ASX boosted by the energy sector, Origin upgrades outlook, Best & Less gets a bid

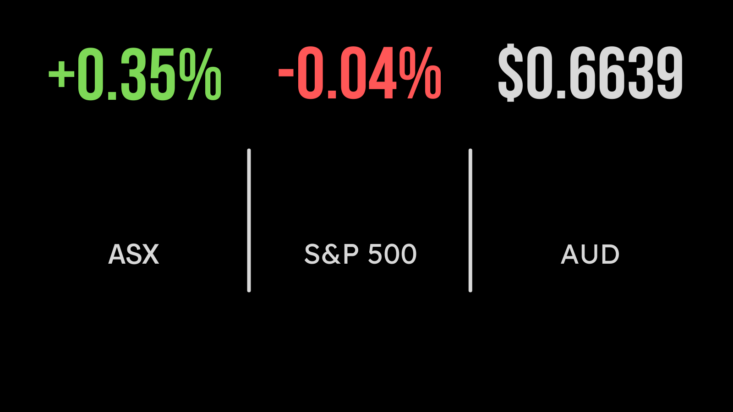

The local sharemarket finished 0.4 per cent higher on Monday, buoyed by the energy and utilities sectors, which gained 1.3 and 1 per cent, despite the oil price continuing to fall. The sector was buoyed by an earnings upgrade from Origin Energy (ASX:ORG) which sent shares 0.5 per cent higher with AGL Energy (ASX:AGL) also benefitting, gaining 3 per cent on the news. The more speculative end of the market was hit hardest amid a selloff in growth, with Syrah (ASX:SYR) down close to 11 per cent and Nanosonics (ASX:NAN) falling 2.8 per cent. The technology sector was the biggest detractor, falling 1.4 per cent on the threat of higher interest rates hitting valuations once again. Origin has benefitted from a price cap on gas and coal, meaning the energy production business has been able to deliver stronger earnings and expanding margins after a difficult period. The group has now upgraded earnings expectations from $600 to $730 million to $950 to $1.2 billion for the financial year. Fast growing renewable energy retailer Octopus Energy has also been performing ahead of expectations.

Blundy back in retail, Deterra, Transurban income boosted, Qube expands

Retail success story Brett Blundy has made another splash in retail ahead of an expected difficult period for the sector. Blundy has combined with Ray Itaoui in lobbing a bid to acquire all the shares in discount retailer Best and Less at a discount to the share price. Floating in 2021 the company has stagnated to the point that the group is offering to take it private for $1.89 per share, compared to the current $1.99 price, with key shareholder Allegro Funds supporting the offer. Shares in Deterra Royalties (ASX:DTR) fell by more than 5 per cent despite the company reporting a 32 per cent increase in royalty payments during the quarter, with investors clearly focused on the fact that a significant portion is driven by the increasingly volatile iron ore sector. Shares in Qube (ASX:QUB) gained just 0.3 per cent after the company announced two sizeable acquisitions, being 50 per cent of New Zealand’s Pinnacle group and 100 per cent of Kalari Proprietary, a bulk commodity handling group. Transurban (ASX:TCL) raised its dividend expectations on strong traffic momentum amid a sustained surge in travel, it now expects to pay 1 cent more in dividends to 58 cents for the half year.

US markets slightly lower on further banking stress, SoFi beats expectations, construction spending improves

All three US benchmarks finished slightly lower to open the week, the Dow Jones and Nasdaq both down 0.1 per cent and the S&P500 off just 0.04 per cent. The weakness was triggered by news that JP Morgan (NYSE:JPM) had been successful in negotiating a deal to takeover the embattled First Republic Bank (NYSE:FRC) out of California. Shares in JP Morgan gained more than 2 per cent, with the company set to add immediately to profitability, while First Republic shares continue to sink as the government will be forced to take on billions in losses. The news comes ahead of another Fed meeting on Wednesday, at which a final 25 basis point hike is expected, while the economy continued to show signs of improvement with both factory activity and construction spending up slightly in April. Shares in fintech platform SoFi Technologies (NYSE:SOFI) fell by more than 10 per cent despite the company smashing expectatons, with investors concerned about a loss in customer accounts.