-

Sort By

-

Newest

-

Newest

-

Oldest

Investors may have settled into an Anything But China mantra, and they may have good reason, but for calculated risk takers there may be a different case to make according to Ruffer’s Duncan MacInnes.

The importance of Australia’s economic relationship with China cannot be overstated, but with the Red Dragon’s economy faltering and our historically close bonds strained, investors need to tread a careful path.

India’s booming population has many considering whether and how to get exposure to its market, despite its year-to-date underperformance. While it may not be the next China, India’s growth prospects remain attractive, driven by multiple tailwinds, and investors now have more points of access, Mason Stevens says.

Markets have moved sharply to reprice Chinese assets upwards after the world’s second-largest economy signalled its reopening. However, some doubt the sustainability of the current bull market, saying key ingredients for a lasting recovery are missing.

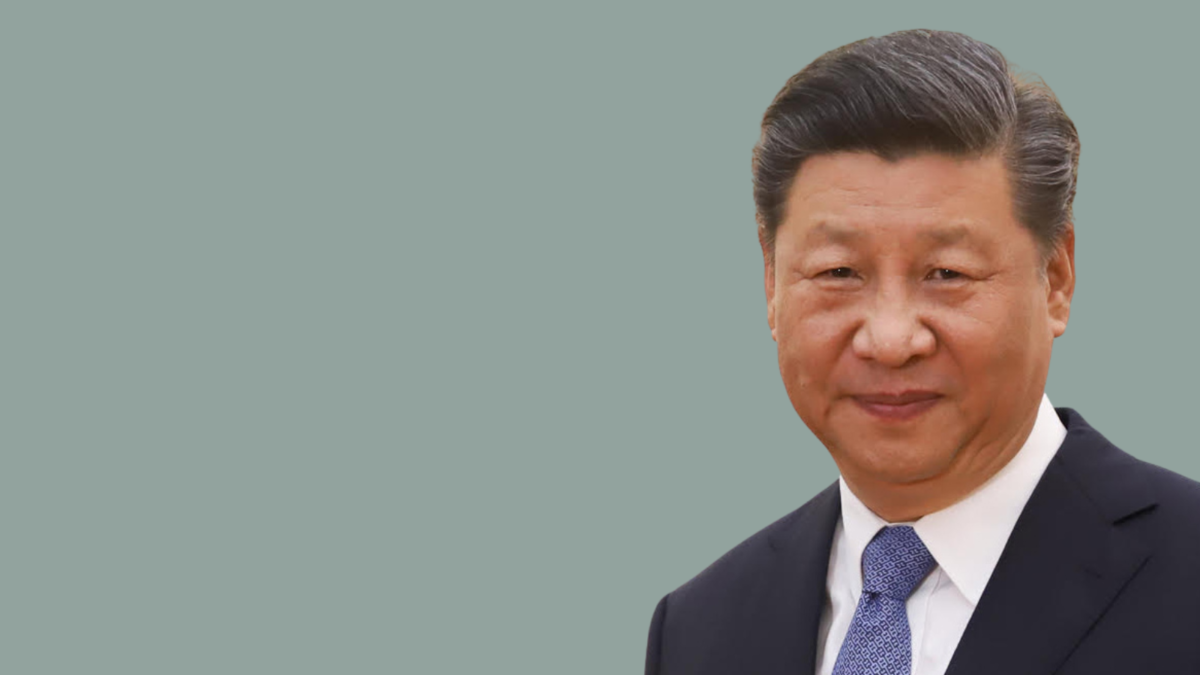

While the market is broadly underweight China, South African-based Foord Asset Management is confident that President Xi Jinping’s economic plan for the country will bear fruit over time.

The Chinese government’s announcement of less onerous isolation guidelines prompted markets to rally in anticipating of a move away from zero-COVID policies. While significant short-term challenges remain, market sources say renewed growth may be in sight, representing future opportunity.

ASX claws back, energy hit, IT takeover rally spreads The ASX 200 (ASX: XJO) spent most of the day clawing back from early losses, ultimately finishing down just 0.2% despite a weak lead from the US market. The story was similar to yesterday with 8 of the 11 sectors down but technology continuing to drive performance, up…

Rough finish to a flat week, materials hit more records, NAB’s buyback The ASX 200 (ASX: XJO) finished 0.3% lower on Friday, ending the week down just 0.02%. Behind the stagnant market was a growing level of divergence between industry performances. Materials and mining continued to power ahead behind record results and all-time highs for Fortescue Metals Group…

ASX sinks, RBA’s taper tantrum, Lew hits Myer again The ASX 200 (ASX: XJO) closed around its lows on a busy Tuesday with the long-awaited monetary policy decision released at 2pm sending the market into negative territory. Every sector barring energy, which is benefitting from an OPEC impasse, finished lower with bond proxies including communications and healthcare…

A confluence of largely unrelated trends is prompting advisers to rethink their former reticence about emerging markets for all but their better-heeled clients. They are taking a whole-world approach. According to Jorden Brown, Capital Group’s Sydney-based managing director in charge of financial intermediaries, advisers have long accepted the investment fundamentals of emerging markets (EM), such…