-

Sort By

-

Newest

-

Newest

-

Oldest

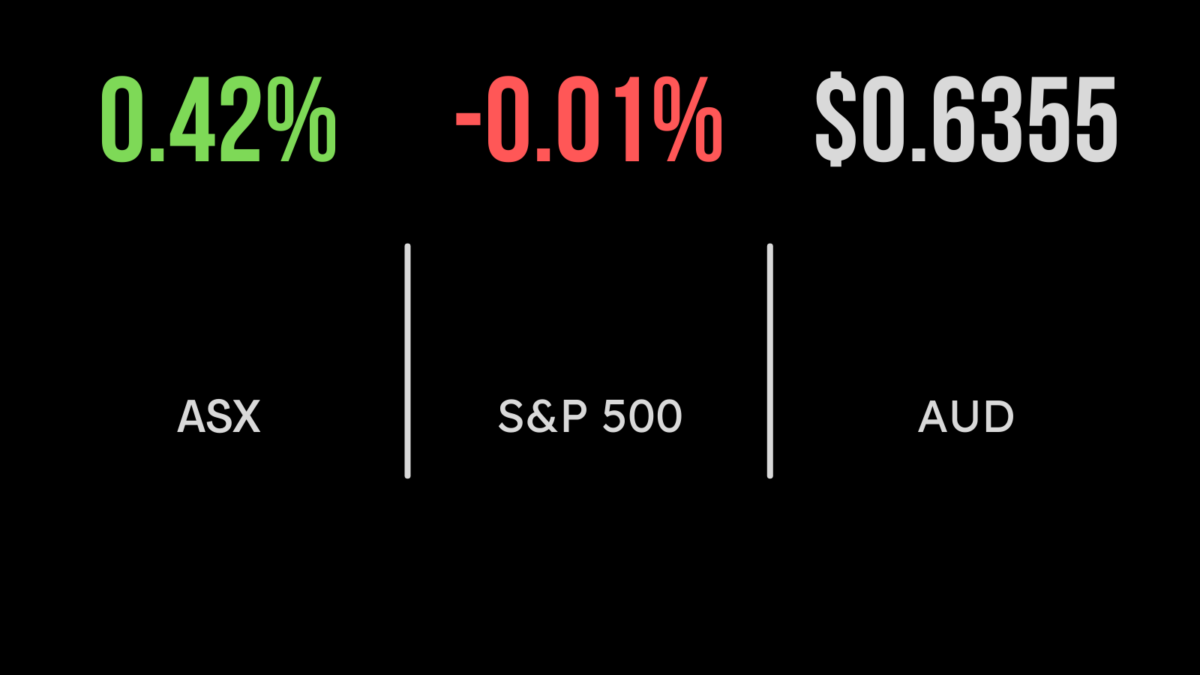

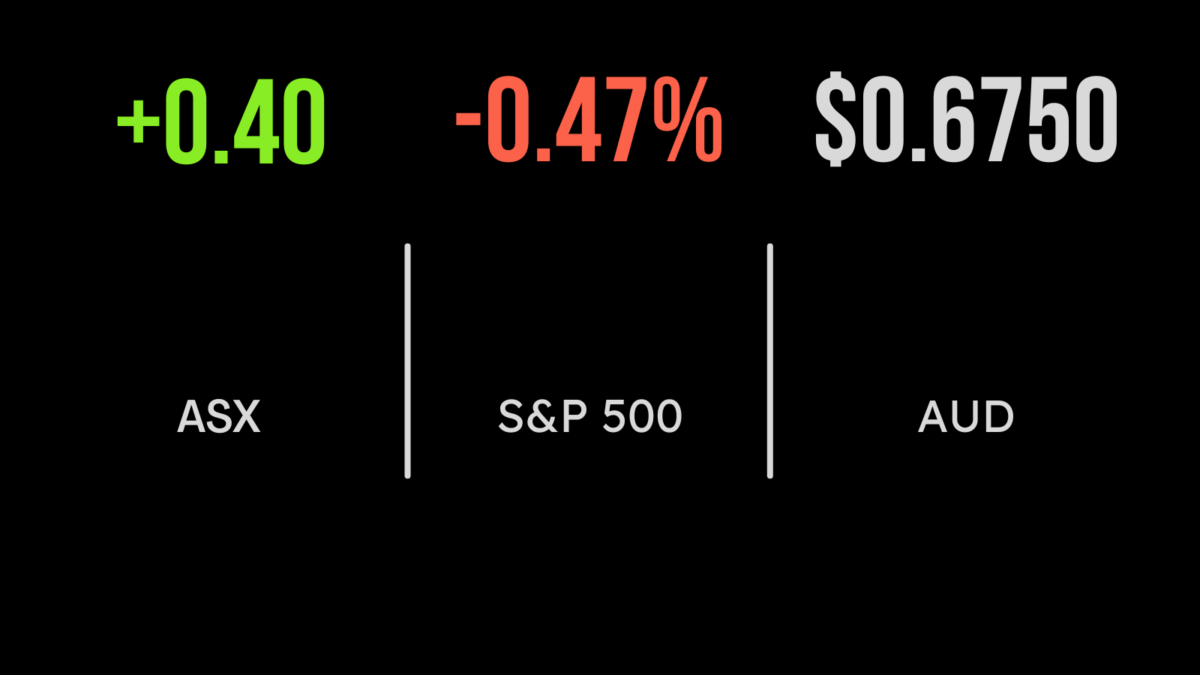

The local share market snapped its losing streak, with both the All Ordinaries (ASX:XAO) and S&P/ASX200 (ASX:XJO) gaining 0.4 per cent on a settling of bond yields and the latest Reserve Bank meeting minutes. According to the new governor, the board had considered raising and now sees November as a ‘live’ meeting with the potential…

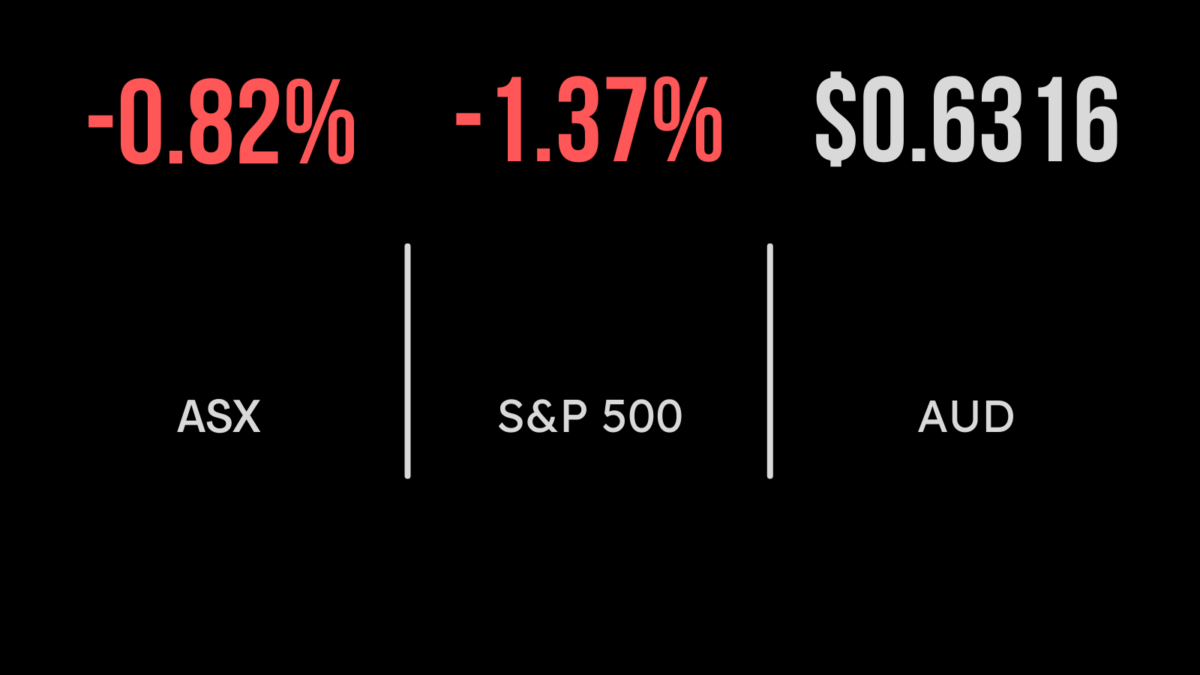

Share market feels the rates heat The Australia share market retreated to a six-month low on Tuesday, as global markets felt the pressure from surging bond yields – despite, in Australia’s case, the Reserve Bank leaving the official cash rate on hold at 4.1 per cent, for a fifth straight month. The benchmark S&P/ASX200 index…

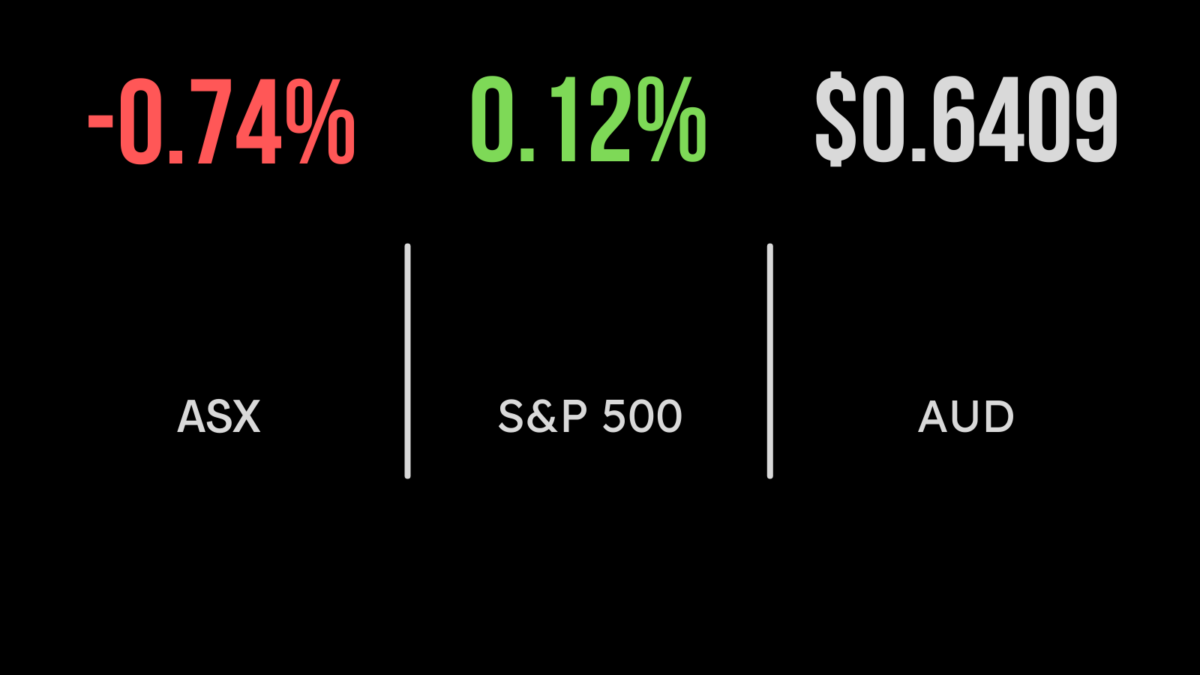

A tech slide dragged the ASX indices lower on Wednesday, ahead of the US inflation data coming in overnight. Consensus expectations were for the US headline consumer price index (CPI) to show core inflation at 3.6 per cent for the year to August, up from 3.2 per cent a month ago – a significant rise….

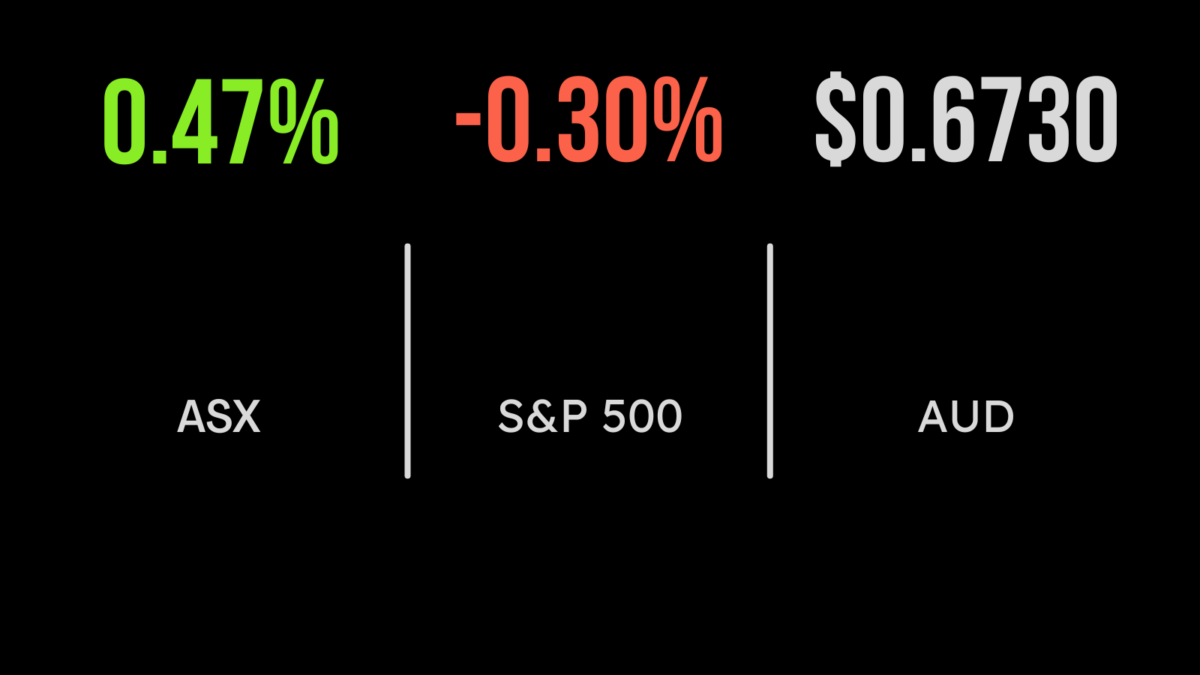

The Australian share market moved higher on Tuesday, as investors assessed conflicting data releases, one showing weakening consumer sentiment but the other indicating business conditions improving. The benchmark S&P/ASX200 index managed to finish 14.6 points, or 0.2 per cent, higher at 7206.9, with the broader All Ordinaries index tracking that rise in percentage terms, adding…

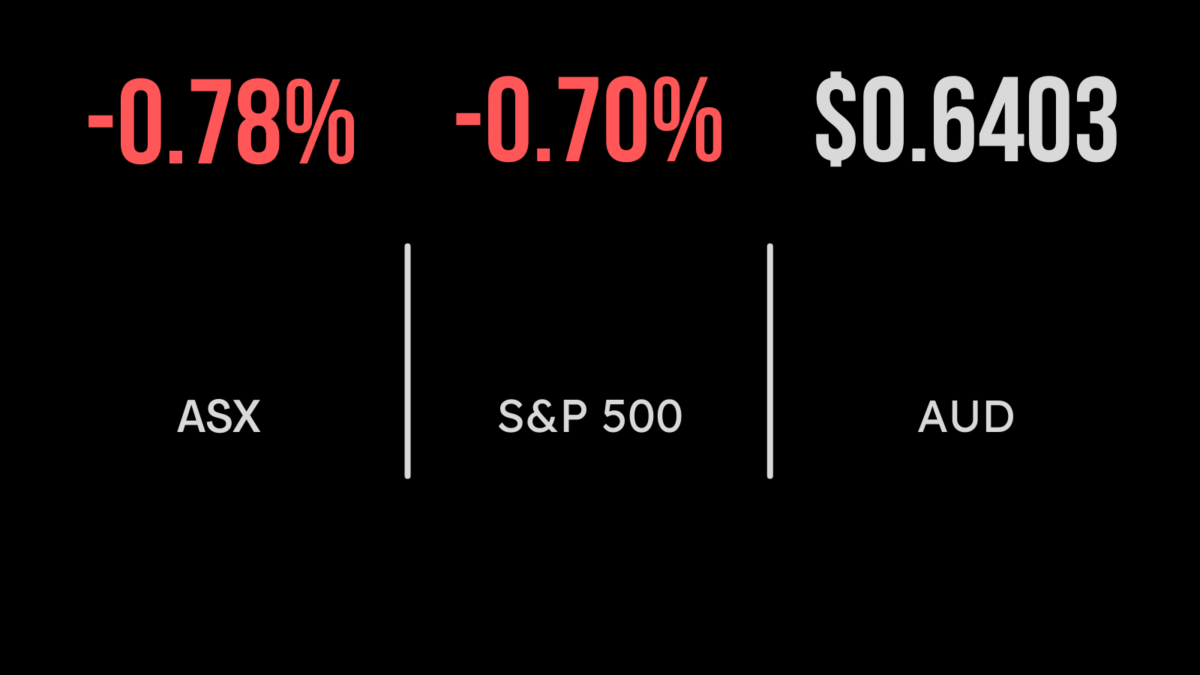

The local share market weakened again on Wednesday, with the All Ordinaries down 0.7 and the S&P/ASX 200 (ASX:XJO) falling 0.8 per cert as seven sectors fell by more than 1 per cent. The rare highlight was the energy sector, which gained 1 per cent on the back of the oil price surging above US$90…

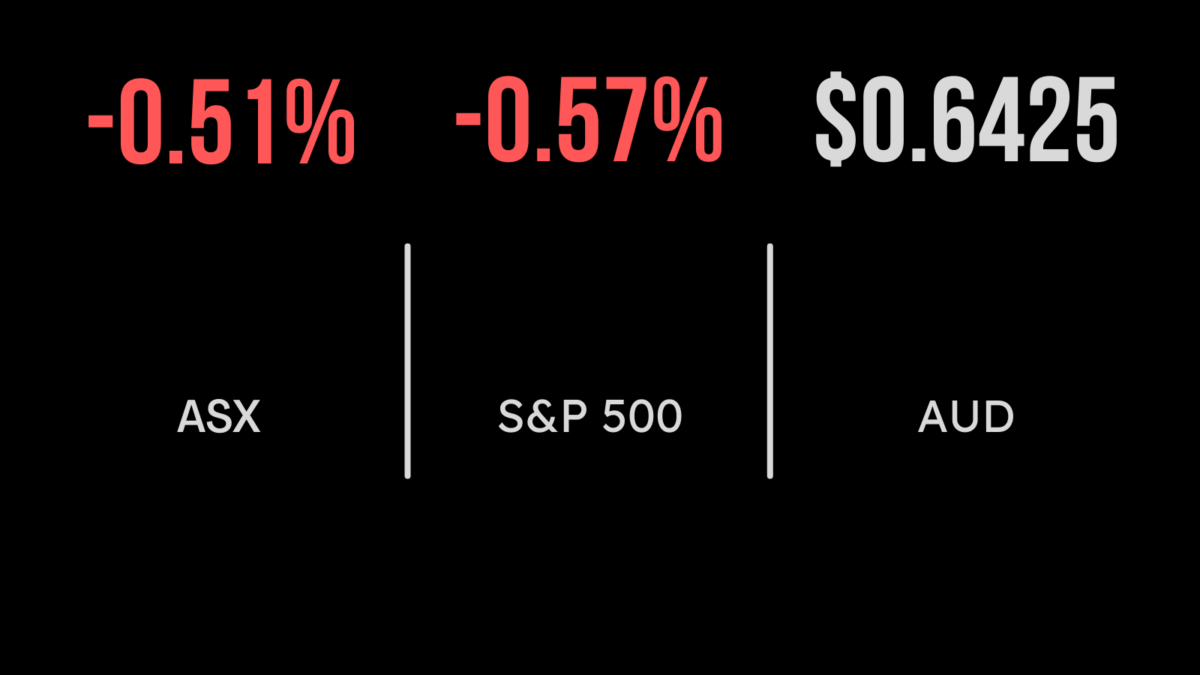

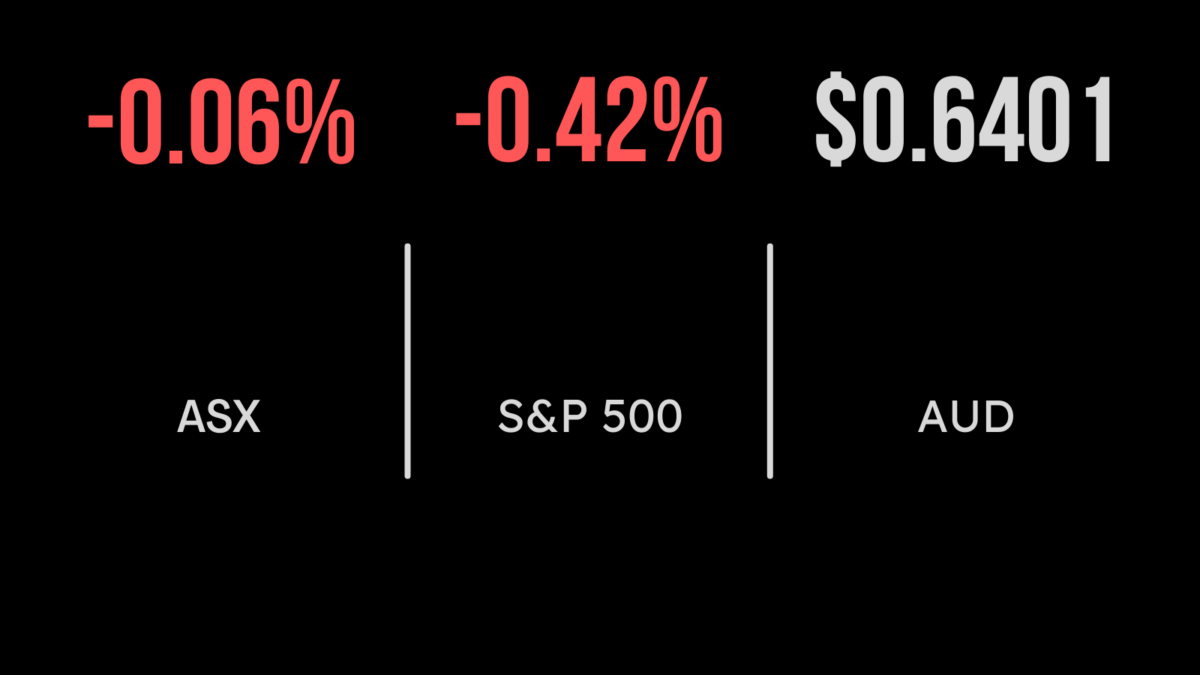

The local share market closed broadly flat on Tuesday, with both the S&P/ASX200 (ASX:XJO) and All Ordinaries falling 5 and 9 points respectively. The primary culprit was a weakening utilities sector which fell 1.2 per cent behind a 2.9 per cent selloff in Origin Energy (ASX:ORG). The weakness came despite news that the NSW Government…

While active management can provide pockets of outperformance both here and globally, research from S&P Global suggests maintaining above-benchmark returns is difficult to maintain.

Rising iron ore prices helped mining heavyweights BHP Group, Rio Tinto, Fortescue Metals and Mineral Resources on Thursday, and in turn that helped to push the major indices higher. The benchmark S&P/ASX200 index finished Thursday up 3.8 points at 7,255.4, while the broader All Ordinaries gained 3.9 points to 7,460. Iron ore has risen 15 per cent since the start of 2023, on optimism…

Optimism for mining stocks battled a downturn in the big banks in deciding the direction for the Australian share market on Wednesday, with the banks prevailing just enough to see the benchmark S&P/ASX 200 close 6.8 points, or 0.1 per cent, lower at 7251.6, while the broader All Ordinaries Index retreated 1.9 points to 7456.1. The bullishness for the miners…

Australian retail sales rebounded in January as household spending defied inflation and higher borrowing costs, strengthening the case for the Reserve Bank to keep raising interest rates, and run a “higher for longer” rates scenario, taking its cue from its central bank peers in the US and Europe. Retail sales rose 1.9 per cent in January after…