Where are all the women in investment management?

“Where are all the women?”.

A memorable moment at the 2016 Fund Manager of the Year awards took place when Dame Quentin Bryce, the former Governor-General, turned to a leading female portfolio manager and asked, “where are all the women?”

That was eight years ago. Fast-forward to today, and the industry is worth more than $4 trillion, yet nothing much has changed.

Some of the truths revealed by journalist Yolanda Beattie in a recent article published by Financial Standard, based on available data and anecdotal evidence gained from speaking with dozens of young women and industry leaders over the past five years, have uncovered some shocking facts. One of them being that financial services remains one of the most male-dominated professions in the country.

The author said: “Mercer, in its Diversity in investment management research findings, February 2017 (2017 Mercer research), reported only 24 per cent of front-office investing roles, defined as anyone recommending, making, or implementing investment decisions, were held by women across the surveyed superannuation funds and fund managers.”

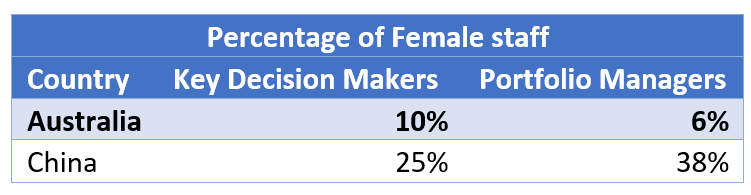

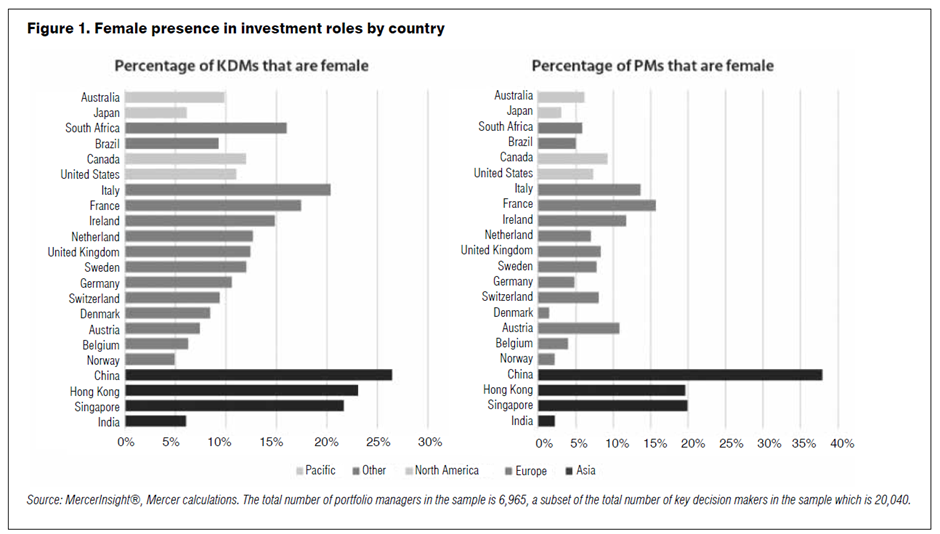

And then this, “According to a more recent global Mercer research, Diversity dressing: The hidden figures, May 2020, Australia ranked 12th out of 22 in the world on gender diversity, with just under 10 per cent of key decision-makers (KDMs) being women.”

For a country that prides itself on being a world leader in its commitment to democracy, human rights and gender equality, having such a small representation of women in this industry is concerning. To take it even further, we were shocked to discover that Australia ranked 50 out of 156 countries in the recent World Economic Forum’s Global Gender Gap Index.

The link is undeniable; female representation, especially in the management and board level, drives an improvement in a company’s bottom line. Gender pay gap inequalities represent “a lost opportunity”.

When comparing to China, ranked at 106th position and had some of the worst gender inequality conditions, how is it that still China had a higher percentage of women represented as key decision-makers and portfolio managers in funds management than Australia?

While the dynamics in China are very different to Australia, it would look like China does a lot more to support female workers than Australia. However, the research found that, “The lack of women in these positions is not from lack of trying. Almost every fund manager spoken to over five years of research expresses an explicit desire to hire more women.”

And these efforts are yielding results; albeit slowly. The number of women in these fields is rising, but it takes time due to the education and qualifications required. Beattie refers to a research study conducted by super fund HESTA which found that “aggregate levels had improved from 17 per cent in 2018 to 22 per cent in 2020.”

Research also showed that unlisted funds continued to perform better than listed. Women held 24 per cent of investment team roles at unlisted managers surveyed, up from 17 per cent in 2018. Listed managers improved modestly, increasing from 16 per cent to 17 per cent in 2020.”

The rise in numbers came a time when more women are studying relevant degrees at university and are becoming comfortable with investing in markets. In fact, in October 2018, “women are now completing management and commerce, and science degrees at near-equal rates to men, creating an ample talent pool for the industry to access and inspire a passion for the specialist area of investing and the more technical study it entails.”

But there are still barriers to entry which prevent females from pursing an investment management career. These include factors such as women being less likely to know about investment management or the challenge women face when having a family just as their careers are taking off.

How can the industry improve on this?

In concluding, Beattie found that “Superannuation funds and asset consultants now routinely ask their investment partners about their diversity performance. The next step is for funds to mandate their manager set to disclose gender targets, and their plans for how to achieve them.”