Commodities the only highlight in rough year: Atchison

The end of FY2022 feels a little like a blur of problems, people and red numbers; that’s not even considering what we have just been through.

A pandemic, supply-chain disruptions, war in Europe, rising energy prices, climate change and soaring inflation are just some of the key themes that impacted global markets throughout the year. As is the case, many of these themes are yet to play-out in full. Nonetheless, with the onset of rising inflation and subsequent central bank interest rate hikes to rein it in, there has been a complete readjustment in the way investors treat each asset class because of risk and return.

To highlight this realignment of assets, Kev Toohey, principal at Atchison Consultants, presents his analysis of the financial-year returns for major investment assets classes over the past 20 years. Below is the winners and losers for FY2022.

FY2022 – FY2013

Without a doubt, the unexpected rise in inflation quickly eroded the purchasing power of portfolios, which in turn reduced the value of certain investments.

A bond market sell-off triggered by rising yields caused some of the most challenging conditions for fixed-income assets in a decade. Adding to the pain was the bond market rout which came precisely at a point when investors needed capital preservation to offset a risk/growth-asset wipe-out.

It left many investors questioning whether an allocation to bonds was still appropriate, putting an end to the 60/40 portfolio split between growth assets and defensive assets. Emerging Markets was hardest-hit by a series of headwinds, making it the worst-performing sector of the year.

Still reeling from the devastating pandemic, Q3 saw the Chinese Communist Party’s (CCP) crackdown on the country’s tech large-caps causing US$1 trillion ($1.5 trillion) to be wiped off the value of US-listed Chinese stocks within six months. At the same time, Chinese property giant Evergrande, whose liabilities exceed US$300 billion ($440 billion), failed to meet interest payments to international investors, exposing China’s real estate debt problem.

And on the other side of the problems list, supply-chain disruptions were causing real headaches at China’s ports. Satellite data showed port activity dropping to the lowest levels seen during the 2020 lockdown. President Xi Jinping’s zero-COVID policy added undue pressure after it placed mega-city Shanghai in lockdown as the country struggled to tame its worst virus outbreak yet. Production at manufacturing plants came to a standstill, creating a large impact on supply chains.

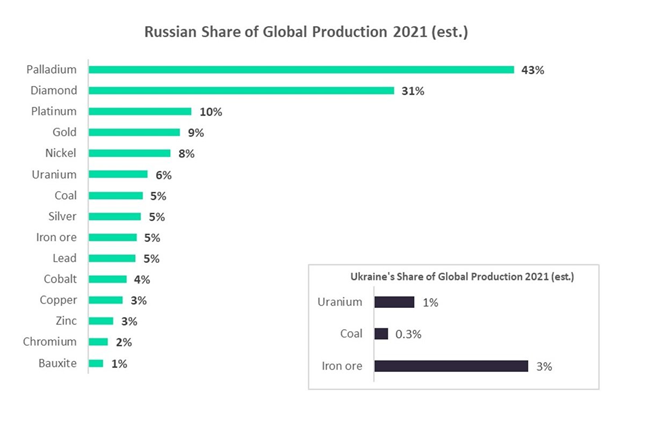

While taking in all the negatives, it’s good to know that there were a few positives. Investors evaluating commodities as an inflationary hedge and investors buying direct property emerged as the only two major asset classes to post returns above inflation in 2022. Commodities exposure was the best-performing sector driven by supply-chain constraints, a global push for renewables and the conflict in Ukraine. In effect, the war in Ukraine and sanctions on Russian exports sent prices of raw materials such as corn, wheat, and copper surging, together with natural gas, nickel, aluminium, platinum and palladium. Looking at the table below, it’s evident just how much of the global production of certain minerals is reliant on Russia.

According to Toohey, “all major equity and fixed-interest asset classes to which Australian investors are exposed have gone materially backwards in inflation-adjusted terms over the past 12 months. The majority of major markets are underperforming inflation for the first time since FY09. FY22 saw marginal differences between Australian equities, unhedged developed-market equities and hedged developed-market equities, meaning all three were roughly as bad as each other when measured from 30 June to 30 June.”

“Unpacking underlying global equity markets over the FY sees all major investment styles (value, growth, momentum etc) posting negative returns over the 12 months in local terms, as well as major sectors other than Energy & Utilities posting negative returns,” says Toohey.