Leading the pack in 2024: High-yield income funds that are outperforming

In 2024 investors seeking to enhance their returns amidst a volatile economic and interest rate landscape are increasingly turning their focus towards high-yield fixed income funds. Funds offering potentially higher returns compared to their lower-risk, modest-yield counterparts are becoming an appealing option for income-seeking investors. Currently three high-yield fixed income fund managers have distinguished themselves by their standout performances as at February 29, 2024.

High yield fixed income funds can invest in various loans and debt instruments, such as:

- High-yield bonds (junk bonds)

- Municipal high-yield bonds

- Emerging market bonds

- Corporate bonds

- Collateralised loan obligations (CLOs)

- Residential mortgage-backed securities (RMBS)

- Commercial mortgage-backed securities (CMBS)

The promise of higher income via high yield funds comes with a heightened level of risk, for example:

Credit risk: Generally, high-yield instruments are more likely to default than investment-grade, necessitating rigorous credit analysis and constant monitoring of the issuer’s financial health.

Interest rate risk: While all fixed income instruments are subject to interest rate risk, the impact on high-yield bonds can be complex. This is largely because the returns on high-yield bonds are more heavily impacted by the credit risk of the issuer than by shifts in interest rates.

Market volatility: During times of market stress, high-yield spreads (the yield difference between high-yield bonds and risk-free treasury securities) can widen significantly, leading to substantial portfolio devaluations.

Sector concentration risk: High-yield issuers are often concentrated in certain economic sectors or industries.

Reinvestment risk: This is an inherent risk in having to re-invest interest payments or principal at lower rates if there’s a call or they mature during a period of declining interest rates. This can lead to lower income from the portfolio than initially anticipated.

Economic factors: Conditions such as inflation rates, unemployment rates and GDP growth can significantly affect the performance of higher-yielding instruments. Adverse macroeconomic conditions can increase the default rates among issuers of debt instruments, thereby affecting portfolio returns.

Despite these risks, the allure of high-yield fixed income funds in 2024 remains strong. They offer a compelling opportunity for enhanced returns against the backdrop of high inflation and a desire for greater diversification. Investors are encouraged to carefully weigh the potential for higher returns against the risks of increased volatility and default rates. Therefore, professionally managing a high-yield fixed income portfolio requires specialised skills, including in depth credit analysis and risk management.

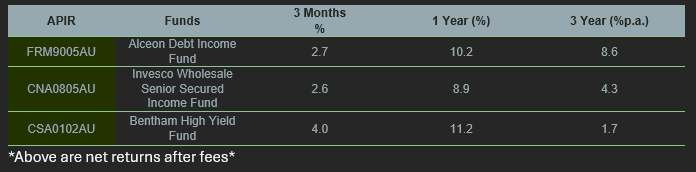

From the Atchison APL there were a total 30 high-yield fixed income fund managers assessed, whereby the average one-year return as at 29 February 2024 was 7.8 per cent, while the 3-year average return was noted at 3.5 per cent.

Below are the top three performing high yield fixed income managers based on the Atchison APL over one year and three years.

Bentham High Yield Fund depicted the highest return over the 1 year (+11.2 per cent) whereby Alceon Debt Income Fund was the top performer over the 3 years (+8.6 per cent)

Alceon Debt Income

A real estate debt fund focused on providing consistent income through a carefully selected and cautious collection of debt backed by real estate assets, this fund predominantly secures its portfolio through first-ranking mortgages registered on properties largely situated along Australia’s east coast.

The loans it finances are varied, supporting real estate developments, construction projects and property ownership. The primary goal of the fund is to offer its investors an annualised total return of 7 to 8 per cent per annum, distributed as a monthly income and sourced from a broad range of loans.

As at February the fund invests 60 per cent in residential construction, 15 per cent in residential land and 7 per cent in industry land.

Invesco Wholesale Senior Secured Income Fund

The Fund seeks to deliver steady monthly income, capital preservation and a gross return of cash plus 4 per cent per annum over three-year cycles. It adopts a core, active management approach, merging detailed credit analysis with macroeconomic risk positioning aligned with broader economic trends.

Additionally, the fund offers protection against floating interest rates. As at February 2024, the fund holds 80.3 per cent senior loans, 10.4 per cent high yield bonds and has a 7.5 per cent exposure in equities.

Bentham High Yield Fund

The Bentham High Yield Fund aims to deliver returns surpassing those of conventional fixed income investments through active management focused on the US high yield bond market. It diversifies by selecting a mix of securities and industries.

The fund’s goal is to exceed the performance of the Merrill Lynch High Yield Cash Pay Constrained Index (AUD hedged) over the recommended investment period and compares its results with the Bloomberg AusBond Composite Bond Index.

Its strategy involves primarily investing in sub-investment grade corporate debt from the US to achieve higher returns. Most recently, the fund’s principal industry investments include 9.4 per cent in Diversified/Conglomerate Services, 7.6 per cent in Electronics and 7.3 per cent in Finance. Its major company holdings comprise 1.5 per cent in Altice Financing and 1.1 per cent in Health Equity.