ASX finishes lower on bank weakness, Block under attack, Estia gets a bid

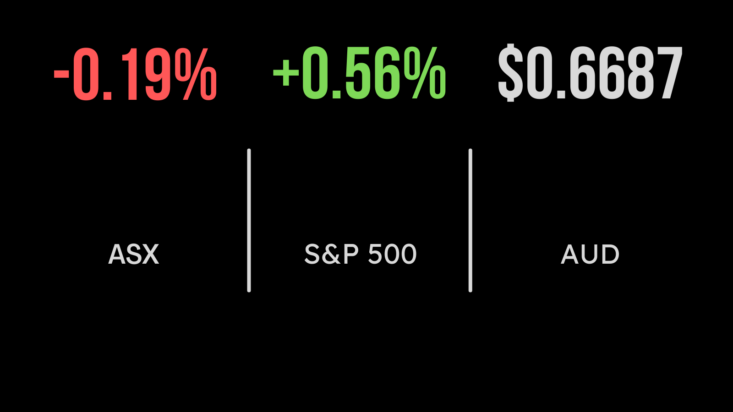

The local bourse finished 0.2 per cent lower taking the weekly loss to 0.6 per cent with the financial sector the biggest detractor, finishing 1.1 per cent lower. Poor sentiment around the outlook for banks contributed to a 1.2 per cent drop in Commonwealth Bank (ASX:CBA), while the materials and utilities sectors outperformed, gaining 0.6 and 0.7 per cent. Gold miners were once again in favour, led by Newcrest (ASX:NCM) which added 1.8 per cent, as the gold price nears USD$2,000 as investors seek a safe haven. Block Payments (ASX:SQ2) was among the worst performers dropping 18.4 per cent after research group Hindenberg issued a short report suggesting the company had been ignoring the illegal use of the Cash App for nefarious means. Elsewhere, the merger and acquisition market is alive and well with private equity firm Bain Capital launching a takeover bid for Estia Healthcare (ASX:EHE) pricing the company at $3.0 per share. The share price of the aged care provider moved 15.2 per cent higher on the news. Gold miners were the winner across the week, led by Evolution Mining (ASX:EVN) which grew 14.3 per cent, joined by Newcrest which finished 8.5 per cent higher.

Global markets move higher despite Deutsche selloff, bond yields fall, orders fall

All three major global indices finished higher on Friday led by the ‘high quality’ S&P500 which gained 0.6 per cent. The Dow Jones adding 0.4 per cent and the Nasdaq 0.3 per cent as staples, healthcare and technology stocks overcame weakness in the financial sector. Germany’s Deutsche Bank (DBK) is the latest to come under significant selling pressure, falling more than 8 per cent after credit default swaps on the country surged overnight. The bank is the latest to get caught up in the liquidity crisis sweeping the globe. Fed member Bullard flagged falling bond yields as a potential ‘cushion’ for the strained balance sheets of banks large and small, with less losses to be realised on asset sales. Bond yields continued to fall as institutions and investors around the world seek to shore up portfolios. Shares in Activision Blizzard (NYSE:ATVI) gained close to 6 per cent after the UK authorities dropped a number of concerns around Microsoft’s (NYSE:MSFT) purchase of the business. Across the week the Nasdaq led the way, gaining 1.7 per cent, followed by the S&P500, up 1.4 and the Dow Jones 1.2 per cent.

Rates move higher, hedging the gold, money markets the winner

Long seen solely as an inflation hedge, but forgotten in the era of rapidly rising interest rates, gold has been among the best performers thus far in 2023. The precious metals has seen a surge in popularity and interest as the financial and banking system comes under significant stress. Such has been the strength that the commodity is nearing an all-time high above USD$2,000 and now over AUD$3,000 per ounce. The hedge has clearly paid off, in the short-term at least, as investors flock to safe haven assets. Central banks appear committed to ‘fighting inflation’ via the blunt tool of interest rates despite the damage this is beginning to do to both the banking sector and the economy more broadly. Both the UK, Swisse and US central banks hiked rates this week, flying in the face of the growing uncertainty and volatility. Among the more interesting takeaways from the last two weeks has been the resurgent popularity of so-called ‘money market’ accounts in the US. Inflows are at record levels as professional investors exit traditional bank deposits in pursuit of investments into US treasuries.