Thematic ETFs drop like hot cakes

Funds into thematic exchange traded funds (ETFs) have dried up this year as technology stocks get hit globally. Investors are being warned to check the soundness of any fund’s theme, along with the fees charged, which often sit higher than those on vanilla ETFs.

Thematic ETFs identify long-term structural trends which enable investors to bet on themes such as clean energy and particular sectors such as technology and gaming. Global index provider MSCI has identified a number of ‘mega-trends,’ or long-term themes linked to macroeconomic, geopolitical and technological change. These include the rise of artificial intelligence, cyber security and renewable energy. Thematic ETFs contrast with market capitalisation ETFs which track benchmark indices such as the S&P/ASX 200 or the S&P 500 and provide broad exposure to the share market.

Ben Johnson, director of global ETF research for Morningstar, says flows into thematic ETFs have slowed dramatically this year across the globe and in Australia. At the end of April 2021, global trailing 12-month flows into thematic funds peaked at nearly US$242 billion. By the end of April 2022, that figured had dropped more than 75 per cent to US$59 billion, according to Morningstar data.

Tech thematic ETFs hard hit

Arian Neiron, VanEck’s CEO and Managing Director Asia Pacific, says with central banks around the world increasing interest rates, the positive momentum in technology stocks has reversed, taking with it niche thematic ETFs.

“The Australian thematic ETP landscape is now hyper saturated with an increasing number of strategies crossing over constituents. Over the last two years, the number of fund managers has proliferated, with some offering esoteric thematic ETFs which have leveraged off the excess liquidity and ultra-low interest environment to pique retail investor appetites. That appetite has abated.”

According to Neiron, there are currently 31 thematic ETFs on ASX up from 19 in the previous calendar period (pcp), a 63.2 per cent increase), making up $5.7 billion in funds under management (FUM), up from $4.3 billion a year earlier. They had gathered $225 million in net flows over the year to 30 April 2022, a big drop from $746 million for the first four months of 2021.

“Notably, the 12 ETFs that have listed in the past 12 months have struggled to gain traction, collectively taking in only $12.4 million. Digital asset exposure ETFs have lost over 40 per cent of their value this year with most technology thematics such as semiconductors, cloud computing, robotics and automation falling by over 20 per cent,” said Neiron.

“Our expectation is that the thematic ETF segment of the Australian ETP industry will compress further and that investors will start to redeem ‘questionable’ thematic strategies as their sparkles loses shine. In contrast, those thematic ETFs that invest in genuine structural trends such as the movement to clean energy away from fossil fuels will continue to be the preferred thematic exposure,” he says.

Backing a winner isn’t easy

Morningstar’s Johnson has written extensively on thematic ETFs. He explains that to be included in Morningstar’s grouping for thematic funds, the fund must explicitly target one or more technology themes, such as disruptive or next-generation technologies. But according to Johnson, the odds of picking a thematic fund that outperforms a low-cost global equity index fund over long-time horizons are stacked firmly against the investor in all regions.

“Globally, just 45 per cent of all thematic funds launched prior to 2010 had survived to see 2020. Of these, only a quarter managed to beat the MSCI World Index. Although, those that do win, can win big.”

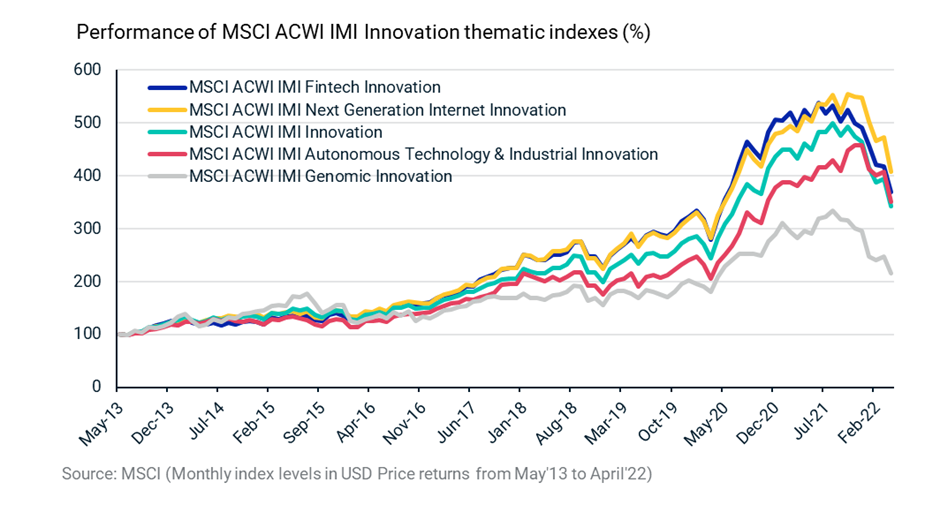

Illustrating that point is the chart below from MSCI, which shows strong gains in a selection of the thematic ETFs linked to the technology sector since 2013 through to April this year. While the indexes have dropped this year, over the long run there are well and truly higher.

Apart from picking a winning theme, Morningstar’s Johnson also warns on fees. “It is hard to understate the importance of compounded fees on long-term fund performance. Indeed, fees have been shown to be the most reliable indicator of future fund performance. Thematic funds tend to be more expensive than their non-thematic counterparts. These higher fees should be scrutinized closely; are they justified?”