Australian Ethical wins Responsible Manager of the Year

Money Management held its fund manager of the year awards last week. Presented by TV personality Andrew Daddo, the awards recognise stellar fund manager performance at a time when markets underwent bouts of extreme volatility.

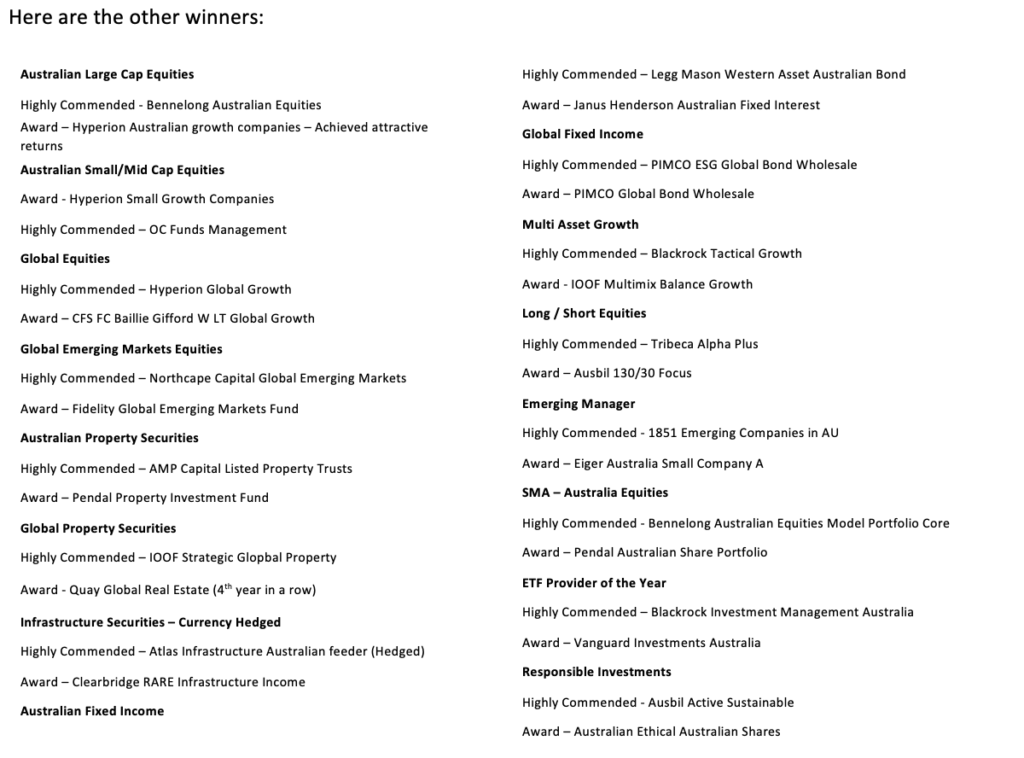

There were numerous awards in various categories, but ultimately the Fund Manager of the Year Award for 2021 was taken out by Hyperion Asset Management, which was the obvious winner, having taken out the Aussie Large Cap Equities and Small/Mid Cap Equities awards with its high-growth approach. The asset manager won the first two and was given a “highly commended” award for the latter.

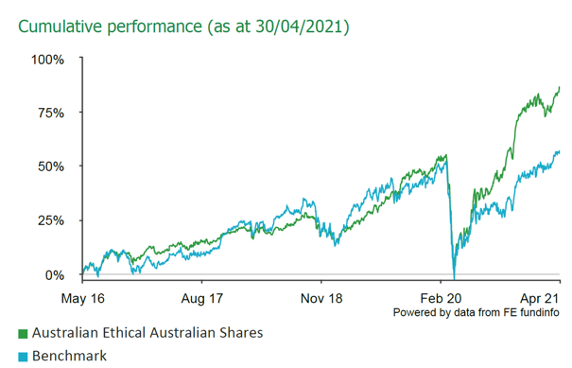

While Hyperion took out the two Australian equities awards, Australian Ethical Investments took out the Responsible Investing award for Australian Equities. It’s been an exceptional year for Australian Ethical with investor numbers up 22% and funds under management pushing well past the $5 billion mark, clearly reflected in its current share price, which is up roughly 86.9% so far in 2021.

Australian Ethical Investments (ASX: AEI)

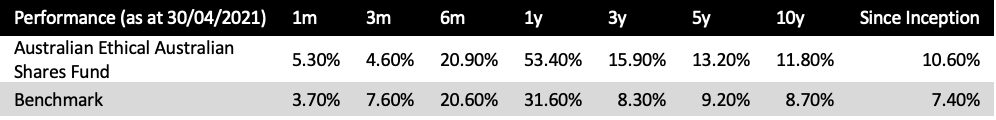

At its recent earnings result, the fund manager recorded a massive increase in net inflows, up more than 43% on the previous corresponding period. Australian Ethical has been able to deliver competitive financial performance by investing responsibly in well-managed ethical companies, that deliver positive change to society and the environment.

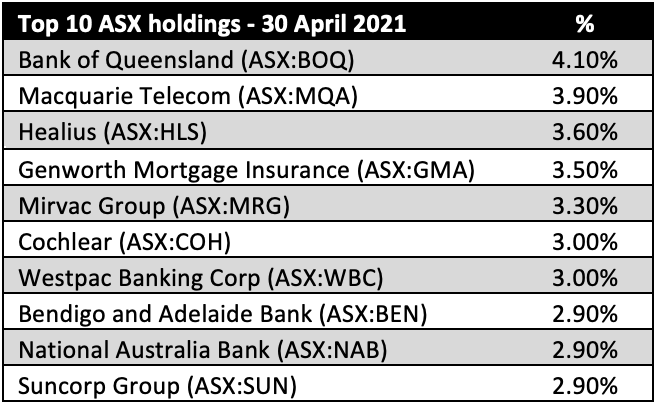

The team uses active stock-picking for growth rather than income stocks, with a bias towards smaller capitalisation stocks listed on the ASX. The team then select stocks based on relative value to where risk has been adequately priced. And finally, an ESG screen is used.

Here is the Australian Ethical Investments portfolio as at the 31 April 2021.

The stock performance of an Australian fund manager that’s focused on ethical investments has far outperformed its peers, as ESG investing is in demand.

ESG has become mainstream in funds management , but AE says it shouldn’t be confused with ethical investment. So, what is the difference between ESG and ethical investing?

AE says ESG integration is merely a tool to assess a company on its “environmental and social impacts as well as the quality of their governance.” Using this tool, one can “gauge the long-term financial health” and its effect on the planet. The theory goes, a company that exhibits poor ESG qualities, such as emitting carbon dioxide into the atmosphere, will face eventual damage to its reputation and sliding demand as its customers switch to less harmful alternatives; ultimately, this affects profitability and its share price. “ESG integration is ethically passive: it is concerned about the financial impact of things like pollution, poor labour practices and a lack of diversity on boards – not whether they are right or wrong.”

An ethical investment manager is something slightly different. This isn’t a tool as such. It refers to a fund manager that actively screens out companies that operate with poor practices and actively searches for companies that do good for people and the planet. AET summarises both styles by saying: “ESG integration is often used by fund managers who want to take a best-in-sector approach… However, basing an investment strategy on ESG alone will never be a replacement for a truly ethical investment approach.”

To go into this in finer detail, AE has looked at the 43 constituents of many “Sustainable” benchmarks. Some of the inclusions tend to favour companies that are sustainable over ones that are socially responsible. AEI highlights a few companies that fall into this grey area.

Gambling companies – Star Entertainment Group (ASX: SGR) and Tabcorp Holdings (ASX: TAH). Both operate in the gambling space and are promoted as socially responsible companies but conduct themselves in ways that prove otherwise. For example, TAH “was fined $45 million for breaching money laundering and terrorism financing laws in 2017, which at the time was the largest civil penalty in Australian corporate history.” How can it receive such impressive ESG credentials?

Mining explosives – Orica (ASX: ORI) is a commercial explosives supplier for the mining, oil, and gas sectors. AET says “Orica publishes a comprehensive sustainability report each year that covers issues like workplace safety, climate change, and good governance,” yet it has received heavy fines for releasing pollutants at its Kooragang and Botany plants, and cyanide into the environment, on 217 occasions.

“Mining and fossil-fuel companies Oil Search, Woodside Petroleum, Wesfarmers and Newcrest Mining” are included in the Sustainability Index because they pay “attention to their environmental impact and looking to give back to the communities they impact with their activities.” However, not all ESG styles are the same. Some will select companies that are fossil-fuel-free; whereas other ESG and ethical funds include oil gas and coal companies that arguably contribute to climate change. And then there is tobacco, alcohol, weapons and military contracting, gambling, junk food, factory farming, adult entertainment, and GMO (genetically modified organism) factors to consider.

Australian Ethical says that “while the companies mentioned in this article are highly rated in ESG terms it is unlikely they would be included in the investment portfolio of an ethical investor without intense scrutiny. Australian Ethical does not invest in any of the companies discussed above.” ESG is a great tool to use to gauge the sustainability and ethical impact of a company, but it should never be mistaken for a “genuinely ethical approach to investment. Ethical investors are focused on delivering returns without harming (and indeed proactively benefiting) the planet, people and animals.”