US economy in ‘classic slowdown’ with persistent inflation

Markets have been incredibly difficult. At the moment there are so many different things going on all at once, slowing growth, rising inflation and on top of that the emergence of black swan events, have caught many, by surprise.

Some of the black swan events include the pandemic, war in Ukraine and lockdowns China. Investors really need to go through and be careful what they see and read and decipher what really is important and what is just noise.

BCA Research’s Irene Tunkel spoke at The Inside Network’s Equities and Growth Assets Symposium in Brisbane, where she described markets in their current state as ‘The Perfect Storm,’ with so many things going on at once.

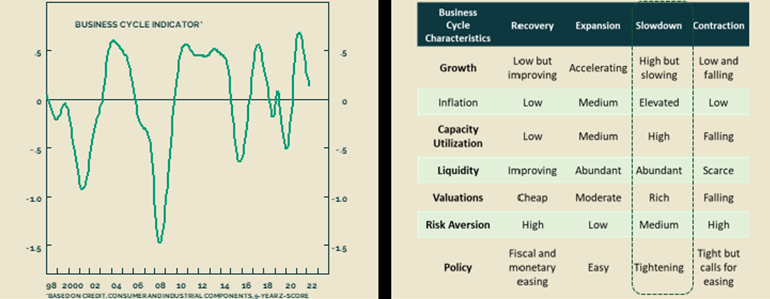

According to the Business Cycle Indicator, Tunkel explains that we are in the classical slow down stage. That means low returns and higher volatility, inflation is elevated, and you get very low unemployment. What is a little bit less normal, is high inflation.

Inflation at these levels is something new. US consumers are expecting 5.5% over the next year. The issue here, is that it’s starting to hurt consumers. The percentage of spending on food by the lowest income cohorts, is now about 25%.

If you add in rent and debt together with fuel costs, many, especially those that earn under $50k, are in real trouble. Consumer confidence has dropped to levels not seen since 2008 when there weren’t any jobs. However, today, jobs are plentiful, yet consumer confidence remains at its low levels.

You could even say that inflation is akin to an aggressive tax, which hurts poor people more. But inflation doesn’t just hurt consumers, it hurts producers as well. Pricing power has decreased which makes it harder to pass on costs to customers and profitability is also dropping.

Tunkel says the Fed must tighten significantly, because what has been done, that is rising of US rates, hasn’t really brought down inflation, all that much. As tightening comes into play, it may affect growth, but a recession is not imminent. Growth is coming off very high levels and also so far most indicators are not pointing to an imminent recession.

Have we hit rock bottom yet?

Tunkel comments, “We need to see rate stabilisation. We are not there yet. Economic growth expectations do not yet reflect deteriorating economic backdrop. Oil prices have stabilised, albeit at higher levels. Valuations have retraced and equities are looking for a whole lot cheaper than before. Equities are certainly oversold. And in terms of Black Swan events, there are no longer of any other black swan events and investors are aware of the risks.”

To conclude she comments, “The US economy is in the midst of a classical slowdown. Investors need to be patient; high inflation is becoming embedded as it hurts both consumers and producers. Investors also need to be weary of a hawkish US Federal Reserve whose top priority is combating inflation. Don’t be surprised if interest rates are raised aggressively. And even if this does happen, equities will wobble at the time of the first hike but will eventually recover.”

The war in Ukraine remains the big concern. It has a significant direct and indirect effect but in the longer term, all these risks will be priced in and hopefully markets will stabilise.