The income conundrum

The combination of rising global interest rates and increasing recession fears has complicated the current investing environment. The traditional “safe haven” of fixed-income has seen volatility spike at a faster rate than equities. For those who require consistent cash flow, this creates a new level of uncertainty. To produce enough income to offset persistently higher levels of inflation, more risk seemingly needs to be accepted within a portfolio.

This plants the seed of the idea that investors must be more creative to generate adequate income. This seed germinates into allocation shifts that require either strategies or asset classes that were previously unfamiliar to the average investor. For example, the role of private real estate or infrastructure, with their built-in inflation protection, may become a logical destination for many investors who can accept illiquidity. Leveraged loans have floating rates that could protect the portfolio against rising interest rates. Other hybrid payout structures—such as structured notes and convertibles—may also be an attractive income option for some.

While these are reasonable places to search for steady income, what has happened in the first half of 2022 may have also provided a roadmap toward achieving income goals by following a more traditional path.

Volatility leads to opportunity

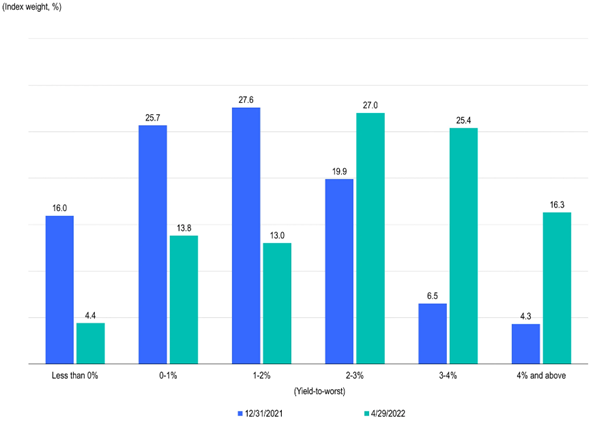

Looking at the global fixed-income markets, the sharp sell-off in bonds has opened an interesting opportunity to invest in various fixed-income asset classes at meaningfully higher starting yields compared to recent history. As of end April this year, about 42% of the bonds in the Bloomberg Multiverse Index—a gauge of the global bond market—yielded more than 3% in nominal terms (Exhibit 1). Only 10.8% of bonds in the index were above 3% at the beginning of the year.

Exhibit 1: Bloomberg Multiverse Index, Index Weight by Yield-to-Worst

Close to 42% of the constituent bonds in the index yield more than 3% in nominal terms, a meaningful increase from just 11% of the index as of the end of 2021.

Looking across asset classes in the United States, mostly because of appreciation, the S&P 500 Index’s dividend yield declined since the start of the pandemic from levels of 2% to 1.5%.3 In contrast, the 10-year US Treasury yield has increased from 1.5% to 3% during the same period.4 With historical volatility of equities 3.6 times higher than fixed income,5 this created a difficult decision for an investor looking for steady income and lower volatility from their portfolio.

Higher quality becoming more attractive

Today, despite the decline in the broad equity market, bond yields at every maturity have risen to levels back in excess of dividend yields. In addition, higher-quality corporate bonds, which tend to have longer duration than high-yield issues, have seen some of the biggest price declines in a generation. This seems to imply that markets are pricing in further rise in rates and elevated inflation.

Similarly, within equities, sectors that are typically considered inflation-sensitive, like utilities, communications, materials and energy, have performed well year-to-date, while the broad market has declined. In other words, the expectations built into current equity prices are creating bifurcations where valuations in some sectors are at levels not seen since before the pandemic.

However, a broad array of indicators and surveys expect inflation to moderate toward pre-pandemic levels. In other words, market participants within fixed-income and equities seem to have a more pessimistic inflation outlook than corporations or individuals, which is creating pockets of valuation opportunities in both investment-grade credit and higher-quality equities that have not been seen since prior to the pandemic.

Inflation peaking?

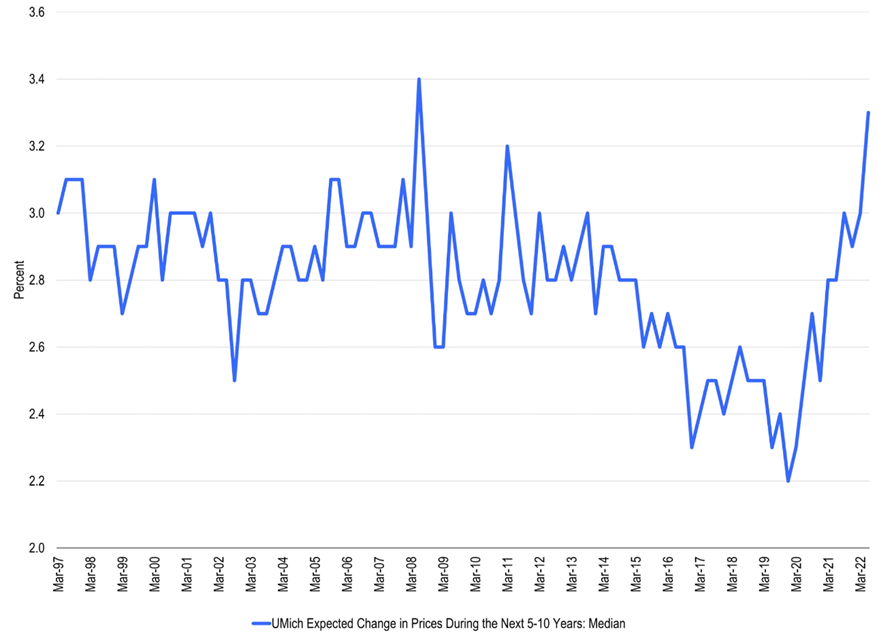

Consumer surveys of inflation expectations have indicated that inflation will be in a higher trend than recent years, but not near the current extreme levels. This difference in expectations will be an important determinant as to optimal portfolio positioning relative to inflation.

Exhibit 2: Long-term Inflation Outlook: Consumers’ Expectations

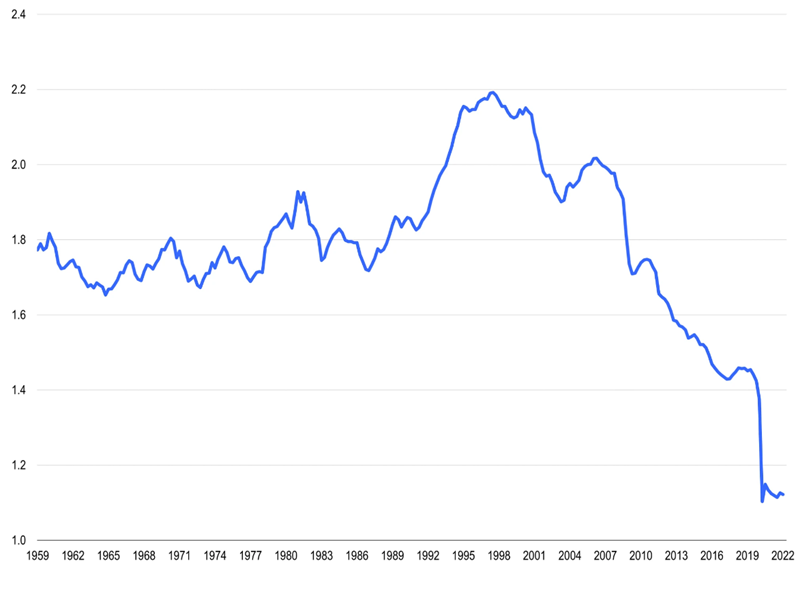

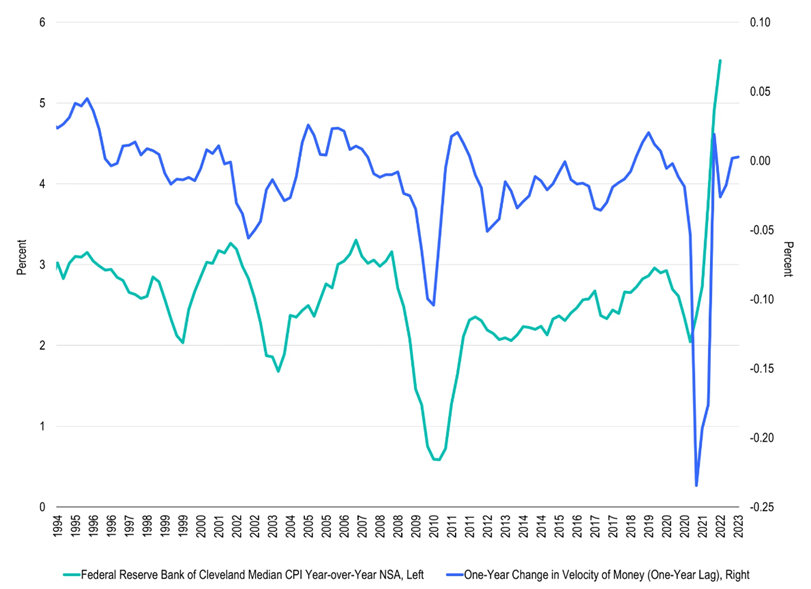

Additionally, there is another concept that is important in understanding inflation: the velocity of money. It is defined as the ratio of gross domestic product to the total money supply in circulation. With the massive amounts of stimulus that have been pushed into the economy, this ratio has declined significantly since the 1990s, coinciding with lower inflation. Looking at this measure a bit more deeply (Exhibit 3), the annual change in the velocity of money has been a good indicator of future inflation with a lag of about a year. This measure seems to be rolling-over.

Exhibit 3: Velocity of Money

The number of times a unit of currency is used to purchase goods and services has fallen since the mid-1990s

Exhibit 4: Inflation Follows Change in Velocity of Money with a One-Year Lag

What does this all mean for an investor? The inflation and growth pictures are not clear-cut, but the markets have priced-in a high-inflation economic outcome. This creates a dislocation that provides wider dispersion of investment opportunities across traditional fixed-income and equity markets. While some alternative investments may be attractive regardless of how the economic landscape plays out, the current valuations of traditional assets may provide an opportunity to re-balance portfolios toward income goals using stocks and bonds.