Super fees still too high, but change is on the horizon: Research

Superannuation fees are still too high across the board according to new research, but recent moves by Rest to lower its fees and Betashares’ entry into the superannuation market could encourage fee reduction, new research reveals.

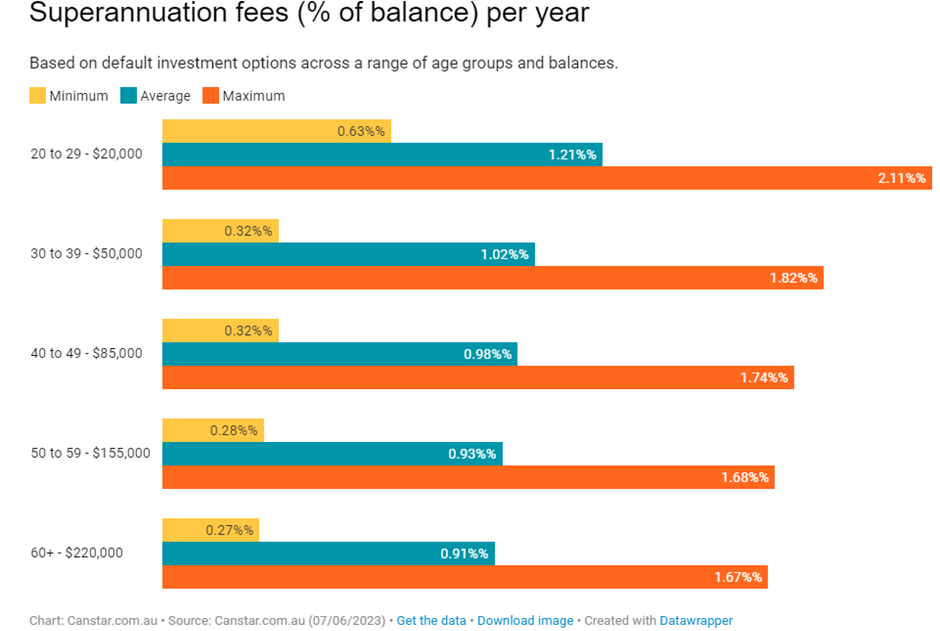

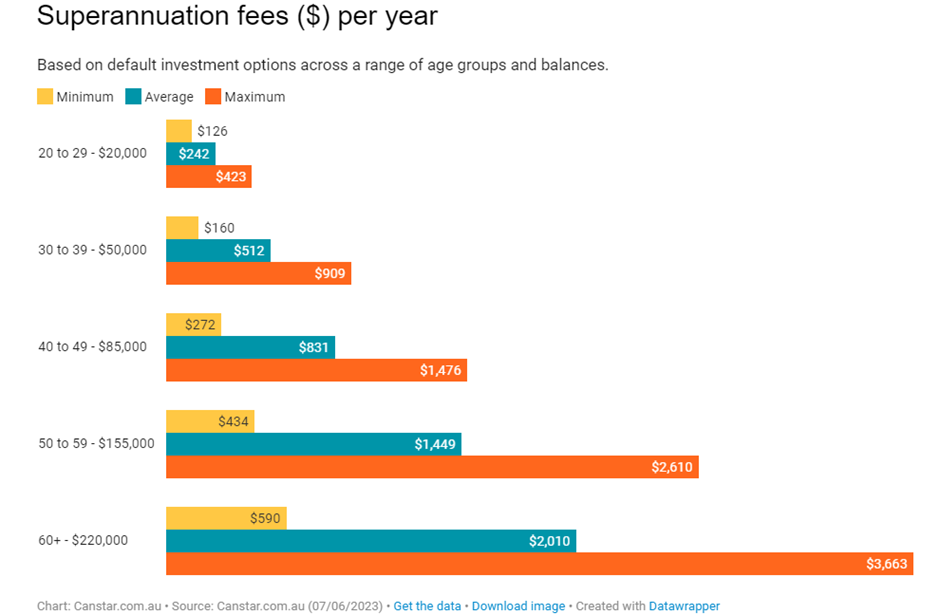

Super funds on financial comparison site Canstar’s database charge on average between 0.91 per cent and 1.21 per cent of an account balance in fees each year, depending on a member’s age, super balance and chosen investment options (see chart).

Fees include administration, investment and performance fees, and other indirect costs.

Fees can amount to a huge cost over the long term: an Australian aged 60 or older with a modest $220,000 in super savings will pay out around $2,000 a year in fees at an average rate of around 0.9 per cent (see chart).

In 2019, Productivity Commission identified the prevalence of high fees in the superannuation industry, chronic underperformance by some funds and a lack of effective competition, particularly in the default fund system.

The commission found that cost savings from increased scale had not been passed on to members as lower fees or higher returns. At the end of 2018, Australians were paying more than $30 billion a year in fees on their super, with fees higher here than in many peer countries.

However, some funds are working to lower fees. Rest recently reduced the asset-based annual administration fee in Rest Super, Rest Corporate and Rest Pension to 0.10 per cent from 0.12 per cent, though it maintained a $1.50 per week fixed administration fee.

Chief executive Vicki Doyle (pictured) said many of Rest’s members work part-time and casual jobs and have accumulated smaller account balances, into which fees could more quickly bite.

“Ensuring our fees are among the lowest is critical to help our members achieve their best-possible retirement outcome,” she said. “For the average Rest member in Core Strategy with a balance of around $35,000, the combined administration and investment fees are now $330 per year. This is less than 1 per cent of the member’s account balance.

“The asset-based administration fee has also been capped at $300 since late 2020. This is one of the lowest caps in the industry, and it means no member in these products will pay more than $378 in annual administration fees,” she said.

Betashares’ entry into the superannuation market is also expected to put downward pressure on fees. The exchanged-traded fund (ETF) provider recently announced it has reached an agreement to acquire Bendigo and Adelaide Bank’s superannuation business as part of plans to expand beyond the provision of ETFs. That follows Vanguard’s launch into the superannuation market in 2022.

Betashares CEO Alex Vynokur said stakeholders can expect the firm to bring its disruptive, low-cost ethos to the super industry.

“While ETFs will always remain the bedrock of our business, we are equally determined to bring our ethos of diversification, cost effectiveness, investor education and engagement into the superannuation sector, and it is a natural next step in our growth strategy.”

The Australian superannuation system is the fourth largest pension market globally. The value of the super pool rose $76.8 billion, or 2.2 per cent, to a record high of $3.62 trillion during the June quarter.