Investors warned against chasing the ‘commodity rainbow’

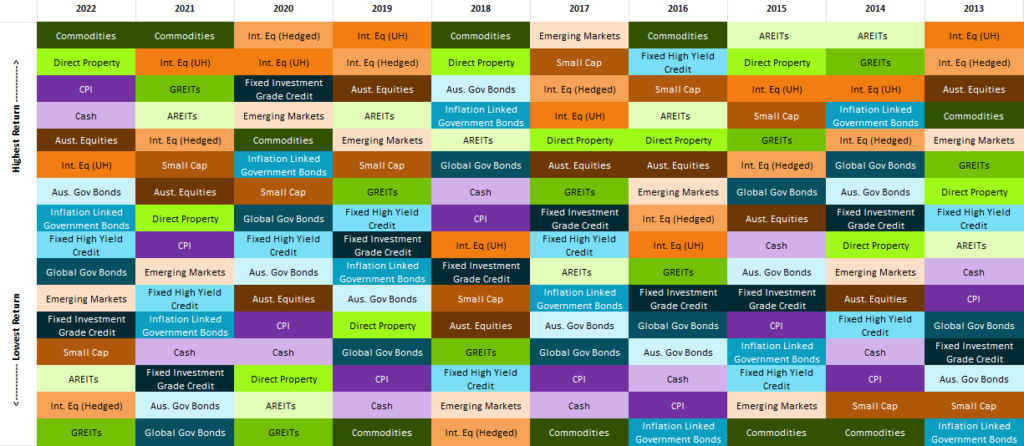

Commodities performed better than any other asset class for the second consecutive year in 2022, and the third time in five years, but investors should be wary of expecting a continued run of outperformance according to investment consulting firm Atchison.

The asset class returned 17 per cent in a tough year for investors, with direct property (11 per cent) and cash (1 per cent) the only other asset classes in the black. Nine of the 15 major asset classes notched double digit negative returns.

While commodities proved a safe haven for investors in a down market, Atchison principal Kevin Toohey cautioned against chasing a repeat performance.

“Commodities tend to be binary in nature – periods at the very top of the table are typically followed by periods at the very bottom,” Toohey said. “Over the 20 years their average return has been 8.7 per cent, placing them ninth on the ladder.”

Over the last 20 years commodity valuations have swung dramatically, he explained, with the highs being accompanied by just as many lows.

“Commodities, which have topped the poll six times… have also come last in seven of the 20 years,” he said.

Consecutive years at the top of the asset returns class is rare. Only once in the last two decades – AREITs in 2014 and 2015 – has another asset class achieved the feat.

Speaking to The Inside Adviser, Toohey says the double run of commodities outperformance has a lot to do with the nature of the underlying holdings and its place in the recession cycle. As the Australian economy enters the brink of a recession or near-recession era, staples like agriculture and energy tend to rise in demand and price.

“Often, late in the cycle, commodities will spike,” he said. “If you look back through 70s, 80s and 90s commodities often do well in the late cycle, early recession period.”

Other, more topical factors also played a role.

“Demand for services was superseded by demand for goods through the pandemic and the attendant supply-line constraints,” Toohey says. “But there has been a build-up in the supply of goods but as we’ve opened up, and the demand has shifted back from goods to services.

“Inventories are at decades-highs so that typically leads to drops in manufacturing requirements, which likely feeds thru to demand for input commodities.”

Direct property has been the most lucrative asset class for Australians over the last 20 years, according to the Atchison research, returning an average of 10.2 per cent between 2003 and 2022.

Australian equities performed next best at 8.9 per cent.