Value factor vs. traditional valuations

Value investing, for all its history as a robust investment strategy, has been one of the worst-performing ways to invest money over the last few years.

Fair enough, the coronavirus has thrown a spanner in the works by wreaking mayhem on investment markets, but value investing still hasn’t outperformed. Since March this year, value managers breathed a short-lived sigh of relief, as value stocks staged a dramatic rebound in the months following the announcement of Covid-19 vaccines and plans to distribute them globally. It raised hopes that a global recovery was underway, and the end of the pandemic’s effect on markets was near. Unfortunately, this wasn’t the case. The Delta variant emerged, and back into lockdown the world went.

So why haven’t cheap, under-valued, quality stocks rebounded?

Quite simply, the ‘value’ in value stocks is the cash the company is making now. During a ‘black swan’ event like Covid-19, the ‘now’ isn’t recognised by the market, and so value stocks aren’t appreciated. A good example are airline stocks such as Qantas (ASX: QAN), which was sold-off after international borders closed and airlines grounded. These value stocks were hammered because the market behaved as if airlines are a thing of the past due to lockdowns, travel restrictions and stay-at-home measures.

Of course, all this will change when the world is vaccinated, and international borders open again. Travel and airline stocks rose as news of a vaccine for Covid-19 broke out, raising hopes for a strong global recovery together with rising interest rates.

So how did value managers perform over the course of the last financial year?

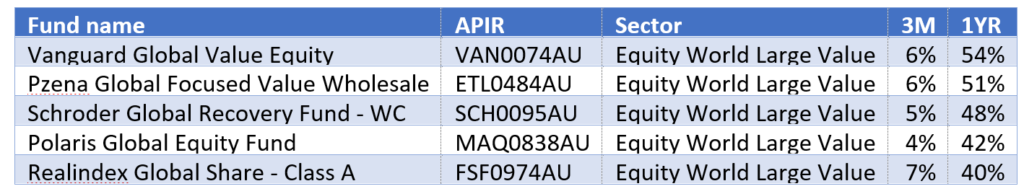

Surprisingly enough, it was an index value fund that topped the performance list, with Vanguard’s Global Value Equity beating out active fund managers to return 54% for the year. Index funds seek to mimic the price movement of a certain index and in this case it was the FTSE Developed All-Cap index, in Australian dollars. which holds some 5,704 companies compared to 1,276 in this fund. The strategy focused on investing in those companies that trade on cheaper valuations according to traditional measures like price-to-earnings (P/E), price-to-book-value and price-to-cash-flow ratios.

While the battle is seen as one between growth and value, in which neither can claim outright victory in past performance, the battle fought was one between Value vs. Growth vs. Index Funds. In this case, the index investor’s passive approach outmuscled the active research and analysis approach undertaken by value investors. Where index funds often do better than value is with mid-cap and small-cap stocks. Actively managed funds have a higher expense ratio and management expense ratio (MER) fee than actively managed funds. Vanguard charges 0.35% pa in management fees.

Following on from Vanguard were active managers Pzena Global Focused Value fund, with a 51% return, Schroder Global Recovery Fund with a 48% return, Polaris Global Equity fund returned 42% and Realindex Global Shares – Class A returned 40%, and the list goes on.

The truth is, about US$11 trillion ($15.3 trillion) is now invested in index funds, up from just $2 trillion a decade ago. The benefit of buying an actively managed fund is supposed to be that it is professionally managed by a fund manager with the sole aim of beating the overall market. The downside to this theory, of course, is that the vast majority of funds underperform, and a big part of that is due to the cost. Index funds often have expense ratios below 0.30%, whereas active funds are greater than 1.0%.

This time around, the index funds have outperformed value.