Portfolio diversification through innovation – Part 2

Part 2 – Apollo Capital Fund

It has been a busy few months for Bitcoin and the cryptocurrency world. Bitcoin’s price rocketed to an all-time high of US$51,785 this month on reports that Tesla would now accept bitcoin as payment for its cars and other products. And so, while the price of cryptocurrencies has started to rise, strict and cautious Australian regulators have prevented financial advisers from giving advice on cryptocurrency. And that’s where Apollo Capital’s eponymous Apollo Capital Fund comes into play. Instead of waiting for regulators to make a more concrete decision on cryptocurrency becoming a regulated financial instrument, Apollo has launched an Australian-first direct crypto investment fund.

How is Apollo innovating?

It doesn’t get more innovative than the ‘blockchain’ and ‘cryptocurrency’. This team of ex-financial market professionals have backed themselves in an effort to bring one of the first dedicated, retail crypto funds to market. The Apollo Capital Fund offers exposure to a “professionally managed portfolio of crypto assets managed by a world-class team with experience in funds management and crypto analysis. The fund simplifies the process for investors looking for crypto exposure, removing many of the difficulties associated with directly investing in crypto.”

What is the approach?

The fund allows investors to gain exposure to Bitcoin while reducing risks, complexity, and regulatory hurdles and avoiding the well-publicised custody risks by engaging a professional, institutional-grade custodian. The Apollo Capital Fund is an award-winning multi-strategy portfolio that takes advantage of market-neutral strategies in the crypto asset market. The fund aims to deliver returns by exploiting inefficiencies in crypto markets, and ultimately seeking asymmetric returns.

The fund’s strategy involves four main areas of investment:

- Core positions: Actively managed core positions in broadly traded cryptocurrencies like Bitcoin and Ethereum;

- Early-stage projects: High-quality but early-stage projects including initial coin offerings (ICOs);

- Opportunistic trading positions: Event-based trades and risk arbitrage (short and loan);

- Exposure to market-neutral strategies: Including the new Opportunities Fund.

Characteristics and Performance

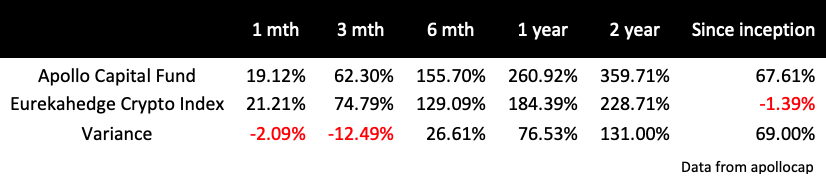

The performance has clearly been exceptional, as shown below, but is highly volatile as readers would appreciate.

The Apollo Capital fund’s performance is net of all fees. The Eurekahedge Crypto-Currency Hedge Fund Index was created to provide a broad measure of the performance of crypto hedge funds. As you can see in the table above, the Apollo Capital Fund begins to outperform the Eurekahedge Crypto index after six months. After one year the fund is ahead by 76.5 per cent, and after two years it is ahead by 131 per cent.

But there’s more than just performance for choosing a crypto fund. And that’s its low correlation with mainstream assets such as stocks or property. A Fidelity Digital Assets report titled “Bitcoin Investment Thesis – Bitcoin’s Role As an Alternative Investment,” has found cryptocurrency to have a very low correlation with stocks. It is an encouraging sign that perhaps the Apollo Capital Fund can be used to reduce overall portfolio risk and for diversification.