Has the RBA lost credibility in the eyes of the market?

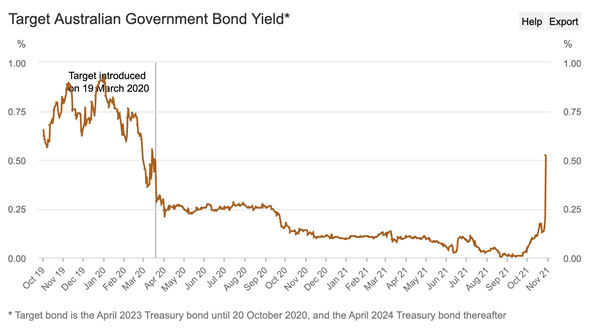

The RBA said it has little choice other than to scrap its yield curve control policy in targeting a 0.1 per cent yield on the April 2024 government bond. RBA Governor Lowe said, “Given the progress towards our goals and the revised outlook, the Board judged that it was no longer sustainable to maintain the target of 10 basis points.”

If the RBA had pinned the yield on the April 2024 bond at 10 basis points in the face of these developments, it would have ended up holding all the freely tradeable bonds in the bond line. That would have meant trading in that bond would cease, and it would diminish the usefulness of the target.

Chris Rands, co-portfolio manager of the Yarra Australian Bond Fund at Yarra Capital Management, said he understood the rationale for the policy switch, but questioned the way that the central bank had handled it.

“The reality was they were buying three-year bonds for 18 months, and I think it would have been better if they’d continued to defend the target for another two days before the board meeting,” says Rands.

“The big change is that the RBA dropped their language around 2024 and said that they’re expecting inflation to be 2.5% per cent around 2023. I think that this is the RBA giving the green light to the market on thinking about hiking rates in 2023.”

Darren Langer, co-portfolio manager of the Yarra Australian Bond Fund, and co-head of fixed income at Yarra Capital Management, says: “Financial stability is one of the RBA’s goals and they have damaged the bond market through their actions. We’ve gone from a world where forward guidance was the norm for central banks to radio silence, which is never a good way to run monetary policy.

“We need to see wages improving, we also need to see unemployment decreasing, and ultimately need to see some sort of growth. And now we’re probably going to see the market focus on those things a little bit more, and less on worrying about whether the three-year bond or whatever the target bond is, is 10 basis points or 12 basis points.” The RBA did maintain a 0.1 per cent yield target on the three-year Commonwealth debt that matures in April 2024, but traders have recently repeatedly pushed the return on those bonds substantially above that benchmark. The move came on the back of stronger-than-expected September quarter inflation figures.