Local market back in the green

After three consecutive losing days, the Australian sharemarket turned northward again on Tuesday, led by the resources stocks. After being scorched on Monday, the ASX’s coal and lithium stocks rallied on Tuesday as global markets stabilised, as did energy prices, despite rising recession risks.

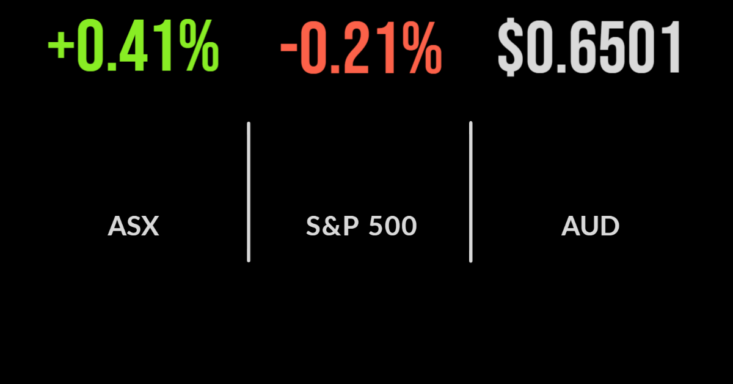

The S&P/ASX 200 Index added 26.8 points, or 0.4 per cent, to 6,496.2 points, while the broader All Ordinaries index rose 29 points, also 0.4 per cent, to 6,696.5.

Among the bulk mining giants, BHP was up $1.00, or 2.8 per cent, to $37.20; Rio Tinto closed $2.61, or 3 per cent, higher at $90.39; and iron ore heavyweight Fortescue Metals added 88 cents, or 5.5 per cent, to $16.82. Diversified miner South32 added 11 cents, or 3.1 per cent, to $3.70.

In energy, Woodside Energy gained 47 cents, or 1.6 per cent, to $30.67; Santos was up 7 cents, or 1 per cent, to $6.95; and Brazil-based producer Karoon Energy regained 3 cents, or 1.7 per cent, to $1.82.

Coal, lithium the leaders

Coal was one of the main sectors generating impetus, with Whitehaven Coal advancing 54 cents, or 6.8 per cent, to $8.45 and New Hope Corporation gaining 33 cents, or 6.1 per cent to $5.73. Queensland and South African producer Terracom surged 8 cents, or 8.5 per cent, to $1.02, Coronado Global Resources added 3 cents, or 2 per cent to $1.52; and Stanmore Resources lifted 6 cents, or 3 per cent, to $2.04

In lithium, Pilbara Minerals rose 27 cents, or 6.1 per cent, to $4.68, and fellow producer Allkem was up 50 cents, or 3.6 per cent, to $14.36, while Mineral Resources – which mines iron ore as well as lithium – jumped $3.63, or 5.8 per cent, to $65.89.

US-based Piedmont Lithium, which has a contract to supply Tesla, gained 5 cents, or 6.3 per cent, to 84 cents, and peer lithium project developer Lake Resources was up 4 cents, or 4.4 per cent, to 94 cents. Shares in lithium explorer MetalsGrove Mining more than doubled in value to 23 cents, from yesterday’s close of 11 cents, after announcing the find of a significant lithium deposit at its Coondina project in Western Australia.

Another stock was added to the lithium cohort yesterday as Atlantic Lithium, which holds a significant lithium prospect in Ghana, West Africa, made its debut on the ASX after floating shares at 58 cents. The stock fell 3.4 per cent to close its first day at 56 cents. Rare earths miner Lynas Corporation advanced 18 cents, or 2.4 per cent, to $7.57.

Among the big banks, Commonwealth Bank was down 18 cents, or 0.2 per cent, to $93.43; National Australia Bank eased 10 cents, or 0.3 per cent, to $29.25; and Westpac retreated 12 cents, or 0.6 per cent, to $21.06; but ANZ went against type, gaining 11 cents, or 0.5 per cent, to $23.15.

Real estate stocks were on the nose, with industrial property giant Goodman Group down 42 cents, or 2.5 per cent, shopping centre owner Vicinity Centres down 4 cents, or 2.3 per cent, to $1.68, fellow shopping centre landlord Scentre Group lost 6 cents, or 2.3 per cent, to $2.54; and office tower owner Dexus shed 24 cents, or 3.1 per cent, to $7.53.

Despite no news to spark a rise, other than an appearance at a major US conference, artificial intelligence company BrainChip Holdings surged 6 cents, or 7.2 per cent, to 89 cents. Network interconnection services company Megaport was the other tech name to shine, up 50 cents, or 6.7 per cent, to $7.94, despite also seeming to have no news to share.

Telstra lost 4 cents, or 1.1 per cent, to $3.72.

The Australian 10-year bond yield moved through 4 per cent, to hit a three-month high at 4.03 per cent, while the three-year bond yield hit a decade high of 3.68 per cent.

Bear growl getting louder

In the US overnight, stocks closed at their lowest level in almost two years as the broad S&P 500 fell deeper into a bear market, down 7.8 points, or 0.2 per cent, to 3.647.3, to be down almost 24 per cent for 2022, and 24.3 per cent below its all-time high, set in January.

The 30-stock Dow Jones Industrial Average fell 125.82 points, or 0.4 per cent, to 29,134.99 — giving up a gain of nearly 400 points earlier in the day. The Dow is now 21.2 per cent below its record high, also marked in January. The tech-heavy Nasdaq Composite index gained 26.6 points overnight, or 0.2 per cent, to 10,829.5: it has fallen more than 33 per cent since hitting a record in November.

The bond market rout continued, with the benchmark 10-year Treasury yield continuing to climb to levels not seen in at least a decade. The 10-year Treasury yield surpassed 3.9 per cent as it continued its climb toward 4 per cent, closing at 3.949 per cent. The 2-year yield, considered to be much more sensitive to Federal Reserve policy, closed at a new 15-year high of 4.287 per cent, up from 4.2 per cent the previous day – it was just 0.13 per cent at the start of 2021.

Gold advanced by US$1.34 to US$1,629.30 an ounce, and oil prices also turned positive, with Brent crude oil gaining US$2.21, or 2.6 per cent, to US$86.27 a barrel, but West Texas Intermediate crude was down a further 32 cents to US$78.18 a barrel. The oil market is trying to get a handle on what’s going on with Russian pipelines, with both Nord Stream 1 and 2 hit by leakages and explosions overnight. Neither pipeline was operational at the time, but contained gas, which is now leaking into the surrounding waters. European officials and analysts said the leaks cannot be coincidental; a German official said evidence pointed to sabotage rather than a technical issue.

The Australian dollar is buying 64.3 US cents, down from 64.96 US cents at Tuesday’s local close.