Valuation gap between value and growth at ‘extreme levels’

Simon Adler, who heads up the Equity Value fund at Schroders, presented at The Inside Network’s recent Equities & Growth Assets symposium, discussing the topic, ‘The War is Over” — meaning the “war” between Value and Growth — and highlighting the opportunity set for ‘value’ investing after more than a decade of underperformance compared to ‘growth’.

Adler joined Schroders in 2008 as an analyst in the UK equity team, and joined the Value investment team in July 2016 to focus on UK institutional and ethical-value portfolios.

It’s been an eventful year, to say the least. For Adler and his team however, the past six months have been a bit of a boon. After lying dormant all this time, value has suddenly begun to deliver once again, staging a very welcome comeback. After Pfizer and BioNTech conducted real-world studies that showed that the COVID-19 vaccine ‘dramatically’ lowered cases, hospitalisations and deaths, it caused a sudden rotation.

Previously unloved sectors of the market rallied quite strongly; sectors such as the banks, energy, automotive and advertising. Sectors of the market that did well during Covid-19 were sold off, such as technology, BNPL and e-commerce.

But Adler cautions investors, saying: “it’s important not to focus too much on short-term percentage price moves, because when you zoom out and look at the bigger picture, you can see that many shares are still trading on deeply depressed valuations.”

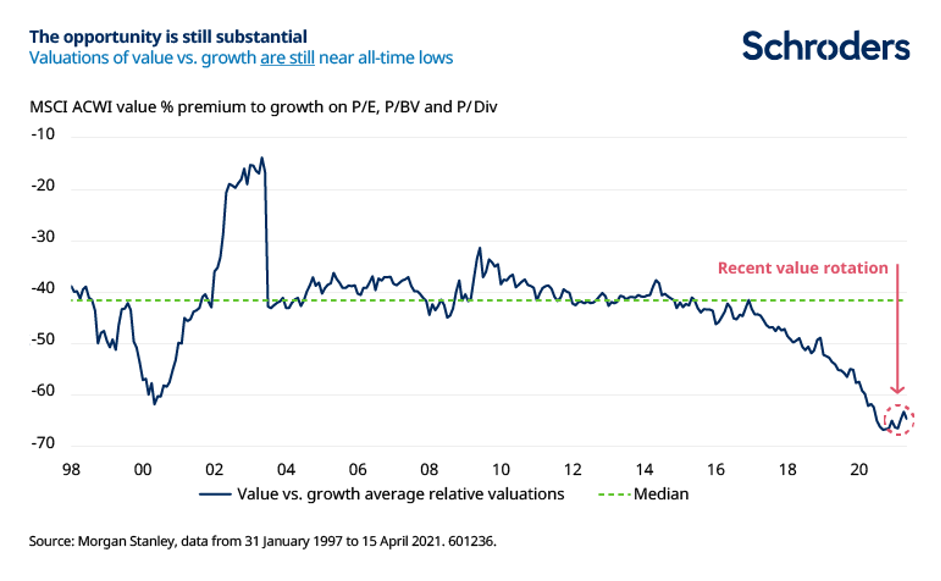

The below chart shows that valuation dispersion within the market – the gap in fundamental valuation between the most highly rated and the least highly rated shares globally – remains at extreme levels.

The small bounce seen in the red dotted circle is what has occurred since October, which is barely visible at the end of the chart. While the recent moves feel spectacular to many, Schroders thinks we’re looking at a tremor of performance rather than a real earthquake. “If valuation gaps in the market are to return to something more like normal in the context of long-term history, there seems to be a long way to go,” says Adler.

Adler includes a second word of caution: “In the last couple of years, we’ve begun to see the sort of crazy market behaviour that typically occurs at the top of market cycles. In fact, this is exactly the sort of behaviour that characterised the peak of the dotcom mania in 1999/2000. We think the parallels between that period of market history – when bullishness got seriously out of control – and today are increasingly plain to see.”

Of course, there are those who disagree and believe these high-valuation growth companies are “genuinely exceptional businesses with solid fundamentals that are changing the world” and that their sky-high valuations are justified. Adler says “this is simply a new reality”.

His response to the justification of these high-valuation growth stocks: “Investors thought the same thing in 2000 too! The top four largest tech companies at the height of the boom were Microsoft, Intel, IBM and Cisco. These were genuinely high-quality businesses that delivered exceptional growth in profits and high attractive returns. They were great businesses, but they also proved to be terrible investments if you bought them at the wrong price. Over the following three years from the peak of the dotcom boom, they fell by an average of 60%. Just because these tech giants are big, innovative and growing fast today doesn’t mean people can’t lose money investing in them.”

Adler says that even if you exclude the “top 5% of mega caps or the most expensive 10% of the universe, you get a similar picture: the difference between the most and least loved parts of the market remains big, by any historical standard.”

This suggests to Adler that the market has once again abandoned the idea that fundamental valuation is important, and the market is looking eerily similar to the one in 1999/2000. What happened during this year? From the peak of the market cycle in March 2000, global equity indices entered a painful, drawn-out bear market. Global value stocks delivered.

Adler’s finishing value pointers:

- “Value as a style often underperforms into the tail end of a bull market. Fashionable areas of the market soar and value investors are often left behind.”

- “But when financial gravity starts to bite, value often does pretty well.

- “And it is during the periods of irrational exuberance that markets will present some wonderful contrarian opportunities for investors that are willing to swim against the tide.”

- “Some of those contrarian opportunities can be found in obvious parts of the market such as in the banking and energy sectors.”