Even a small Bitcoin allocation can help portfolio, says Nickel Digital

With Bitcoin’s mainstream acceptance and Australia’s push to form a framework around cryptocurrency, it raises the question as to whether professional investors should allocate a portion of their portfolio towards cryptocurrency.

According to a research report commissioned by London-based crypto hedge fund Nickel Digital Asset Management, 15 per cent of institutional investors and wealth managers “believe that long-term, over 10 per cent of the funds they help to manage will be in digital assets, including cryptocurrencies and tokenized investment vehicles.”

Bitcoin has been quite the star performer, especially during Coronavirus, when it quadrupled its value (in US$) in 2020 and then doubled again in 2021 – reaching an all-time high over $64,000 in November – but in January 2022, BTC experienced a massive pullback, which stripped the price back to $35,070. The cryptocurrency has since rebounded to $44,191.10.

The report also revealed “38% of the professional investors interviewed expect the funds they help run to have between 5% and 10% held in digital assets; 26% believe the figure will be between 3% and 5%, and one in five (19%) expect it to be between 1% and 3%.”

Anatoly Crachilov, CEO and founding partner of Nickel Digital, commented: “Our analysis of a statistically significant nine-year period reveals an asymmetric positive impact of a single-digit allocation of crypto assets to institutional portfolios, as such an allocation strongly improves risk-adjusted returns, without compromising risk framework of the underlying portfolio. It comes as no surprise that long-term institutional allocators are contemplating allocation to digital assets as part of their portfolio construction.”

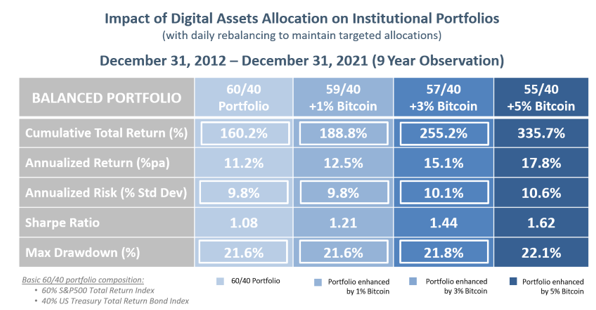

What was an interesting take from the report is that allocating a small percentage of a portfolio to Bitcoin in a diversified portfolio had a remarkable effect. The report noted that, “Over nine years, between 31 December 2012 and 31 December 2021, a diversified portfolio of 60% equities (S&P500 Total Return) and 40% bonds (US Treasuries Total Return) would have delivered a cumulative total return of 160% with portfolio risk (standard deviation) of 9.8% and maximum drawdown of 21.6% (caused by the equities selloff in March 2020).”

An allocation of just 1% to Bitcoin would have increased the portfolio return by a meaningful 29 percentage points (or 18%), to 189% over the reviewed period, without increasing the overall portfolio’s risk, which remained at 9.8%. The report suggests that Bitcoin is uncorrelated to other asset classes, and works perfectly as a hedging/diversification tool.

When increasing the portfolio allocation from 1 per cent to 5 per cent in Bitcoin, the overall portfolio cumulative return skyrockets to 355%; more than double the return without crypto. Standard deviation does rise, but only by a touch, from 9.8 per cent to 10.1 per cent.

Nickel currently has four funds investing in the digital asset space: its market-neutral Digital Asset Arbitrage Fund, Diversified Alpha Fund, DeFi Liquid Venture Fund and the Digital Gold Institutional Fund.