MDA market review: a watershed year

Managed Accounts, or Managed Discretionary Accounts (MDAs), are a relatively new investment solution available to consumers and financial advisers following recent advances in platform technology. MDAs have evolved to a point where advisers can offer clients a broad range of investment assets and clients have complete visibility of the investments held in their portfolio. What is interesting is the speed at which they have grown over the last few years. According to research firm Investments Trends, 35% of financial advisers used MDAs last year, up 5% from the previous year. Among independent advisers, the percentage was 47%, up from 37%.

We wrote an article this month on how Managed Accounts were fast disrupting traditional investing via managed funds/unit trusts and direct shares. Surprisingly, they were “the fastest-growing segment, which is good for financial planners and other advisers who participate in managed accounts. The total in MDAs at the end of June 2020, was $79.71 billion – about 25% higher than predicted in 2015.” The Institute of Managed Account Professionals (IMAP) estimates that growth will run at about 40% a year for at least the next two years, taking the industry to more than $115 billion by 2020.

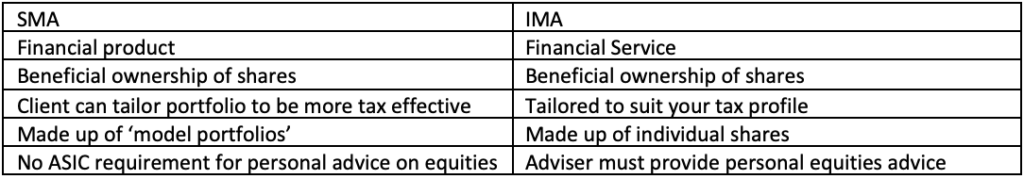

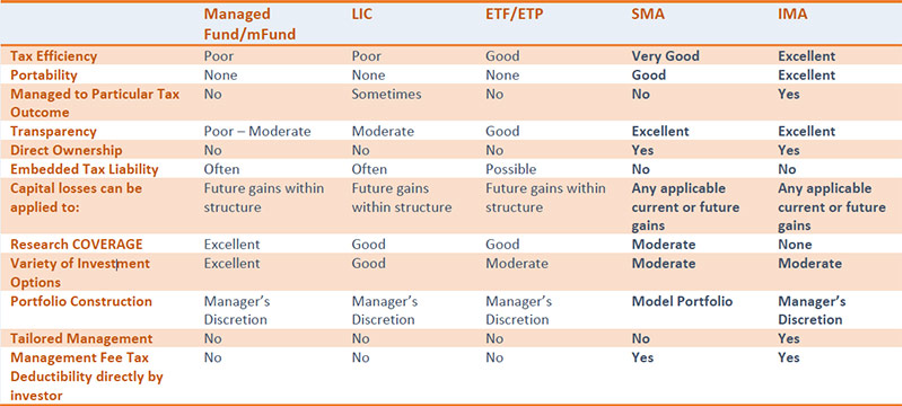

An MDA is a general term that describes two types of accounts.

- The first is a separately managed account (SMA). An SMA is a financial product: each investor gets the same portfolio. It’s almost like a managed fund but the advantage is that each client can see each individual portfolio holding.

- The second type of account is an individually managed account (IMA) – this is a financial service, as opposed to a product, in which each investor’s portfolio is individual and tailored to their requirements. A client can transfer existing shares into the IMA, which will be professionally managed.

The table below from PPM (Private Portfolio Managers) provides a comparison of the key features of Australia’s primary investment management structures.

Despite the rapid growth, managed accounts represent a small percentage of the total managed fund and equities market. As a result, the big research houses seem not to cover the managed accounts space; not yet, at least. The other point to note is that for a research house to collate data, the MDA manager would need to send through performance data on a monthly basis. These monthly surveys provide advisers and investors with vital information on each MDA, such as performance, fees, and distribution data, which investors can use to do their own comparisons. Without this data, it’s hard to gauge which MDAs have performed well and which ones have performed poorly.

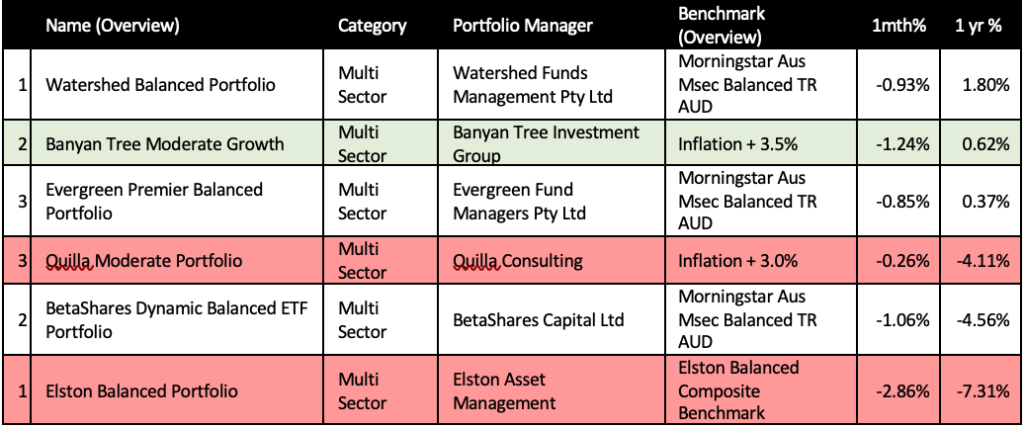

Not to worry, we at The Inside Network, have compiled a database of known MDAs together with performance data. Although the research houses don’t cover the MDA space, some of the wealth platforms may store performance data if they hold the MDA. Either way, here are the top and bottom performing MDAs for the last 12 months, from the limited data we managed to retrieve.

Top 3 and Bottom 3 ‘Balanced’ MDAs

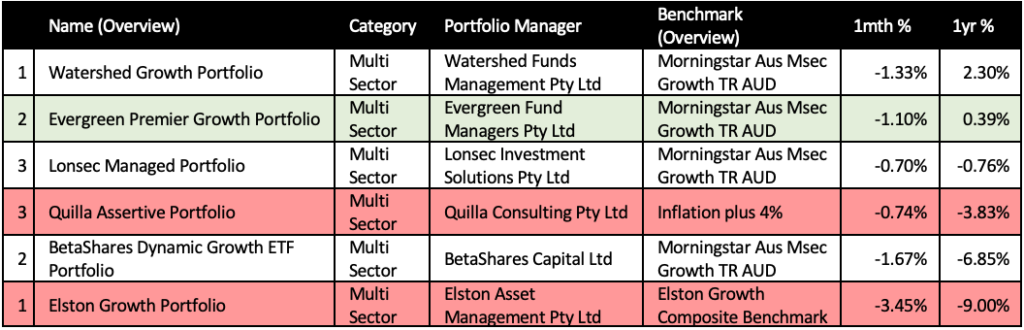

Top 3 and Bottom 3 ‘Growth’ MDAs

Looking at the table above, Watershed Funds Management topped the list in in both Growth and Balanced categories, followed by Evergreen Consulting. While a 2.30% yearly return didn’t shoot the lights out, it was the best-performing in the Multi-Sector asset class. In comparison, the average balanced fund, for the first three months of FY21, returned 2.0%, but back-pedalled -0.7% for the last 12 months. Share markets pulled back in September after rallying for the previous five months. Australian and hedged international shares were -3.6% and -2.9% respectively for the month. So from that perspective, the top few MDAs have beaten the average managed/super fund return. It is fairly evident that the COVID-19 pandemic tore through global markets creating uncertainty and volatility. This dented investor confidence and hampered fund manager returns.

On the flip side, taking out the wooden spoon for worst MDA, jointly, were Elston’s Growth and Balanced funds, with returns of -9.0% and -7.31% for the year. Betashares similarly struggled with its index approach dragging the BetaShares Dynamic Growth and Balanced ETF Portfolio well below the benchmark. The unsung heroes in times of despair were gold, cash, and longer-dated bonds. These assets continue to play their role as defensive safeguards.

The key takeaway from this analysis is that MDAs need to be managed and assessed as regularly, if not more regularly, than any fund manager or direct stock. Many see the strategy as set-and-forget and see the benefit of outsourcing to an expert and moving on. But with an MDA considered a recommendation, advisers are bound to ensure the products they are recommending are at least performing as well as the alternatives, and continue to remain appropriate for the investor client.