‘Jumping at shadows’: Is investor fear out of step with macro environment?

Wealth managers are well accustomed to the practice of allaying client concerns about the stability of markets, but investment leaders from across the spectrum believe the gap between perception and reality is at an all-time high level.

The market is not without risk. It never is. Yet relatively speaking, the macro environment is strong and relatively stable. There is a growing consensus, however, that the nerves of Investors are jangling far more than market conditions warrant.

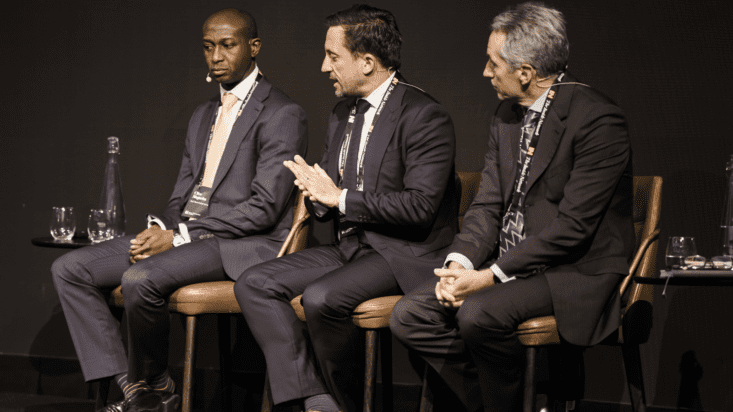

Speaking on a panel to open The Inside Network’s Income and Defensive Assets Symposium in Sydney this week, wealth management executives explained just how affected clients are by the risk factors they hear about through media and other channels.

“I don’t think I’ve ever seen a bigger divergence between a reality that’s actually pretty good, in terms of the macro, and (in my view) a risk outlook that’s actually not too bad at all,” said ex-RBA economist and research leader for Macquarie, Tim Rocks, now chief investment officer at advice group Evans and Partners.

“People talk about the geopolitical risks, but in the grand scheme of things they’re pretty mild. It’s a really good investment environment but clients are jumping at shadows.”

Rocks, an experienced investment strategy specialist, said there were a few idiosyncratic factors likely playing into the mind of the Evans and Partners client base, which ranges from retail advice clients up to endowments and charities with $200 million under management.

On the retail side, especially, many of its several thousand clients run businesses that are facing “short-term” economic challenges linked to the domestic economy. A lot of its predominantly Melbourne-based clients are also still suffering a “hangover” from the Covid era under Dan Andrews, he said, when most of the state’s business activity came to a grinding halt for an extended period. “It’s a bloody Melbourne thing, right?” he said, adding that the period has given Victorians a more risk-averse mindset. “That’s part of the battle I face, talking people of ledges.”

Yet what really separates clients from reality, he explained, are the misconceptions they harbour around economic factors – both here and abroad.

“When we think about where risks were a year ago compared to where they are now, I would say that the risk of inflation persistence was the biggest one around and we’ve kind of won that battle,” Rocks said. “And geopolitical [risk] has always been over-rated.”

According to Morgan Stanley’s head of wealth management research in Australia, Alex Ventelon, the same issues permeate, with investors considerably more than they should. “The context of inflation is very much at the core of inflated investors concerns,” he said. “And I can very much relate to Tim [in that]… 90 per cent of the questions I get often relate to geopolitics.”

These concerns, added State Street Global Advisors senior strategist Clive Maguchu, are not limited to retail or domestic clients, with global institutional players also harbouring outsized fears about the market environment.

“In the institutional space there are very similar concerns being raised,” he said. “It always starts off with politics, the conflicts happening around the world, slowing growth… we all watch the news, and it’s all very negative.”

What State Street falls back on, he said, is its own quantitative process, which they use as a way to ground the conversation. The inherent data and thematic story it tells, he explained, help convey to clients that what happening in the portfolio is actually happening in the macroeconomic environment – particularly for risk assets.

“And once we get past those initial conversations about geopolitics… it becomes about what’s actually in the portfolio and what we can do to the portfolio to maintain strong returns.”