Another solid week for local market

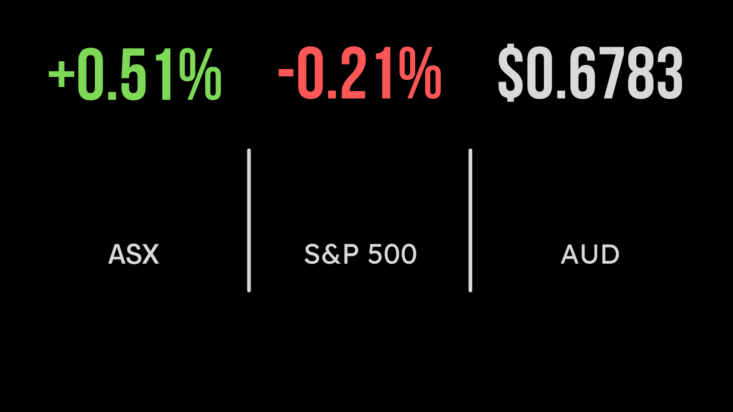

A positive mood on Friday lifted the benchmark Australian index, the S&P/ASX 200, by 0.5 per cent on Friday, to 7361.6, with gains in mining companies offsetting losses in health and property sectors. The index added 2 per cent over the week, notching its third consecutive week of gains, and ended at its highest closing level since March 7.

The Financial sub-index gained 0.8 per cent, marking its third consecutive weekly gain, with all of the Big Four up on the week.

The bulk mining giants all breathed a sigh of relief that Cyclone Ilsa, despite most being the destructive storm to hit Western Australia in more than a decade, largely spared the world’s largest iron ore export hub of Port Hedland. Fortescue Metals shares added 3.8 per cent over the week, to $22.43, while BHP gained 3 per cent, to $46.45 and Rio Tinto put on 3.2 per cent, to $120.94.

Gold stocks followed the bullion price higher, with the sector index rising 2.9 per cent on Friday for a 7.1 per cent jump for the week, its fifth consecutive weekly gain and its highest level since January 5, 2021. The tailwind lifted Northern Star Resources by 9.9 per cent, to $14.40; while Evolution Mining added 8.7 per cent over the week, to $3.64; and takeover target Newcrest Mining was up 6.7 per cent, to $29.96.

This week, market focus will centre on the minutes of the Reserve Bank of Australia’s April meeting, at which it paused its rate-hike cycle. Investors will want to hear more of the board’s reasoning for the pause, and indications of its view on the outlook.

Investors cheer mixed US data

It sounds counter-intuitive, but signs of weakness in US economic data was taken as a big positive by global markets, with the blue-chip Dow Jones Industrial Average up 1.4 per cent for the week, despite a 0.4 per cent fall on Friday, to 33,886.47. The broader S&P 500 index’s 0.2 per cent dip on Friday saw it end the week 0.8 per cent higher at 4,137.64; and the tech-heavy Nasdaq Composite index ended the week 1.2 per cent higher, at 12,123.47, despite a 0.4 per cent slide on Friday.

US investors are caught between hoping that a halt to rate rises might be on the horizon, and concerns that further tightening will be needed to bring inflation down. The US Producer Price Index, which measures wholesale inflation, fell by 0.5 per cent in March, with annual growth down 2.2% while unemployment claims rose.

Balancing this, the market has seen a stronger-than-expected start to quarterly corporate earnings results.

This data combination was taken by markets as proof that interest rate rises were coming to an end, but Federal Reserve Governor Christopher Waller poured cold water on that optimism on Friday, saying in a speech that despite a year of aggressive rate increases, the Fed Board “haven’t made much progress” in returning inflation to the 2 per cent target, and need to move interest rates higher still.

Oil prices made a 1.6 per cent weekly gain, the fourth straight week of increases, supported by tight global oil supplies and a weaker US dollar.

Gold lost US$5.40, or 0.3 per cent, over the week, to US$2,015 a barrel. The Australian dollar begins the week buying 67.1 US cents, up from 66.49 US cents at the start of the shortened week.