Market buoyed by Wall Street, gold stocks tank, OZ Minerals downgrade

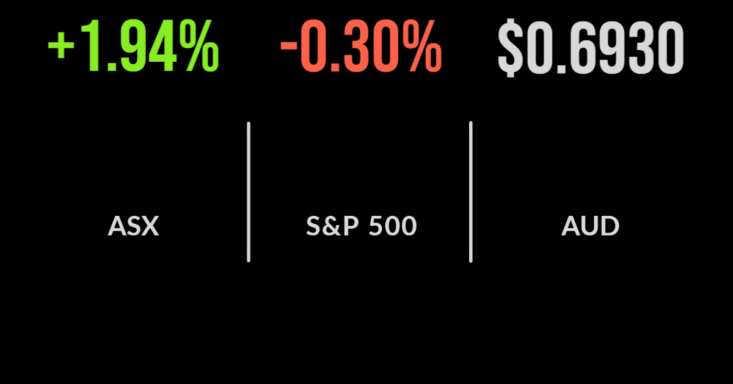

A positive lead from Wall Street, in which bad news on the economy became good news for stocks, resulted in the ASX gaining 1.9 per cent to begin the week.

Every sector was higher, with energy and financials gaining 2.6 per cent each, buoyed by hopes that rate hikes may not be as aggressive as expected.

Tech and consumer retailers also gained more than 2 per cent with the healthcare sector the ‘worst’ adding just 0.8 per cent.

Both Commonwealth Bank (ASX: CBA) and National Australia Bank (ASX: NAB) were among the leaders adding 4 and 3.4 per cent.

Imugene (ASX: IMU) was the top performer gaining more than 45 per cent after sharing positive news on their trial for treatment against gastric cancer.

The biggest laggard was the gold mining sector with Evolution (ASX: EVN) falling 22 per cent, Northern Star (ASX: NST) 12 and Newcrest (ASX: NCM) down 5.6 per cent.

The driver was a downgrade in guidance from Evolution on progress at their Red Lake plant which will see 2023 growth of just 12 per cent.

Metcash fights back, Charter Hall property values, Dye & Durham cut offer for Link

Metcash (ASX: MTS) is clearly taking ground from the other grocery retailers, benefitting from local positioning and a broader range of brands.

The company reported a 5.9 per cent increase in sales for the nine months to March and an 8.6 per cent improvement in the first seven weeks of the new year.

The result was a 17 per cent increase in earnings to $472 million and an 18 per cent jump in profit to $299 million.

Shareholders will receive an 11-cent dividend, taking growth on the prior year to 22 per cent, with management also announcing a partnership with Goodman Group to build a distribution centre in Victoria; shares fell 2.7 per cent.

Link (ASX: LNK) shares gained 4.1 per cent after acquirer Dye & Durham reduced their offer from $5.50 to $4.30 but ultimately confirmed their interest.

Carsales (ASX: CAR) will raise fresh capital to fund the acquisition of the remainder of Trader Interactive it doesn’t own for $1.2 billion while OZ Minerals (ASX: OZL) was the latest to add to confession season, a 13 per cent downgrade on poor production seeing shares fall 3.8 per cent.

Markets bumped despite strong goods orders, FTX considers Robinhood buy

Global markets started strongly after better-than-expected durable goods orders were posted in May, up 0.7 per cent, which was significantly higher than the 0.2 per cent forecast.

This stopped a six-month decline and suggests businesses may be growing more confident.

Markets fell, however, led by the Nasdaq which was down 0.8 per cent with portfolio rebalancing a key driver.

This time of year many managers decide to sell off their worst-performing stocks and increase the better performers in an effort to clean up portfolios for tax purposes.

There was little in the way of stock-specific news outside of the announcement that crypto exchange FTX was considering acquiring trading platform Robinhood Markets (NYSE: HOOD) which sent shares in the latter up 14 per cent.

The People’s Bank of China has confirmed their support as the economy seeks to dig its way out of extended lockdowns.