A starter for yen: Ruffer

The Bank of Japan (BoJ) – longtime poster child of ultra-loose monetary policy – looks to have finally started relaxing its grip on bond yields.

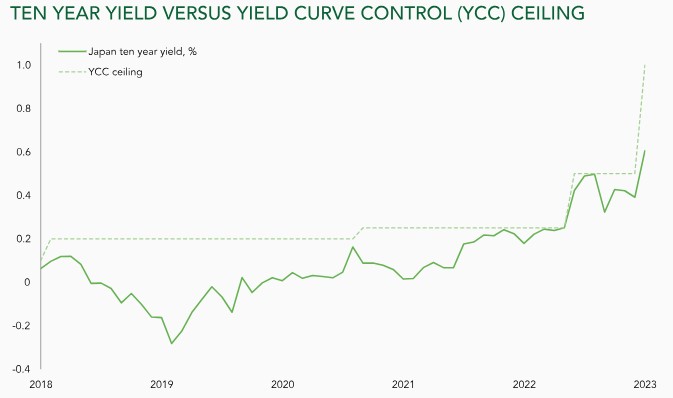

In the dog days of summer, Japan’s central bankers announced a shift to ‘flexible yield curve control’. The yield on ten year Japanese government bonds (JGBs) will now be managed with an upper limit of 1 per cent (double the level last reset in December). This month’s chart shows the step change to the BoJ’s cap and the corresponding moves in the ten year yield.

A 0.5 percentage point increase to the upper limit on a ten year yield doesn’t sound particularly groundbreaking. More of a snip than a snap. The yen’s initial reaction was muted too – rising 2 per cent against the dollar on the day before sliding back to below pre-announcement levels.

This is mainly because there has been no let-up in the popular yen carry trade – whereby investors borrow yen to buy dollars and then harvest the higher yield. As rates have risen in the US over the summer months, this trade has continued to be a simple, mechanical and rewarding source of returns.

But the contestants’ fingers are on the buzzers. This policy adjustment matters because it changes a key dynamic in global debt markets.

Historically, when JGB yields float higher, domestic investors are incentivised to unwind their foreign bond holdings and repatriate the proceeds back into the home market. The dynamic is more pronounced today due to how far Japan’s monetary policy has diverged from other major central banks – not least the US Federal Reserve, which has conducted a fast and steep hiking cycle to contain inflation. Given Japanese government debt represents 16 per cent of global sovereign bond indexes, an eastbound flow of capital could send ripples across markets. Most patently it would revive a flagging yen.

Whilst the event risk (‘what will happen if the BoJ removes the cap?’) has been allayed, the pressure on yields could gradually drive global risk premia back up and further expose market vulnerabilities. We think this is just the first step on a longer path to a stronger yen and higher Japanese rates.

Moreover, the BoJ is conditioning its inflation outlook on further US disinflation and economic slowdown. If US inflation proves stickier than expected, the BoJ’s revised stance may amplify the market’s response.

The portfolio is well positioned to benefit from a change of heart on the yen; we have 16 per cent across yen cash and JGBs, with an additional 10 per cent exposure via yen call options against sterling and the US dollar. We also hold Japanese interest rate options, positioned to make money as Japanese rates rise. Portfolio duration remains towards the lower end of our recent range at 3.5 years (the higher the duration, the more a bond’s price will drop when interest rates rise), equities are below 15 per cent and cash weightings remain high.

Markets are currently pricing in a lot of good news: immaculate disinflation, a recessionary ‘near-miss’ and rampant investor appetite for US equity and corporate debt. But disappointment on any of those three fronts would force a rethink.

Defensive assets have been punished by markets this year, as animal spirits have been unleashed. But we have high conviction that the yen is exactly the sort of asset to which investors will flock as the effects of tighter financial conditions come to bear.

*Jasmine Yeo is an Investment Manager at Ruffer UK