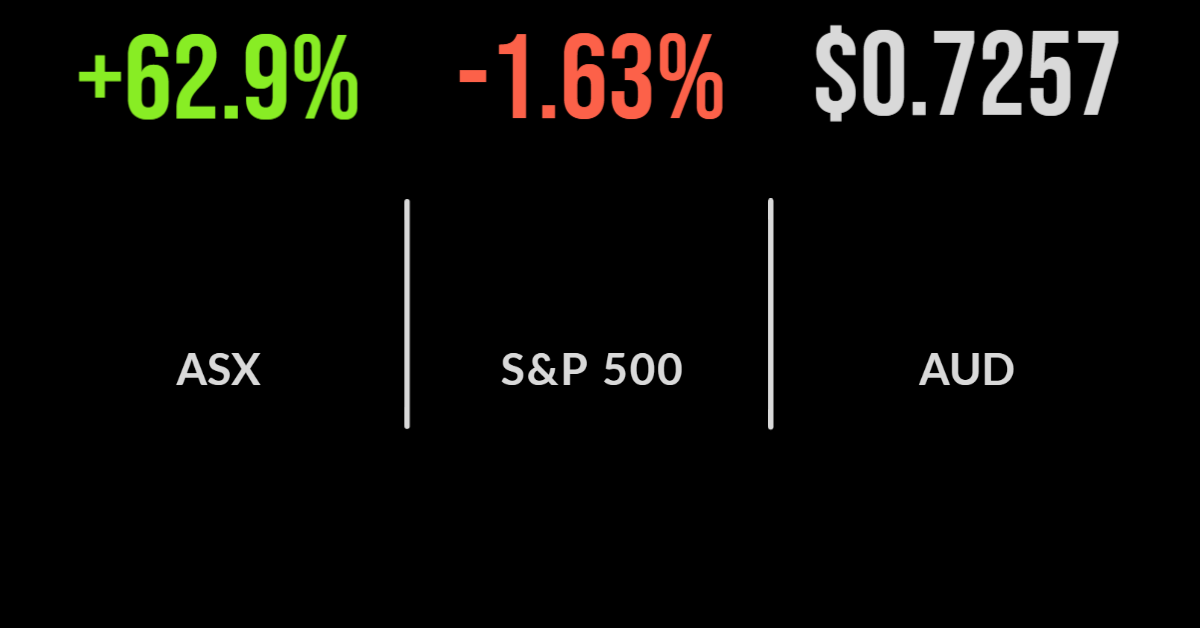

The local market finished the week on another positive note, despite the return of concerns about the aggressiveness of central banks around the world, with the S&P/ASX 200 posting a 0.9 per cent gain on Friday. It was propelled by the materials sector, with copper and iron ore miners benefitting from the loosening of lockdowns but more…

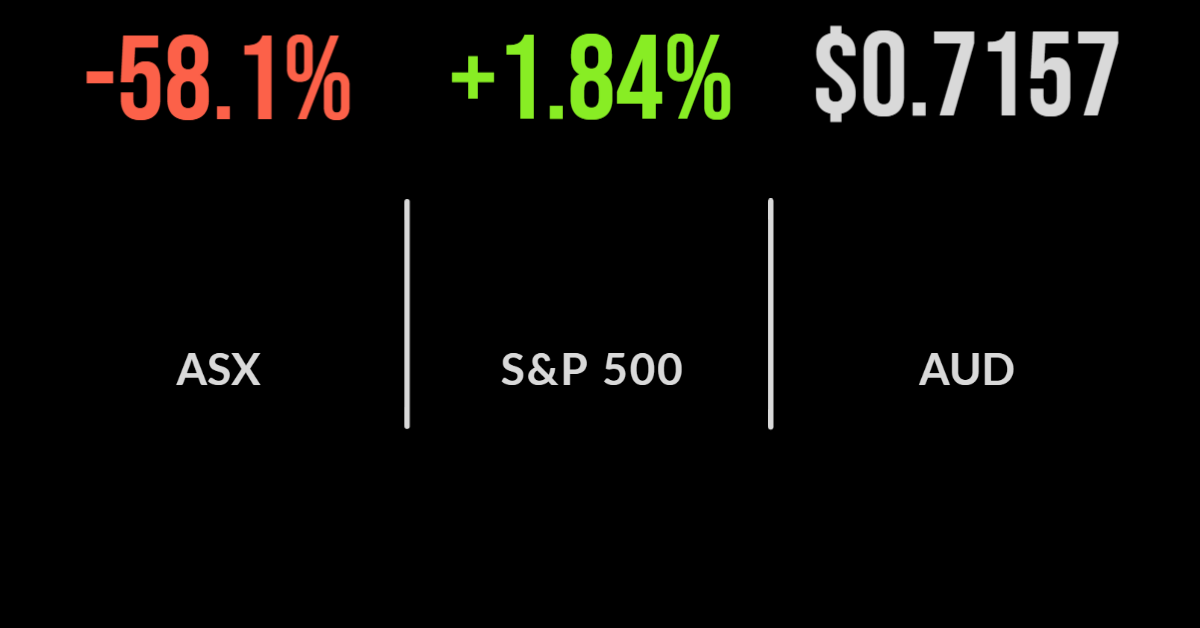

The local market continued on a negative trend to open the month of June with the S&P/ASX 200 falling 0.8 per cent on the back of a broad-based selloff. The biggest detractor was the healthcare and technology sectors, falling 1.8 and 2.5 per cent respectively as US Federal Reserve members continue to predict aggressive rate hikes. Cochlear (ASX:COH) and CSL (ASX:CSL)…

AUSIEX, one of Australia’s leading wholesale brokerage firms, this week highlighted the growing popularity of ESG and sustainable investment trades.

“We spend the majority of our research time on understanding industries,” explained Catherine Allfrey, portfolio manager of Wavestone Capital, when presenting to leading financial advisers at The Inside Network’s Equities Symposium in Perth last month.

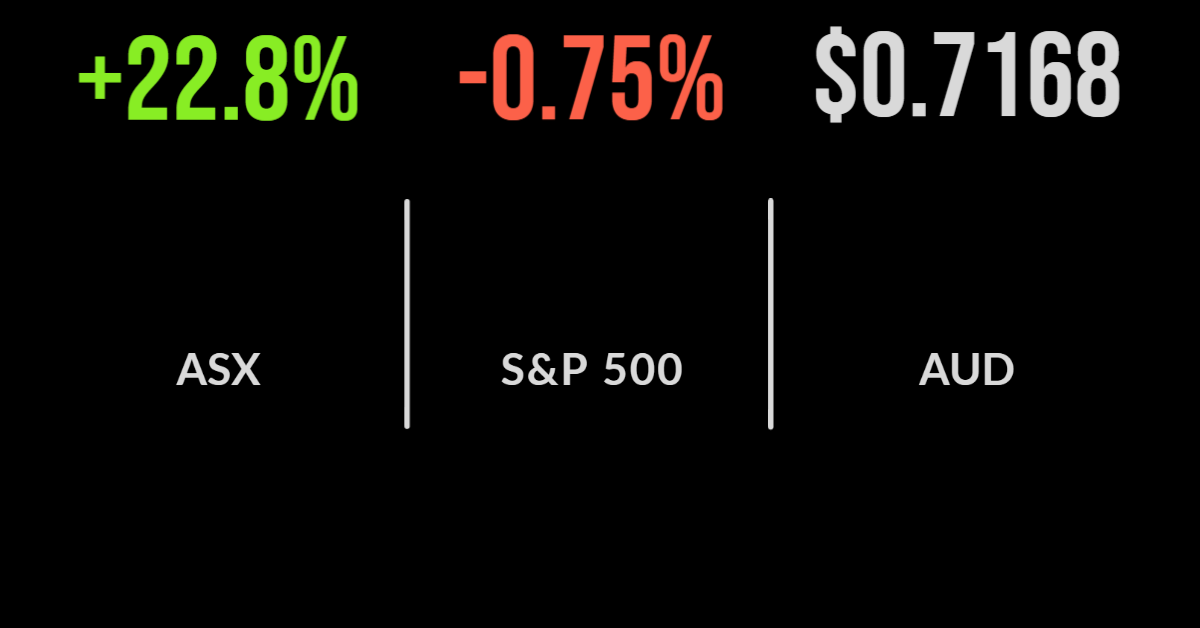

The local market managed to eke out a positive return on Wednesday, gaining 0.3 per cent on the first trading day of June. Another rally in the iron ore price, which supported the likes of Fortescue (ASX:FMG) and BHP (ASX:BHP), the latter up 2.3 per cent, wasn’t enough to dig the materials sector out of…

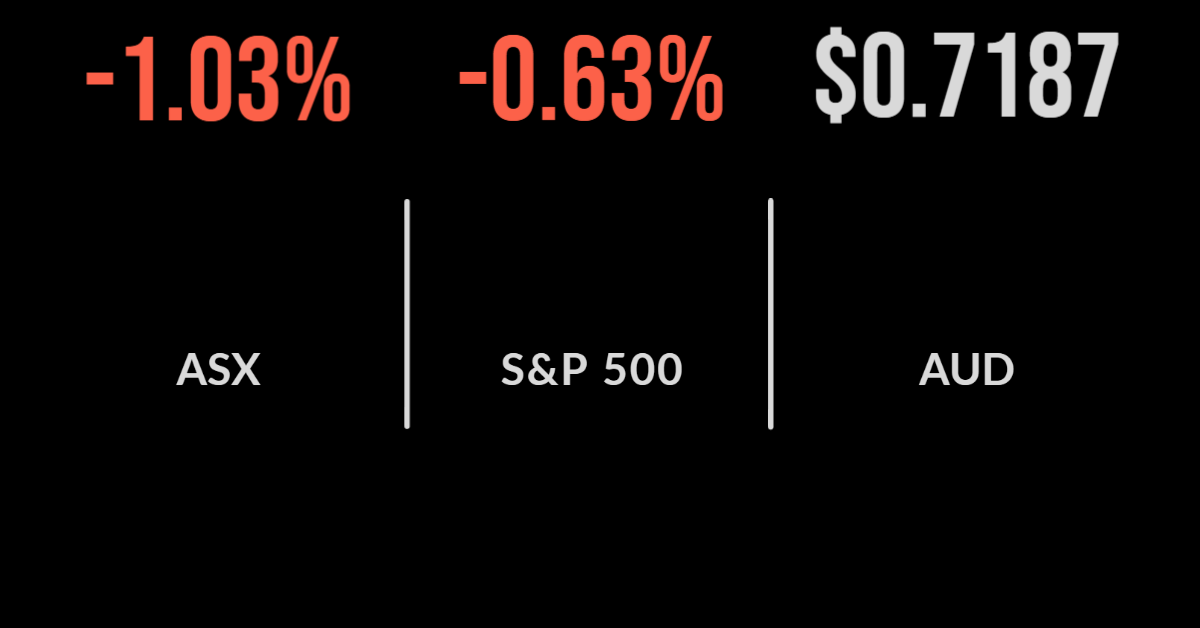

The domestic market managed to reverse the prior day’s gains, falling 1 per cent on Tuesday after US bond yields jumped on further central bank commentary. This coincided with agreement on further bans on Russian oil imports which sent the oil price above US$120 per barrel. Every sector was lower, led by technology and financials,…

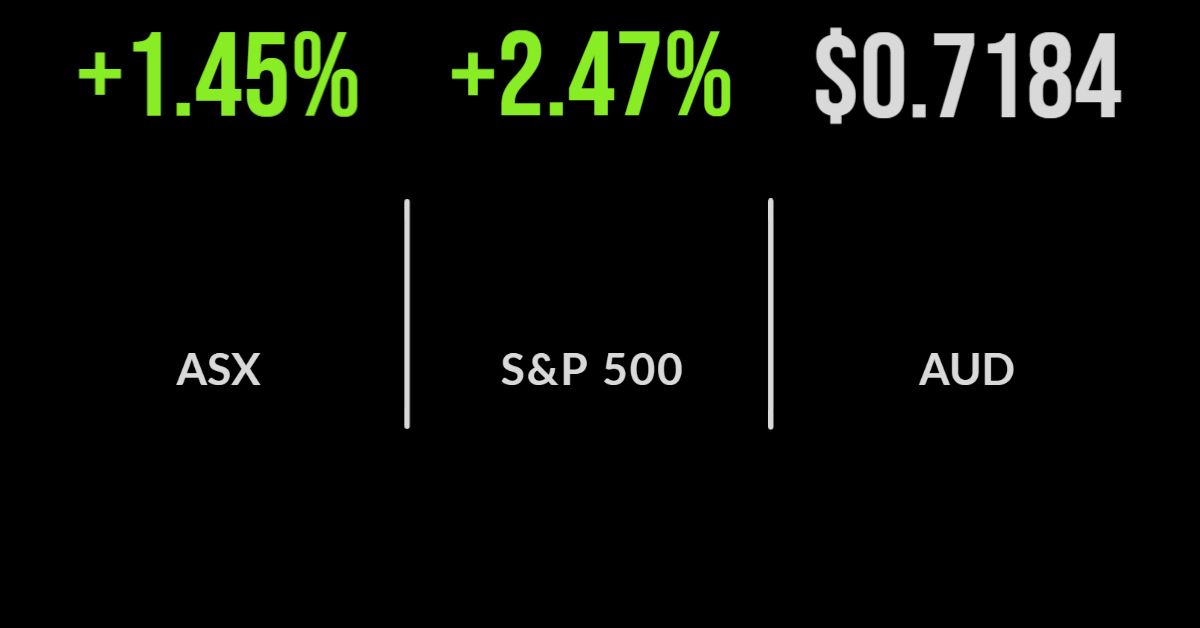

The weakest monthly inflation print in close to two years offered the best possible backdrop for the local market on Monday, with the S&P/ASX200 gaining 1.5 per cent. Technology was the standout, up 4.6 per cent, with only a small handful of companies falling on a buoyant day for the market, led by AGL Energy…

‘An era of structural inflation is upon us” explained Con Michalakis, head of investments at Statewide Super, speaking at The Inside Network’s Equities and Growth Assets Symposium, held recently in Adelaide for the first time. Challenged with setting the scene for the full-day discussion on equity and growth allocations, Michalakis drew upon his extensive experience…

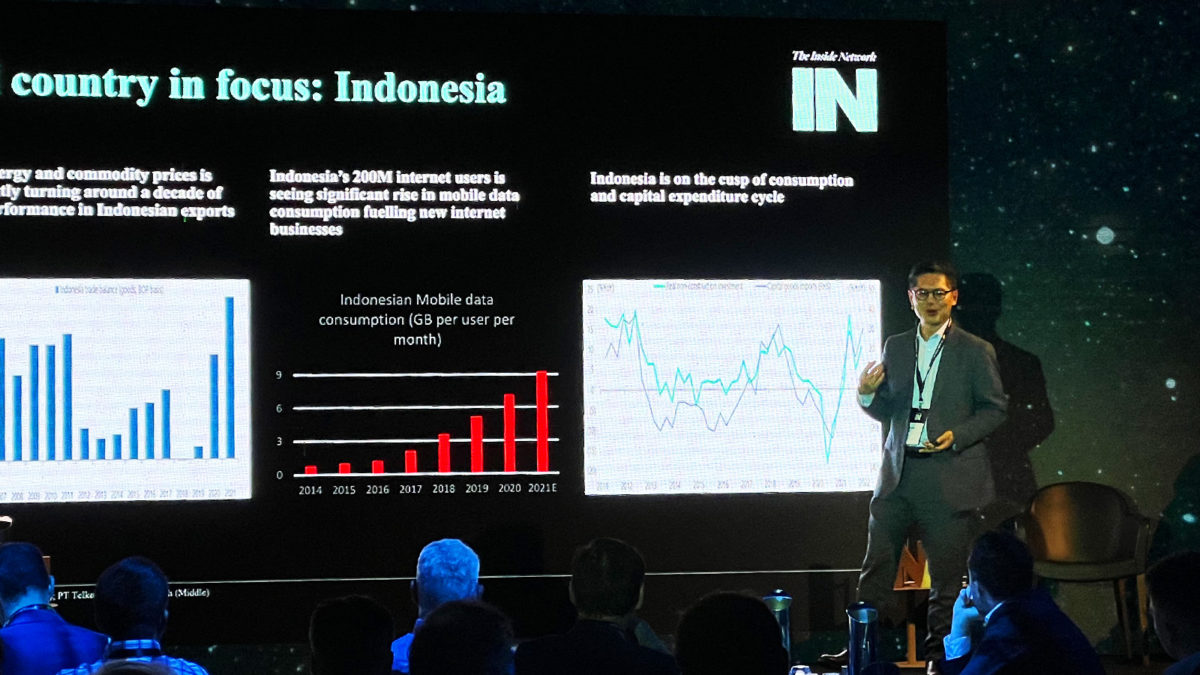

“Have we really thought about the investment implications of a world in which inflation is persistent?” That was the question posed by Dr Joseph Lai of Ox Capital.