Simple rules for creating a lifelong investment portfolio

Last year, one of Australia’s leading investors and fund managers walked into my office for a recording of The Australian Investors Podcast.

I had just been scribbling some notes on my whiteboard about philosophy, discount rates and practical aspects of investing in high growth companies for the long run.

He saw some of my chicken scratches, turned to me and said, “we don’t spend anywhere near enough time on this stuff as I’d like.”

In part one of this mini-series, Rask’s 10 rules for stock market investing, I revealed how a decade of research, education, experience and interviewing Australia’s top investors had molded my investment philosophy. In this article, I’m going to tell you how to implement the ideas I put forward in that article.

What I’m about to say will be 10x more profound if you read Part One first. Click here to open the previous article in a new browser tab.

Investment process: the Core & Satellite approach

If investment philosophy is the ‘why’, the investment process is the ‘what’.

What you actually do to express your investment philosophy and make money.

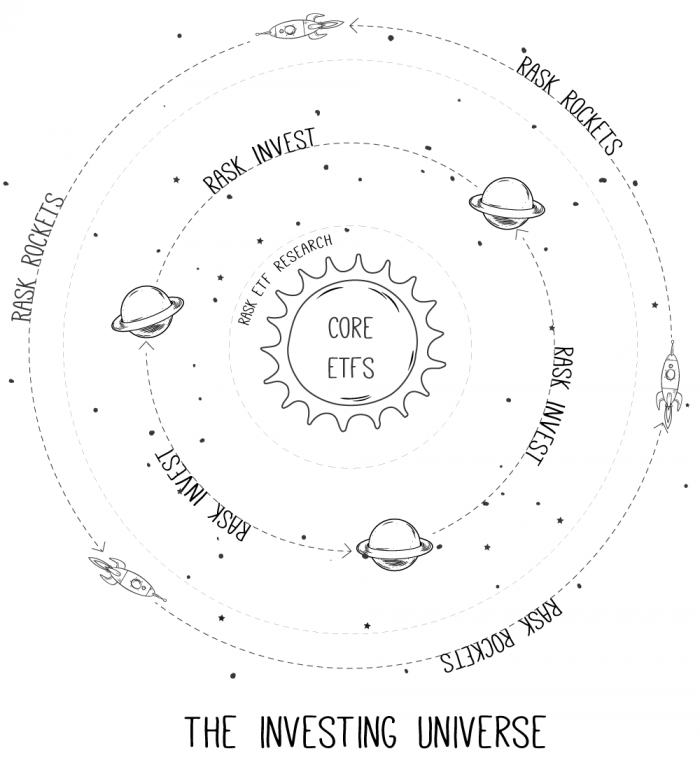

I’ve met many investors who would benefit immensely from following a very simple and effective framework for investing. At Rask, we tell our members to consider using a ‘Core’ and ‘Satellite’ investment process for long-term wealth creation because it is intuitive, limits risk and provides upside.

We have designed all of our premium membership services to reflect this framework for investing, not just in shares/equities but across other asset classes.

It starts with the Core

The ‘Core’ of a portfolio is the centre of every investor’s universe. It’s where most investors should begin (and end) their investment journey. Venture too far away from the Core without the right knowledge and equipment and you’ll be lost forever.

We believe the Core of a portfolio should be reserved for investments that are:

- Proven (i.e. based on objective empirical evidence)

- Low-cost (for maximum compounding)

- Low turnover (for tax reasons), and

- Easy to understand (for the sleep-at-night factor)

In practice, index funds, most low-cost ETFs, property and some managed funds would go in the Core.

Our Rask ETF service was designed to offer general investment advice on ETFs and provide a simple investment strategy which may be suitable for beginner investors and those who are looking for a hands-off approach outside of Super.

Note: If we cannot identify a new high conviction share idea for our Rask Invest members (see below), we advocate for dollar-cost averaging into passive and low-cost investments in the Core of a portfolio.

Satellite & tactical positions

The Satellite or ‘Tactical’ part of a portfolio is the smaller part (or parts) that investors can reserve for their ‘active’ investing and riskier positions.

We believe individual shares can produce the best returns for focused investors. That said, a long-term time horizon (10+ years) and high-conviction approach, driven by deep research and valuation work, are essential for success.

Patience in buying is important. Patience in holding is vital.

Our Rask Invest membership service is our premium share research service which seeks to identify and recommend only the most impressive companies currently valued over $250 million in market capitalisation from both the ASX and global markets.

To identify individual Satellite positions, our approach is as follows:

- The companies must have a strong competitive advantage or ‘moat’

- Management must be aligned, talented, transparent and consider themselves as ‘owner-operators‘ (founders and families are great)

- The businesses must be within our team’s circle of competence (i.e. what we can understand). Given our expertise lies in the technology, finance, software and industrial sectors, we almost never venture outside of these industries. Fortunately for us, the companies in these industries can be extremely profitable.

- The business must operate in a structurally growing and increasingly important sector, market or geography. The total addressable market (TAM) is very important when we are aiming to invest for 5-10 years or more.

- The shares/business must be reasonably valued. We will use the standard valuation modelling tools, such as discounted cash flow (DCF) analysis, internal rate of return (IRR), comparables and ratios, and sum-of-the-parts.

Moonshots & rockets

Not only do we carefully select which companies, markets and geographies to focus our attention, we are also prepared to venture into distant places in search of more long-term value.

One of the most recent additions to our Rask Membership services is our Rockets program. This is our highest risk investment service and is limited to small and micro-cap Australian companies. Although we apply the same investment philosophy and process detailed above, the investments in the Rockets program are much more volatile (higher “risk”) but — we hope — are capable of higher growth.

We consider Australian small-caps to be the most fruitful hunting ground for private and individual investors due to the lack of analyst coverage and low levels of liquidity.

The net result, we believe, is that the ASX small-cap space (i.e. companies below $250 million in market capitalisation) yields high levels of informational advantage and analytical insight to investors who are willing to do the work and have the temperament to match. For investors with smaller amounts of capital than a professional funds management firm, the unique characteristics of small-caps may unearth very compelling growth opportunities months or even years before larger investors and mainstream readers are capable of investing.

This is where our Rockets program and membership service seeks to add value. Companies identified in the Rockets program are designed to complement an investor’s established and diversified portfolio. Thus, they fit firmly in the ‘Tactical’ or ‘Satellites’ sleeve of a diversified investment strategy.

In summary, we believe that investing successfully for the long-term is about accumulating good assets regularly and being very patient. That’s as difficult as it needs to be.

Active investing in high conviction shares or companies isn’t for everyone, and that’s okay. You don’t need to choose between one (active investing) or the other (index funds held inside Super or brokerage account).