High-conviction strategies and the role of risk management

US-based fund manager Loomis Sayles, founded in 1926, has delivered a respectable return for its clients for 2021, after it smashed the index both for the quarter and the year. Global markets returned 6.0% over the last quarter and 25.8% over the year; Loomis exceeded on both, with an 8.2% return for the quarter and 30.3% return for the calendar year.

On a quarterly basis, performance was generated primarily by the portfolio’s healthcare stocks which rose +1.39 per cent followed by consumer staples +0.85 percent, and materials +0.80 percent. On a stock-by-stock basis, UnitedHealth, IQVIA and Mettler-Toledo were clear standouts in the healthcare space. Consumer staples saw Costco and Estee Lauder deliver strong returns, while Sherwin Williams and Linde led the materials sector.

On the flipside, dragging the portfolio down were stocks in the consumer discretionary sector, which fell -0.92%. Here, laggard stocks included Peloton, Home Depot, Mercari, Salesforce, Dropbox and Paypal.

Loomis also delivered over the financial year, with portfolio returns well-supported by healthcare (+3.67%), communication services (+2.43%) and tech (+2.06%); with consumer discretionary (-3.64%) and financials (-0.72%), doing not so well.

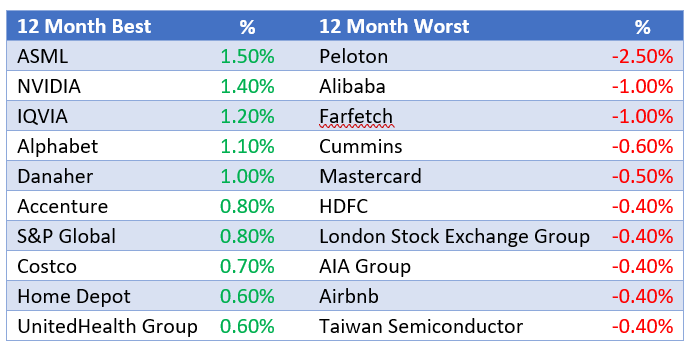

Without doubt the best performing stocks in the portfolio were semiconductor stocks ASML and NVIDIA returning +1.50% and 1.40% respectively. Both stocks are leaders in the semiconductor market: ASML leads the lithography market and is the world’s only manufacturer of extreme ultra-violet lithography (EUV) systems. Costing $150 million each, these systems are required to produce the world’s smallest 7-nanometre (nm) and 5nm chips.

The technology used to produce these tiny semiconductors took three decades to develop and is leagues ahead of any meaningful competition. Next year, ASML will look to manufacture its first ‘high-NA” (standing for ‘numerical aperture) EUV systems that can produce even smaller 3nm and 2nm chips. Its clients, TSMC, Samsung, and Intel included, will want to secure these EUV systems to ensure they maintain tech supremacy.

NVIDIA, also in the same industry, is exposed to the same tailwinds. It operates in the graphics processing unit (GPU) market, of which it controls 83 per cent, with AMD holding the remaining 17% share. Generally speaking, NVIDIA’s graphics processing units are seen by the market as having a better build and higher quality than AMD.

Both stocks have been beneficiaries of the global chip shortage, with share prices rising on the back of skyrocketing demand. Analysts expect ASML’s revenue and earnings per share (EPS) to grow 19% and 22%, respectively, while with NVIDIA, analysts expect its revenue and earnings to grow 60% and 74%, respectively, for the full year.