ASX rallies as regional banks recover, retail underperforms, China growth returns

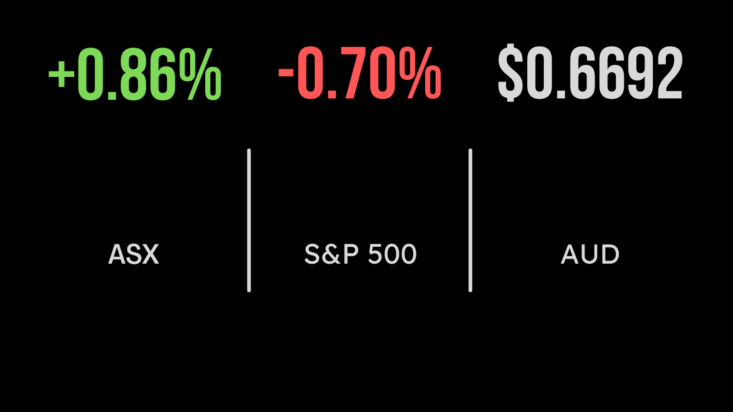

Positive sentiment continues to return to the local market, with the S&P/ASX200 gaining 0.9 per cent on Wednesday. While the technology sector was the biggest gainer, finishing up 2.4 per cent, a broad-based improvement in the financial and banking sector was central to the rally. Australia’s regional banks, despite having significantly more capital requirements than their US counterparts, rallied strongly with Bendigo and Adelaide Bank (ASX:BEN) gaining 2.1 per cent, and the Bank of Queensland (ASX:BOQ) up 2.3 per cent. Gold miner Northern Star (ASX:NST) fell 1.3 per cent after the company announced it would halt production at their Alaskan operation, Pogo. Link Administration (ASX:LNK) and Xero (ASX:XRO) were among the biggest winners, with the former benefitting from a settling of interest rates and the latter, on valuations.

China news improves, oil bear market extends, energy prices set to surge

The outlook in China continues to improve, despite growing political pressure from the US government. Retail sales were 3.5 per cent higher than the same period last year, reversing a contraction in the prior quarter. On the other hand, industrial output grew 2.4 per cent, slower than expected, but this was impacted by the Lunar New Year. In Australia, the retail sector continues to struggle in light of an increasingly stretched consumer, Domino’s Pizza (ASX:DMP) fell 1.7 per cent, along with Lovisa (ASX:LOV) which fell 3.1 per cent. Recession remains the focus of energy markets, with the price of oil falling another 4.6 per cent overnight, reaching a three month low, as traders fret about the outlook and potential for a surplus of supply in 2023. Sticking with energy, Victorian households are set to see power price increases of 31.3 per cent following approval by the national regulator, with most other key states increasing between 20 and 25 per cent.

Banking concerns extend to Credit Suisse, wholesale prices fall, tech outperforms

The technology sector is once again outperforming the rest of the market, with the Nasdaq gaining just 0.1 per cent overnight as the likes of Apple (NYSE:AAPL) and Microsoft (NYSE:MSFT) held up strongly amid a flight to quality. The weakness in the Dow Jones and S&P500, which fell 0.9 and 0.7 per cent respectively, came as banking stress expanded into Europe following comments that Swisse authorities were considering stepping in to support Credit Suisse (NYSE:CS). The group has seen more than US$100 billion in cash withdrawals and several losing quarters in a row, with shares falling 15 per cent overnight. It pushed the likes of Société Générale (NYSE:GLE) down double figures, while Wells Fargo (NYSE:WFC) was also caught up in the selling pressure. In positive news, retail sales fell 0.4 per cent in February, even more when inflation is taken into account, while wholesale prices dropped 0.1 per cent, with most economists having predicted an increase.