Managed account growth continues

As Australia joins the rest of the world and transitions to a post-Covid era, it’s never been more difficult to be an adviser. Investment products are becoming more complex, everything is over-regulated, risks are everywhere, ultra-low bond yields aren’t budging, equities are expensive, and inflation is starting to rear its ugly head.

Advisers are facing a new paradigm of investing, in which traditional advice models are being replaced with digital advice solutions. Managed fund and equity portfolios are being replaced with managed account solutions such as MDAs, IMAs and SMAs.

MDAs, when used appropriately, can be a win-win for both the adviser and investor. The managed account is a professionally managed portfolio that is rebalanced or amended when required, in a transparent structure that is tax-efficient.

It’s generally cheaper and may assist meeting compliance requirements, while delivering value to clients. And the shift to managed accounts has only accelerated. According to the joint report by Investment Trends and State Street Global Advisors (SSGA), 70 per cent of planners use, or intend to use managed accounts, up from 44 per cent in 2012.

One of the big benefits of using managed accounts is that it frees-up time that can be better spent on building client relationships. This was especially evident during the pandemic where planners allocated 17 per cent of new client inflows into managed accounts compared with 12 per cent before.

MDAs span every part of the market, from asset-class-specific to multi-asset, diversified balanced funds. In this article, we review the top Australian equity models using publicly available data.

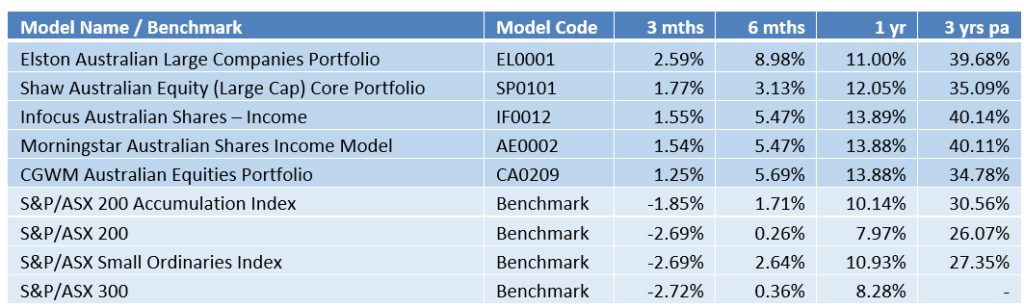

Performance ending 30 September 2021

Topping the list of Australian equity managers during the quarter was Elston’s Australian Large companies portfolio, which returned 2.59 per cent. Its six-month performance of 8.98 per cent, the one-year performance of 11 per cent and three-year performance of 39.68 per cent a year, are all remarkable returns. In comparison, the S&P/ASX 200 benchmark index fell 2.69 per cent last quarter, and is up only 7.97 per cent for the year.

Bruce Williams, executive director and portfolio manager for Elston Asset Management, says much of the recent performance is due to strong revenue growth and good cost control from the underlying companies.

Iron ore miners have enjoyed a strong tailwind that is unlikely to be repeated, the banks didn’t do as badly as first thought and have rebounded quite strongly, Williams says. “We don’t expect a significant change in valuations over the next 12 months, as COVID skews and particularly monetary support are likely to remain in place. But we think it is unlikely we’ll see further broad-based multiple expansion from these levels and that further gains must be driven by earnings growth – return expectations should be tempered accordingly.”

For the September quarter, Energy and Industrials outperformed while Materials underperformed substantially due to a sharp decline in the iron ore price, which fell 44% to under USD$120 per tonne. Mainly due to an unwinding of speculative fervour when the iron ore price was over USD$200 per tonne, which led to large sell declines in BHP, Rio Tinto and Fortescue. Although the falls seem excessive, it is worth noting that the iron ore price has simply retraced to where it was a year ago.

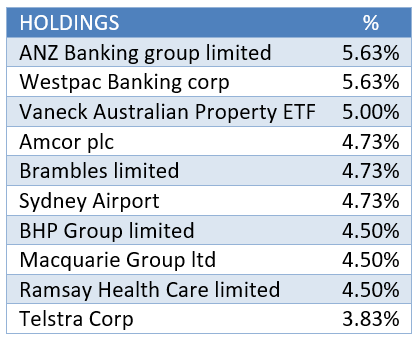

Here are the top holdings as at 30 September 2021.

Making up the top five MDAs for the September quarter were: Shaw’s Australian Equity (large cap) MDA posted a 1.77 per cent, Infocus Australian Shares – Income managed 1.55 per cent, Morningstar Australian Shares Income Model 1.54 per cent, and CGWM Australian Equities Portfolio 1.25 per cent.