-

Sort By

-

Newest

-

Newest

-

Oldest

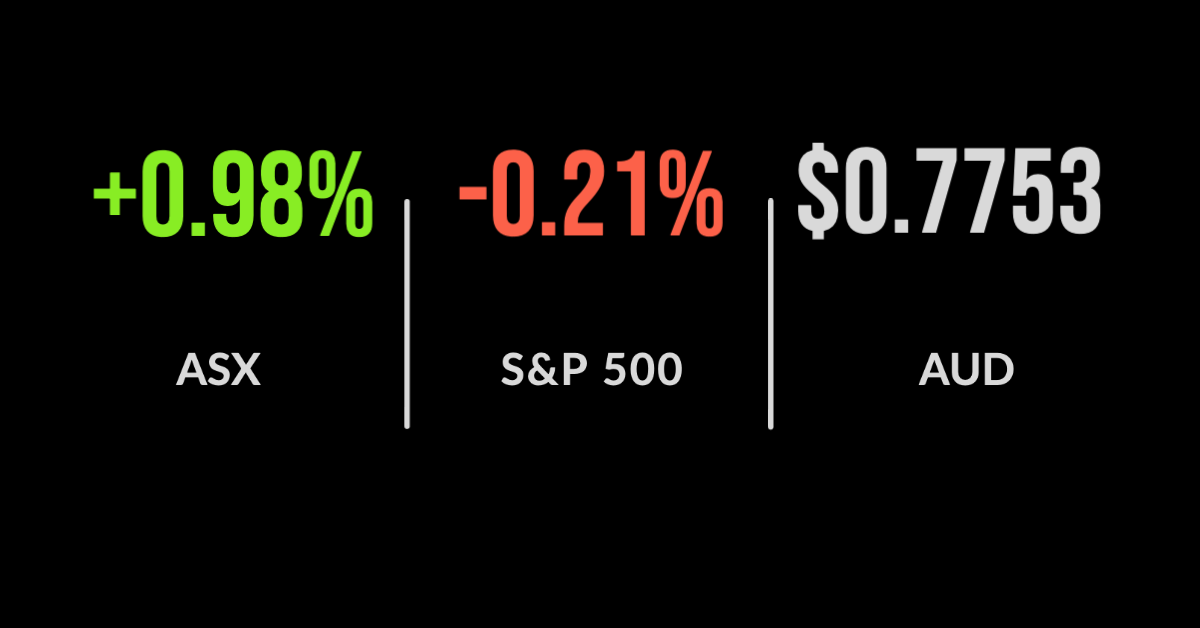

ASX overcomes iron ore fall, exports smash records, Victoria on tenterhooks The ASX200 (ASX: XJO) managed to deliver another 1.0% gain on Tuesday despite the backdrop of what appears to be nine COVID-19 cases in the northern suburbs. Whilst borders are not yet closed, Qantas (ASX: QAN) and Flight Centre (ASX: FLT) weakened in a broadly stronger market. Utilities were the…

Small gain for ASX, CBA nears $100, Zip keeps buying The ASX200 (ASX: XJO) managed to finished just 0.2% higher on Monday as strength in the banking sector including the Commonwealth Bank of Australia (ASX: CBA) offset weakness in materials. CBA is once again trading at an all-time high and just $1.24 short of the $100 mark. Iron oreand commodities…

Another weekly gain, inflation headwinds, Kogan canned, IPOs pulled The ASX200 (ASX:XJO) finished Friday on a positive note, up 0.2%, delivering a weekly gain of the same amount. For the day, only the materials and energy sectors finished lower, the latter on concerns of a boost in supply from Iran. The consumer staples and healthcare sectors were…

Dip buyers emerge, ASX moves higher, EML Payments enters trading halt, Nuix continues to fall The ASX200 (ASX:XJO) fell throughout the day despite a positive open, finishing 0.1% higher as dip buyers emerged following last week’s unexpected sell-off. The IT and energy sectors were the stories of the day, with the former returning to normal heading 1.2% higher…

ASX retakes 7,000, iron ore falls, CBA hits new record, dispersion grows The ASX200 (ASX:XJO) finished the week on a positive note, moving 0.5% higher and retaking the 7,000-point level. Every sector was higher barring materials, with Fortescue (ASX:FMG) and BHP Group (ASX:BHP) falling 2.8% and 1.5% respectively after the iron ore price dropped 9.5% during the day. On the positive side, the…

ASX follows Wall Street lower, defensive rotation, Graincorp beats expectations The ASX200 (ASX:XJO) has followed Wall Street lower, falling 0.9%, after higher-than-expected inflation figures spooked investors overnight. Short-term traders are betting that the Federal Reserve will be forced to increase interest rates earlier than expected, suggesting long-term growth companies will be worth less as a result. The selling pressure…

Market weakens on China tensions, local tech dumped, hot IPO market cooling The ASX200 (ASX:XJO) fell 0.5%, weakening throughout the day as news continued to worsen. Initially, it was US payment giant PayPal (NYSE:PYPL) delivering a strong earnings result but announcing they would soon be bringing their BNPL offering to Australia in direct competition with Afterpay (ASX:APT). Shares in APT fell 7.0% and the IT…

Bank rally not enough, Westpac hike dividend, job ads continue to surprise The ASX200 (ASX:XJO) rose just three points to begin the week, with a powerful day from the financials sector (+1.4%) which represents some 30% of the index not enough to overcome broader weakness. Energy and materials continue to detract amid signs that inflation is being…

Mixed day but higher finish, new highs for stalwarts, Woolworths disappoints The ASX200 (ASX:XJO) managed another small gain, adding 0.3%, powered ahead by the technology sector; Afterpay (ASX”APT) and Zip Co (ASX:Z1P) adding 3.5% and 2.5% respectively. With half the sectors down, it was the consumer businesses that were the biggest detractors, Woolworths (ASX:WOW) falling 3.9% after delivering lackluster third quarter sales figures….

ASX stagnates at 7,000, Tabcorp receives another bid, Bingo deal approved The ASX200 (ASX:XJO) remains stubbornly anchored to the 7,000 point level, falling 0.2% on Tuesday as most sectors were once again hit by the threat of increasing inflation. The materials sector was the biggest positive contributor, with the likes of BHP Group (ASX:BHP), Rio Tinto (ASX:RIO), and Fortescue Metals (ASX:FMG) all adding 1%…