Wealth hits record high, but wealth gap widens even further

The gap between the haves and have-nots is widening according to new research, with the average wealth of the top 20 per cent of Australians by income growing four times faster than that of the bottom quintile for the past two decades.

This comes while Australian household wealth hit record levels in the June quarter, with household wealth rising 2.6 per cent over the quarter to a record $15.1 trillion; that’s up 3.9 per cent from a year ago.

According to the Australian Bureau of Statistics, wealth per capita grew 2.1 per cent, or $11,442, to $567,632 per person.

Around 68 per cent of household wealth – $10.3 trillion – is stored in property, compared with $3.6 trillion in superannuation, the data showed. Australians held $1.3 trillion in shares and $1.6 trillion in cash deposits.

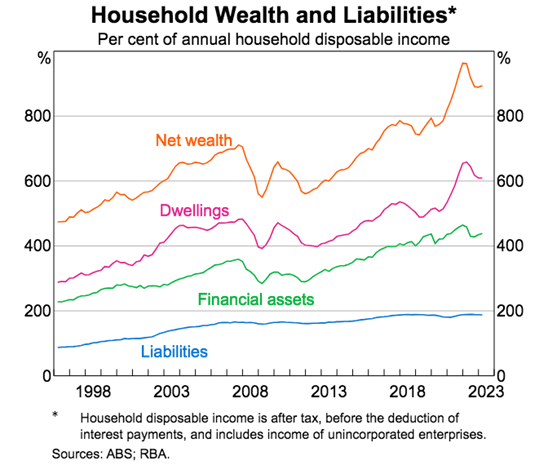

Property holdings drove the increase in household wealth, contributing 2.1 percentage points to the overall quarterly growth. Superannuation balances were supported by strong performance in overseas sharemarkets and rising employer contributions in a strong labour market. While household debt levels are rising on higher interest rates, the value of net household wealth was more than four times the value of household debt as of the end of the August (see chart).

Wealth divide widens

While wealth is growing overall, new research from the Australian Council of Social Service (ACOSS) and the University of New South Wales (UNSW) reveals that much of it is held by just a few people, with wealth inequality increasing strongly over the past 20 years.

Their report shows that from 2003 to 2022, the average wealth of the highest 20 per cent rose by 82 per cent – and the wealth of the highest 5 per cent rose by a whopping 86 per cent. In contrast, the middle 20 per cent saw wealth grow 61 per cent; it grew just 20 per cent for the lowest quintile.

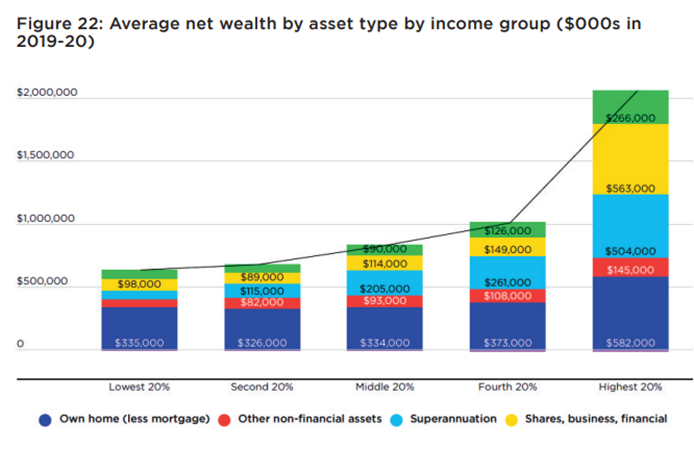

Measured a different way, the wealthiest 20 per cent hold average wealth of more than $3.2 million – six times greater than the average for the middle 20 per cent and 90 times that of the lowest 20 per cent.

The increase in wealth inequality has been driven largely by the growth in superannuation balances, which grew by 155 per cent in value due to compulsory savings, the report stated.

Contrary to the image of ‘mum and dad’ property investors, it showed investment housing is unequally shared, with the wealthiest 20 per cent holding 82 per cent of all investment property by value, from average holdings of $266,000. The cohort also owned 78 per cent of all shares and other financial investments, with an average value of $563,000.

ACOSS CEO Cassandra Goldie (pictured) said that if the trend is left unchecked, growing wealth inequality threatens to entrench social divisions in the Australian community.

“Governments can reverse that tide by fixing inequities in our housing and superannuation policy that disproportionately benefit those with the most,” she said.

“The pandemic response highlights the profound impact of government policy on income inequality in our society. Sadly, it was a story of two steps forward, and two steps back when the increased payments were withdrawn and income inequality returned to close to pre-pandemic levels.”

Carla Treloar (pictured), Scientia professor at the Social Policy Research Centre at UNSW Sydney, said while income inequality has remained relatively steady, wealth inequality has increased over the past decades.

“We can reverse this trend through more affordable housing and a fairer tax and superannuation system,” she said. “Additionally, increasing income support payments permanently will reduce income inequality.”

Higher income earners hold more of their wealth in financial assets. The average superannuation wealth of the highest 20 per cent was $504,000 – two-and-a-half times that of the middle 20 per cent ($205,000) and seven times that of the lowest 20 per cent ($66,000). The average investment property holdings of the highest 20 per cent are worth $266,000 – three times that of the middle 20 per cent ($90,000) and four times that of the lowest 20 per cent ($75,000) (see chart).

Globally, Australia is doing well in terms of overall wealth levels. The nation’s reliance on private saving via home ownership and superannuation means that, at around $1.2 million, average wealth in Australia was the fourth highest in the world in 2022, after Switzerland, the United States and Hong Kong.

However along with income, overall wealth declined during 2022 due to inflation and higher interest rates, the report said.