Tesla among six new stocks added to the Chi-x TraCRs platform

Investors are piling into COVID-hit international companies amid a share trading boom. According to ASIC’s analysis of trading volumes during the COVID period, share trading volumes among retail investors have doubled.

With that in mind, international share trading has become a lot easier, but can still come at a substantial cost, with added tax implications, and currency risks. The fluctuating Australian dollar can positively or negatively affect your international investments if they are not protected against currency movements. Such protection usually requires the purchase of currency options to hedge currency exposure.

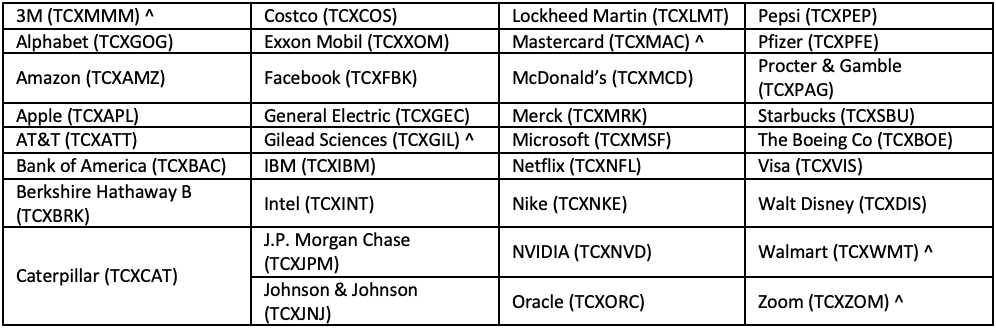

This is where a new innovative securities class named TraCRs (pronounced ‘tracers’), which stands for transferable custody receipts, was launched to fill in the gap. Quoted on the Chi-X exchange, these securities give Australian investors access to the benefits of owning US shares, in some of the world’s biggest brands, such as Disney, ExxonMobil, and Microsoft. Last week, the exchange unveiled its latest tranche of US-listed companies, bringing the total to 41 US companies. The six new securities include

- BlackRock (TCXBLK)

- Cisco (TCXCSC)

- The Coca-Cola Company (TCXCCC)

- PayPal (TCXPYP)

- Stryker (TCXSYK)

- Tesla (TCXTSL_

Deutsche Bank’s head of depositary receipts, Australia and New Zealand, Chris Bagley said: “Following today’s announcement, we now have a total of 41 TraCRs available, giving Australian investors access to a growing list of iconic US-listed companies. Together, these 41 depositary receipts represent over 45% of the market capitalisation of the S&P 500 Index, or about 65% of the Nasdaq 100 Index. In response to resounding market feedback, we are pleased to make Tesla and PayPal available, among others, in this latest tranche.”

Chi-X Australia Chief Executive Vic Jokovic said the latest tranche complements the growing number of popular US listed companies available via TraCRs.

“All six names are hugely popular choices with investors and our broker partners. Local market investors are naturally curious about innovative brands. Tesla is leading the world’s transition to sustainable energy with its electric vehicles, battery energy storage, and solar products. Meanwhile, PayPal operates a global online payments system that recently announced its intention to compete in the buy-now-pay-later (BNPL) sector with ‘Pay-in-4’ and the ability for customers to hold bitcoin and other cryptocurrencies.”

How do they work?

The underlying US custodian (Deutsche Bank) buys and holds the underlying US shares on behalf of the TraCR issuer (also Deutsche Bank). The issuer, which is also the market-maker, is then responsible for the issuing, redemption, and operational management of TraCRs on the Chi-X exchange. According to Investopedia, a market-maker is an individual market participant of an exchange that also buys and sells securities for its own account, at prices it displays in its exchange’s trading system, with the primary goal of profiting on the bid-ask spread.

Here are the benefits of holding a TraCR:

- You will have a beneficial interest in the underlying US share. For example, if you hold one Apple Inc TraCR, you have a beneficial interest in one Apple Inc share.

- TraCRs can be bought and sold during normal market hours the same way you would trade an Australian share. Cleared through ASX CHESS, TraCRs are registered at a local share registry and settled on your CHESS HIN on T+2 basis.

- You receive your dividends in Australian dollars

- TraCRs give you greater portfolio diversification of owning US shares managed through your local broker

- Protected through Australian regulation and ASIC supervision

The latest tranche has come at a perfect time, just before the US elections. Mr Jokovic says “Brokers are expecting significant volatility going into the election and it will be interesting to see how this major event will impact markets.”

Having a beneficial interest in the underlying share means you have access to dividends. It also means you have the right to convert your TraCR holding at any time into the underlying share. But the biggest benefit from purchasing TraCRs is that they are traded in Australian dollars, which removes the need for the costly currency hedging of each individual global stock. Think of it as another unique and simple way to gain exposure to global markets.