Tepid jobs data eases rate fears

The local share market advanced to a fresh eight-month high on Thursday after weaker-than-expected jobs data showed the Australian economy slowing, raising expectations for less aggressive rate hikes from the Reserve Bank.

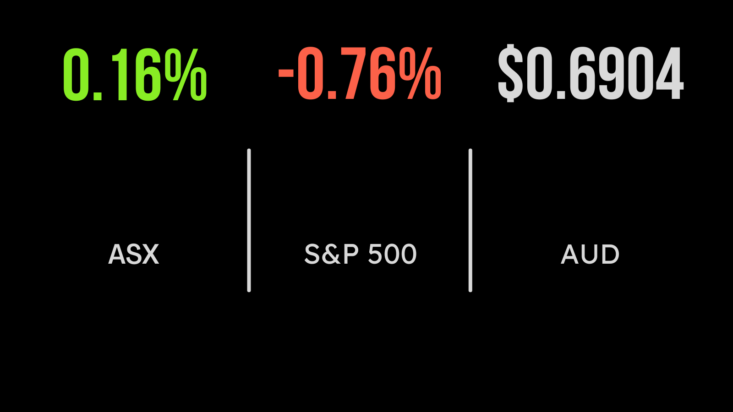

The benchmark S&P/ASX200 index closed on Thursday up 41.9 points, or 0.6 per cent, to 7,435.3, its best level since April 22. The broader All Ordinaries gained 38.9 points, or 0.5 per cent, to 7,648.4.

The Australian Bureau of Statistics reported that employment fell by 14,600 in December, the opposite direction to expectations of an 25,000 increase. Unemployment came in at a still very low 3.5 per cent, but not quite as good as the 3.4 per cent that economists’ consensus was expecting.

Miners lead market

Mining led the market higher, posting a 1 per cent rise in the sub-sector index. Rio Tinto gained $3.97, or 3.3 per cent, to $125.96, a ten-month high. Fortescue Metals was up 38 cents, or 1.7 per cent, to $22.58, while BHP closed 60 cents, or 1.2 per cent, higher at $49.68 after announcing that it was on track to meet its production guidance for 2022/23.

Of the lithium producers, Allkem advanced 36 cents, or 2.9 per cent, to $12.61, and Pilbara Minerals added 1 cent to $4.02. IGO, which mines nickel as well as lithium, rose 13 cents, or 0.9 per cent, to $14.34, and Mineral Resources, which produces iron ore and lithium, was up 37 cents, or 0.4 per cent, to $88.06.

In the energy arena, Woodside Energy eased 22 cents, or 0.6 per cent, to $36.78, Santos lost 12 cents, or 1.6 per cent, to $7.24. Whitehaven Coal lost 6 cents, or 0.7 per cent, to $8.93 but Yancoal Australia gained 16 cents, or 2.6 per cent, to $6.35.

The big banks were all higher, although more modestly. CBA moved 1 per cent higher to $108.74, ANZ added 0.4 per cent to $24.88, Westpac was up 0.6 per cent to $23.95 and National Australia Bank edged 0.1 per cent higher at $31.71. Investment bank Macquarie rose 1.3 per cent to $181.98. Suncorp rode a broker upgrade to a 44 cent gain, or 3.7 per cent, to an 18-month high of $12.36.

Telstra gained 6 cents, or 1.5 per cent, to $4.15, marking its highest close in a year.

Biotech heavyweight CSL added $2.42, or 0.8 per cent, to $295.25. Investigative analytics and intelligence software company Nuix surged 12 cents, or 14.6 per cent, after it said it expects half-year earnings to beat last year’s effort.

Wall Street gets rate blues

US indices retreated overnight as investors mulled the likelihood that the Federal Reserve will keep raising rates despite signs of slowing inflation. The blue-chip Dow Jones Industrial Average lost 252.4 points, or 0.8 per cent, to 33,044.6, its third straight losing day. The broader S&P 500 slid 30 points, also 0.8 per cent, to 3,898.8, while the tech-heavy Nasdaq Composite shed 104.7 points, or just under 1 per cent, to close at 10,852.3. European markets shared the weaker sentiment, with the STOXX 600 index giving up 1.5 per cent.

On the commodity front, gold jumped US$25.17, or 1.3 per cent, to US$1.932.31 an ounce, while the global benchmark crude oil grade, Brent crude added US$1.27, or 1.5 per cent, to US$86.25 a barrel and West Texas Intermediate gained US$1.10, or 1.4 per cent, to US$80.58 a barrel. The Australian dollar is buying 69.12 US cents this morning.