‘The destination is what’s important’: FPA/AFA chart next stage of merger plan

The Financial Planning Association and the Association of Financial Planners have confirmed members will vote in February on their proposed merger, with a joint release this week indicating the next stage of consultation will see drafts of key documents including the proposed information memorandum, resolutions and constitution sent out in early December.

Since the merger was first announced in early September, executives from the two associations have been meeting with members to answer questions and discuss the proposal.

Once the key document drafts are sent to members in December an “extended consultation period” with members will follow, with final documents then sent to members before voting opens in early February. Voting will close around the end of February at separate Extraordinary General Meetings (EGMs).

Both EGMs will be held in person and on-line, which the two groups will help encourage members of both associations to participate.

At least 75 per cent of voters will need to approve for the proposed merger to go ahead.

Heart of the matter

The key documents to be drafted and handed out in December will contain much of the crucial information members will be using to decide whether the merger makes sense.

The documents will provide relevant information about transaction considerations and implementation plans, as well as proposed revenue and operating models, and the management team.

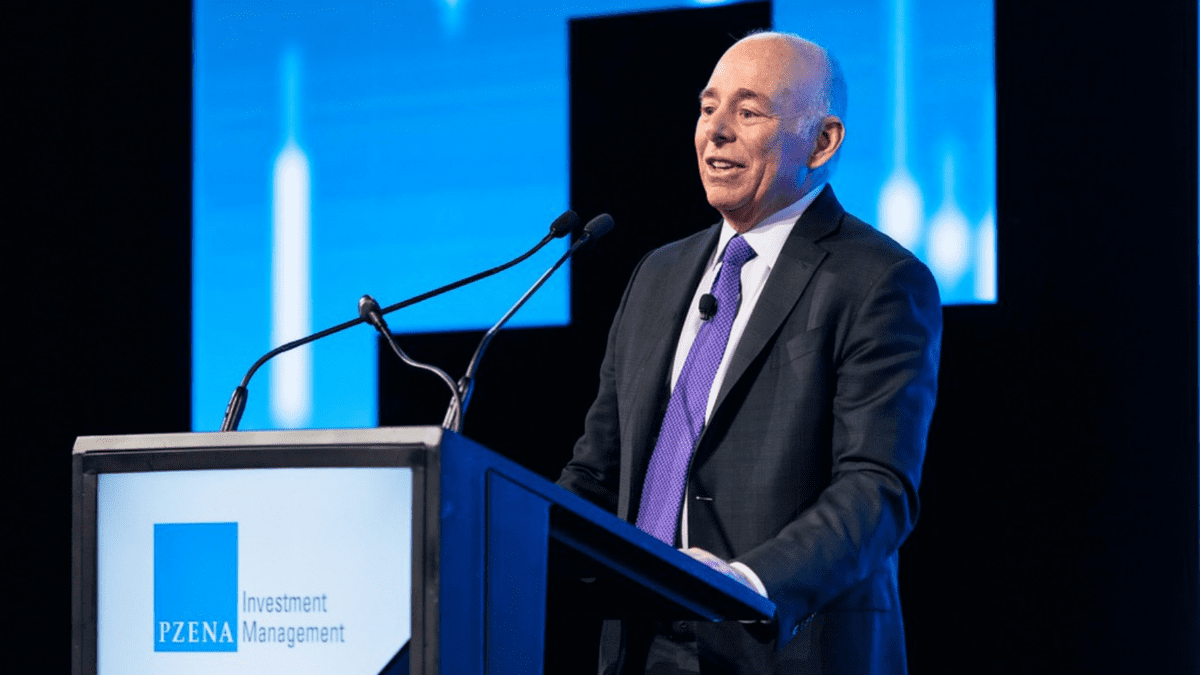

“We don’t want to drag things out in excruciating detail but it’s important for members to understand what the merged association will look like, who it operates for, what it’s called – that’s important for a lot of people – and the key terms we’ll be operating under,” FPA chief executive Sarah Abood tells The Inside Adviser.

At this stage Abood is slated to retain her role as chief in the combined association, while the new board of the proposed entity is expected to be pro-rated across the two associations with the larger FPA having eight directors and the AFA four.

“The constitution will outline the objectives and key elements of how the associations will come together and how it will be governed on an ongoing basis, plus the powers that members have to choose the people that will represent them,” Abood says. “Those are the critical things.”

Key to the financials of a merged entity will be the continuation of the FPA’s Certified Financial Planner program, which Abood previously said will be the “primary designation” for the proposed merger if it goes ahead. “But advisers who hold other designations such as the FChFP [The Fellow Chartered Financial Practitioner] and the ChLP [Chartered Life Practitioner] will be continue to be supported,” she noted in September.

Given its larger suite and longer lease, the FPA’s office on Clarence Street in Sydney is expected to become the merged group’s base.

No better time

When the merger was originally announced, executives from both organisations acknowledged that rationalisation across the industry played a part in the decision.

Both groups have seen a decline in membership numbers and attendant revenue broadly in line with the 30 to 40 per cent drop in registered advisers since its peak at 30,000 in 2018.

The need for united representation was also cited in light of the Quality of Advice Review, which is due to hand down its recommendations in December, and the Australian Law Reform Commission’s ongoing review into the Corporation’s Act.

Abood points out that while many members have expresses their support for the merger, and are keen to push it forward, the two groups need to make sure they execute the merger process appropriately.

Keep in mind, she adds, that both groups are essentially creating a new version of themselves and both and taking different paths to get there.

“But the destination is what’s important,” she says.