Sharemarket sinks on China data, ASX (ASX:XJO) down 0.5 per cent, commodities sink

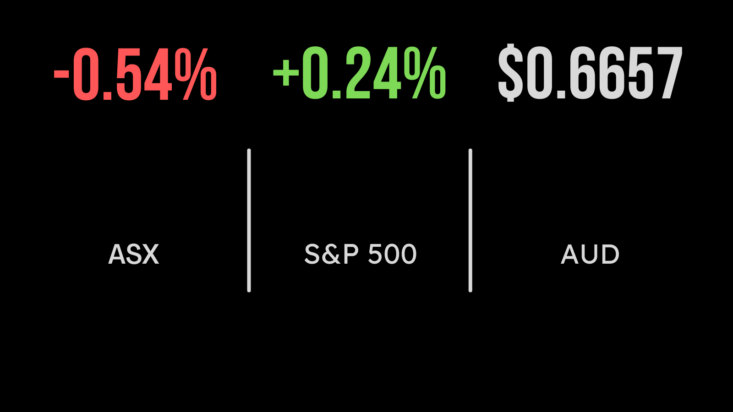

Only the technology sector was immune from the selloff on Monday, gaining 0.2 per cent, behind a rally in Block (ASX:SQ2) shares. Both the All Ordinaries (ASX:XAO) and S&P/ASX200 (ASX:XJO) fell by 0.5 per cent with the staples and industrial sectors taking the most significant hits, falling 1 and 0.9 per cent. The biggest detractors were the majors, as both Woolworths (ASX:WOW) and Treasury Wines (ASX:TWE) fell by more than 1 per cent. But all eyes were on Chinese inflation data which unexpectedly remained flat on 2022 levels, triggering concerns that the economy may now be facing a deflationary spiral, the exact opposite problem as the rest of the world. Naturally, this triggered a selloff in commodities on expectations of weaker demand, despite it offering hope of further stimulus from the central government. Shares in BHP (ASX:BHP) and Rio Tinto (ASX:RIO) both fell by 1.1 per cent, while Fortescue (ASX:FMG) fell 2 per cent.

Ardent flies on upgrade, GQG lifts assets, Magellan institutional struggles raised

The owner of Dreamworld and WhiteWater World, Ardent Leisure (ASX:ALG) gained more than 13 per cent after the company posted a significant earnings upgrade as travel surges around the country. According to management revenue was up 70 per cent to $83.9 million, the highest level since 2016 as consumer spending remains robust in the face of inflation. Shares in fund manager GQG Partners (ASX:GQG) gained 3.1 per cent after the company reported net inflows of US$1.2 billion for the quarter amid sustained outperformance. This took total assets under management to US$104 billion, an increase of $6 billion for the month on the back of strong market performance. It was the opposite story for Magellan (ASX:MFG) which fell 2.9 per cent as analysts suggested that institutional funds under management in the core global equities strategy may now be as low $5 billion.

Dow rallies ahead of inflation data, earnings season ahead, NVIDIA flat despite growth hopes

The Dow Jones stood out on Monday, gaining 0.6 per cent ahead of another inflation print due today. Forecasters are expecting a continued fall in the inflation rate down to 3 per cent, from 4 in May, bringing it very close to the targeted 2 per cent rate. Despite this Federal Reserve members continue to advocate for more rate hikes. The S&P500 and Nasdaq also gained, albeit less, finishing 0.2 per cent higher respectively, with NVIDIA (NYSE:NVDA) broadly flat despite an analyst suggesting the company could dominate as much as 90 per cent the AI demand for chips. Wholesale inventoried were flat in May, as overstocking is reversed ahead of an expected slowdown in spending, while the major investment banks including JP Morgan (NYSE:JPM) are set to report earnings at the end of the week and offer a barometer for the economy.