-

Sort By

-

Newest

-

Newest

-

Oldest

ASX down as Victoria braces, materials weaker, ALS profit jumps The ASX200 (ASX: XJO) finished 0.3% lower on Wednesday, with the materials and e-commerce sectors leading the fall. BHP Group (ASX: BHP) and Rio Tinto (ASX: RIO) remain under pressure, falling over 2% each as the hot commodity sector is cooled by increasing supply. The Commonwealth Bank of Australia (ASX:…

Small gain for ASX, CBA nears $100, Zip keeps buying The ASX200 (ASX: XJO) managed to finished just 0.2% higher on Monday as strength in the banking sector including the Commonwealth Bank of Australia (ASX: CBA) offset weakness in materials. CBA is once again trading at an all-time high and just $1.24 short of the $100 mark. Iron oreand commodities…

Another weekly gain, inflation headwinds, Kogan canned, IPOs pulled The ASX200 (ASX:XJO) finished Friday on a positive note, up 0.2%, delivering a weekly gain of the same amount. For the day, only the materials and energy sectors finished lower, the latter on concerns of a boost in supply from Iran. The consumer staples and healthcare sectors were…

Shares bounce back, Victorian budget disappoints, mixed unemployment result The ASX200 (ASX: XJO) clawed back most of Wednesday’s losses, adding 1.3% on Thursday as the risk-on environment returned. The rally was powered ahead by the tech sector, 4.3% higher, along with property trusts, up 2.6%, and consumer discretionary stocks, up 1.7%. It was Qantas (ASX: QAN) that drove the…

Markets turn red, EML Payments dumped, China flags iron ore pressure The ASX200 (ASX:XJO) dropped the most in three months, finishing down 1.9% as a multitude of pressures hit the market. The materials and energy sectors both fell by around 3.0%, the former sold off after Chinese representatives flagged their intention to reduce the country’s reliance on…

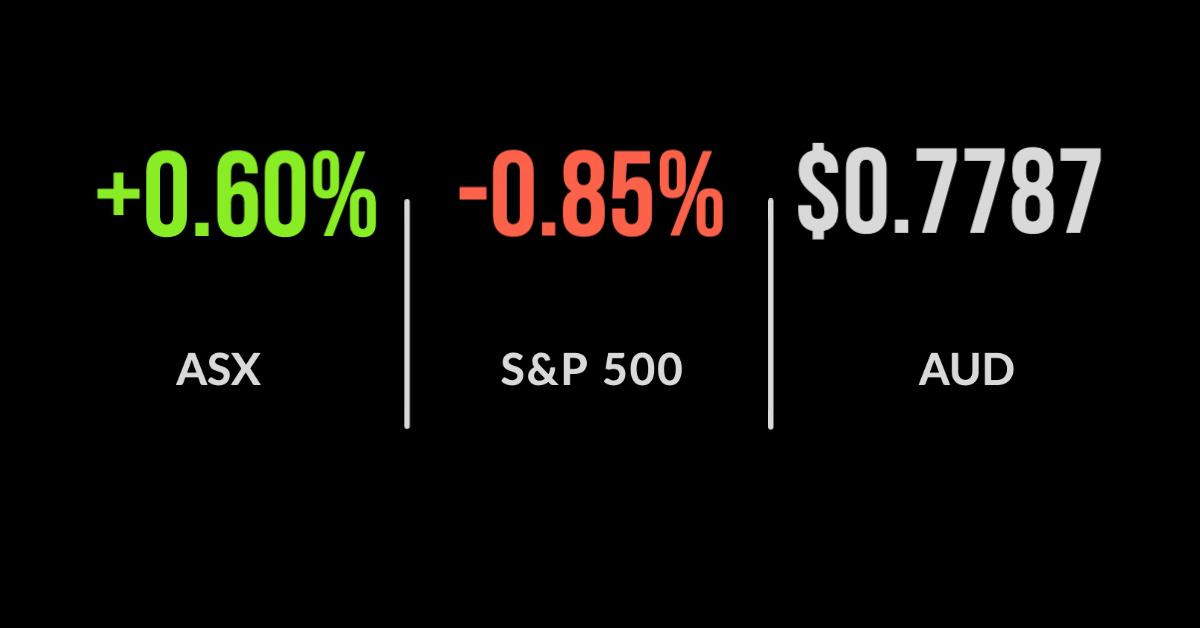

ASX hits four day high, gold shining again, growth bubble stalling The ASX200 hit a four-day high, finishing 0.6% to the positive on Tuesday; showing the short-term focus of the market at the moment. The energy and materials sectors were the biggest contributors, jumping by 1.6% each. For energy, it was the case of oil prices hitting…

Dip buyers emerge, ASX moves higher, EML Payments enters trading halt, Nuix continues to fall The ASX200 (ASX:XJO) fell throughout the day despite a positive open, finishing 0.1% higher as dip buyers emerged following last week’s unexpected sell-off. The IT and energy sectors were the stories of the day, with the former returning to normal heading 1.2% higher…

ASX retakes 7,000, iron ore falls, CBA hits new record, dispersion grows The ASX200 (ASX:XJO) finished the week on a positive note, moving 0.5% higher and retaking the 7,000-point level. Every sector was higher barring materials, with Fortescue (ASX:FMG) and BHP Group (ASX:BHP) falling 2.8% and 1.5% respectively after the iron ore price dropped 9.5% during the day. On the positive side, the…

ASX follows Wall Street lower, defensive rotation, Graincorp beats expectations The ASX200 (ASX:XJO) has followed Wall Street lower, falling 0.9%, after higher-than-expected inflation figures spooked investors overnight. Short-term traders are betting that the Federal Reserve will be forced to increase interest rates earlier than expected, suggesting long-term growth companies will be worth less as a result. The selling pressure…

Sell off continues despite budget, Qantas tanks on flight delays, CBA delivers The ASX200 (ASX:XJO) fell 0.7%, the second straight negative session, pushed lower by utilities and energy companies, down 2.2% and 2.0% respectively. The Federal Budget which offers little in the way of future spending or policy direction was broadly in line with expectations, the deficit lower than…