-

Sort By

-

Newest

-

Newest

-

Oldest

With rates well and truly crested and bonds once again showing their strength as a defensive ballast mechanism, Capital Group believes the time might be right for investors to swap out cash-like investment vehicles for investment grade credit.

The Bank of Japan has been marching to a different beat than other central banks. While the Federal Reserve, ECB and Bank of England hurried to ramp up rates in a battle against inflation, a deflationary mist lingered over Japan. Until now…

Credit and equity markets both suffered a very bad 2022, as the collapse of negative correlation between stock and bond prices left no safe haven for investors. But 2023 could be a big year for bonds, with analysts warning investors waiting on the sidelines that they risk missing out.

With central banks running out of meaningful avenues to impact economies and markets rife with volatility, many investors will be tempted to dial back risk as much as possible.

Atchison Consultants’ Kevin Toohey on why bond benchmarks only cover a slice of a diverse universe.

Bill Prendergast discusses the role of fixed income and its role in portfolios today.

Adam Grotzinger from Neuberger Berman shares insights with James Dunn from The Inside Network on how important ESG factors are in the bond and credit market these days.

Another record, another lockdown, Nick Scali, Pinnacle dominates The ASX 200 (ASX: XJO) managed to eke out another consecutive record finish, despite adding just 8 points and finishing 0.1% higher. It continues a positive start to the month, driven by seven of the eleven key sectors finishing higher. This comes despite Victoria entering its sixth lockdown, another seven day…

Tech sell off drags ASX, banks, gamblers hit, Solomon ramps up push for Myer board spill The ASX 200 (ASX: XJO) followed a weak global lead to fall close to 1% on Friday, despite a late afternoon recovery. Every sector was lower across the board barring energy, which continues to benefit from the impasse between members of…

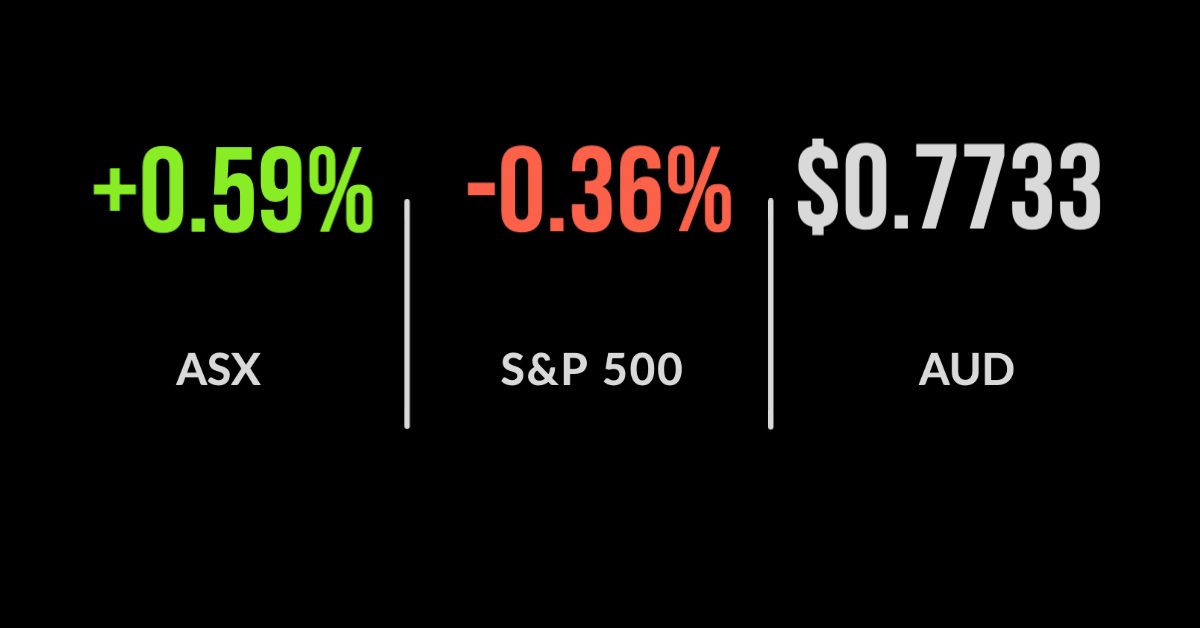

ASX trades off high, retail sales higher, Wesfarmers flags tough comparables The ASX 200 (ASX: XJO) finished at an all-time high, adding 0.6% on Thursday as the energy sector continued to rally. The energy sector was 3.3% higher along with utilities, up 2% again, whilst consumer discretionary was the only detractor, falling 1.1%. Worley Ltd (ASX: WOR), which…