Alternative investments go mainstream and reshape the retirement paradigm

After a challenging 2022, many advisers and investors began to question their traditional retirement approach to investing.

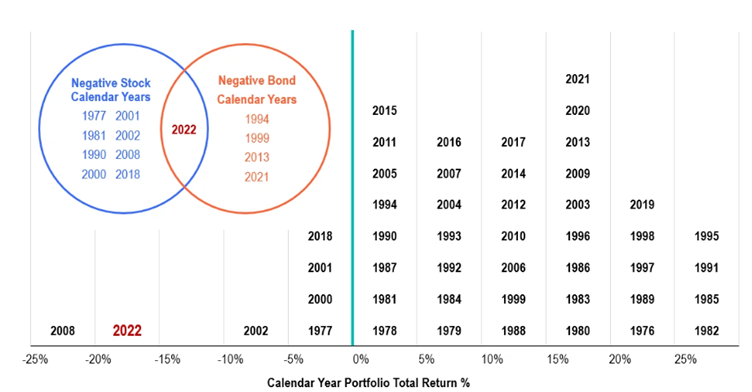

Stocks and bonds were both down double-digits for the year. According to Callan Associates, there have been only two other years since 1926 when both stocks and bonds have been negative – 1931 and 1969.

Rising interest rates, record inflation, increased volatility and double-digit negative returns for both stocks and bonds during 2022 left many advisers and investors wondering if they need to reconsider their retirement portfolios.

60% US Stock/40% US Bond Index Portfolio

1976-2022

Sources: FactSet, MSCI, Bloomberg.

We should be careful to separate the potential benefits of diversification and the 60/40 portfolio as a proxy. Unfortunately, as we experienced in 2022, there are periods of time where traditional investments are highly correlated to one another.

Pension plans have historically made significant allocations to alternative investments because of the various roles that they can play; pursuing growth and income, portfolio diversification and inflation hedging. However, up until recently, many of these investments were limited to institutions and family offices. Now through product innovation, these investments are more accessible to a broader group of investors, with more flexible features.

Overall, in our view, retirement plans should be modernised to reflect the broader set of tools available to pursue client goals.

We believe advisers and investors should rethink their retirement strategies to respond to the changing market environment, the new products at their disposal, and the fact that many retirees are living longer, more productive lives through their retirement years.

Alternative investments can play multiple roles in retirement portfolios, which include generating potential growth and income, seeking to dampen volatility, and/or helping to hedge the impact of inflation.

We believe advisers and investors should develop different approaches for the accumulation and decumulation phases of retirement, and should periodically revisit retirement plans to ensure they are on target for their objectives.

If used appropriately, alternative investments may improve the likelihood of achieving the various goals through retirement planning phases.

*Tony Davidow is a senior alternative investment strategist with the Franklin Templeton Institute