Legal practice popular with advisers acquired

Dwindling financial adviser numbers have dropped below the 20,000 mark, hitting a five-year low. And although it’s been a difficult few year for some wealth managers, others have evolved during the pandemic, finding themselves head and shoulders above the rest.

Sequoia Financial Group (ASX: SEQ) is one of these, having recently acquired Topdocs Legal, a legal services provider focused on SMSFs, for the purchase price of $330,000. And it was a “no-brainer” deal.

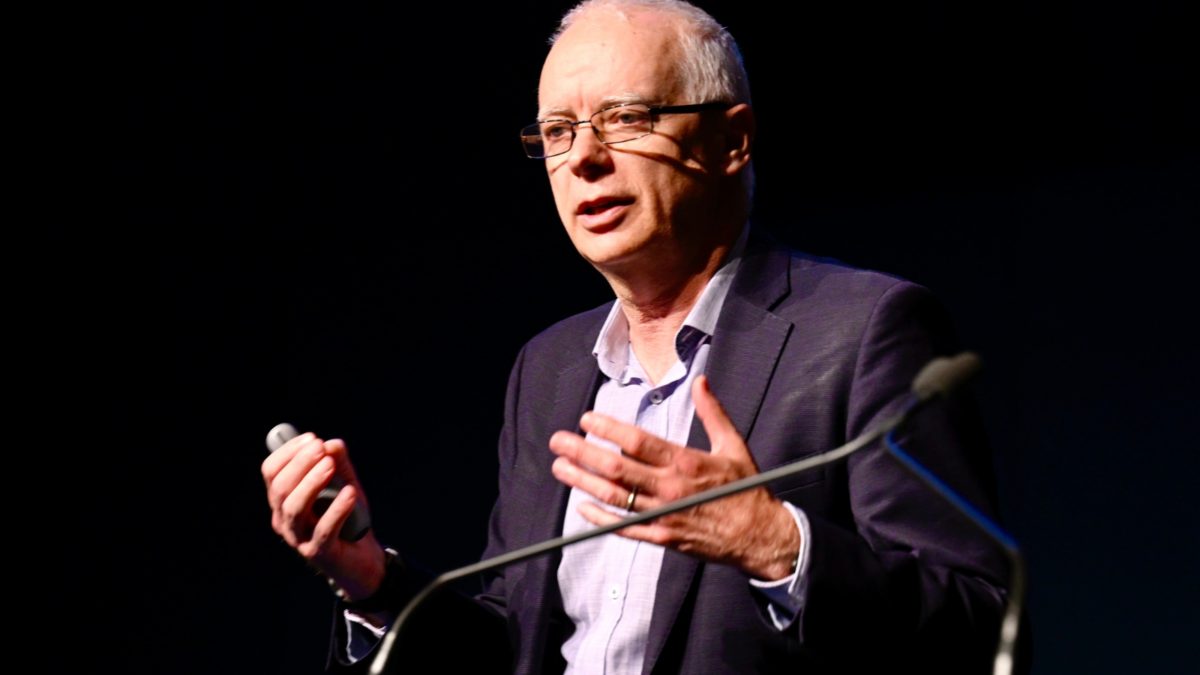

Sequoia managing director Garry Crole said: “The current industry focus on needing to review outdated family trust and other trust structures was an area of strength for TDL and will continue for Docscentre Legal as we introduce this service offering to our planning and accounting networks across Australia.”

The acquisition fits neatly with the existing Sequoia business and enhances the existing document businesses when reviewing and amending trust and SMSF documents. Topdocs Legals’ clients are of similar calibre, being from an accounting, financial planning or legal background as well as small-to-medium-sized enterprises (SME) and high-net-worth individuals seeking a high-quality legal service. Under the arrangement, Topdocs Legal will be renamed Doscentre Legal and all existing Topdocs Legal staff will be relocated to Sequoia’s Melbourne offices.

“From our financial planners’ perspective, this enhanced expertise on legal issues relating to SMSF compliance, increased capability in preparing deeds of ratification, rectification or confirmation to assist with certain compliance issues, advising on alternative SMSF investment structuring for property or other assets is a further move of the group to use scale to help drive down the cost of providing advice to a community who needs it,” said Crole.

Sequoia’s financial advisers stand to benefit from the purchase by receiving potential legal advice on estate planning for SMSFs, including binding death benefit nominations, powers of attorney, member benefit guardians and the structuring of death benefit payments.

In summary, Crole highlighted the acquisition as being “consistent with Sequoia’s mission,” in providing multiple services to advice intermediaries and professional parties, and to further enhance the Sequoia’s existing service.