Mirae Asia Great Consumer fund upgraded to ‘Recommended’

The Asian middle class, but particularly that in China and India, is one of the fastest growing-population cohorts in the world; and potentially, the most important long-term thematic for investors. The scale of growth in the middle-class is unprecedented, and will have far-reaching impacts on consumption patterns ranging from luxury goods, to staples, banking, financial services, travel and healthcare.

It came as little surprise, then, that Lonsec this week upgraded its rating of the Mirae Asset Asia Great Consumer Equity Fund from ‘investment-grade’ to ‘recommended.’ Commenting on the change, Lonsec said it now has “greater conviction in Mirae’s established presence in Asia and its research process targeting quality growth companies benefiting from the rise of the Asian consumer. Furthermore, lead Portfolio Manager Joohee An has a strong track record managing the underlying strategy since 2011 and is considered a capable investor with strong local insights.”

The fund is an active, long-only strategy, investing in equities listed on Asian sharemarkets (excluding Japan) with a specific focus on those companies likely to benefit from the evolving consumption patterns of the region. While the A$ unit class remains in its infancy, the strategy has around US$891 million ($1.1 billion) in assets under management, while Mirae in general has over US$23 billion ($29.5 billion) in Asian equities under management.

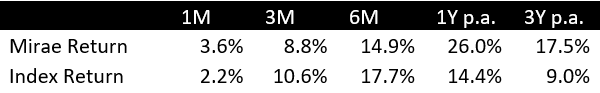

The investment philosophy is bottom-up, relying on fundamental research and seeking quality growth, rather than ‘value’ or momentum plays. This dedicated company focus has resulted in strong outperformance since the fund’s Australian launch in 2016, but particularly in 2020, when the fund outperformed its benchmark by close to 12 percentage points.

Performance has been driven by a willingness to stray from the index, with active share on average around 80 per cent and through a buy-and-hold rather than high-turnover strategy. The managers are willing to back those long-term growth ideas they fund, with portfolio turnover just 27 per cent since inception.

The fund offers a more targeted exposure to the increasingly popular emerging market sector, focusing only on those companies that are delivering solid growth and avoiding the concentration risk associated with the broader benchmark. At present, 55 per cent of the fund is invested in China, 18 per cent in India and 14 per cent in Korea, with consumer discretionary and staples companies not unexpectedly making up 50 per cent of the investments. Key holdings in December 2020 include Tencent Holdings, e-commerce platform Pinduoduo and fast-growing Indian bank HDFC.