Inflation reprieve cheers market

A softer than expected headline inflation figure sparked a rally in the Australian sharemarket on Wednesday, as the Australian Bureau of Statistics (ABS) reported that consumer prices rose 5.6 per cent for the year to end of May, down from 6.8 per cent in April, meaning the consumer price index (CPI) actually fell 0.4 per cent for the month.

The Reserve Bank’s preferred measure of inflation, the so-called “trimmed mean,” also came down, from 6.7 per cent to 6.1 per cent. But even though the trend is down, the market still appears to hold concerns that inflation is not quite improving at the rate the RBA had forecast.

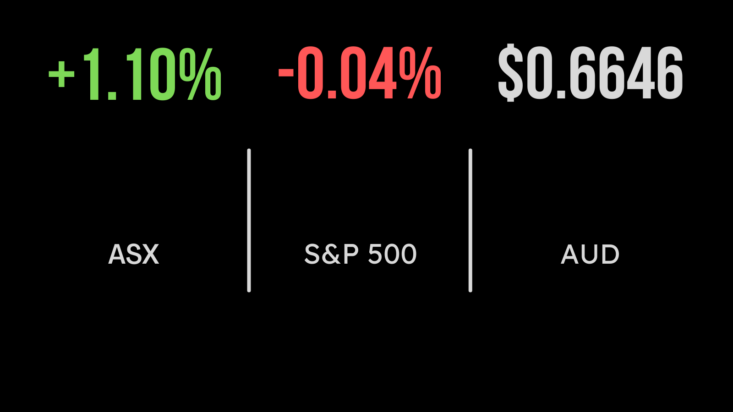

The benchmark S&P/ASX 200 index rose 78.3 points, or 1.1 per cent, to 7196.5, in its biggest one-day rise since April 11. The broader All Ordinaries index lifted 84.1 points, or 1.2 per cent, to 7384.10.

Financial stocks had a good day, with Magellan Financial rising 39 cents, or 4.4 per cent, to $9.22; AMP adding 3 cents, or 2.7 per cent, to $1.15 and Perpetual gaining 51 cents, or 2 per cent, higher to $25.94.

The big four banks all rose, with Commonwealth Bank up $1.11, or 1.1 per cent, to $99.54; ANZ putting on 31 cents, or 1.3 per cent, to $23.43; Westpac adding 39 cents, or 1.9 per cent, to $21.40; and National Australia Bank advancing 50 cents, or 1.9 per cent, to $26.25.

Fast food sizzles, but hold the cheese

Consumer discretionary stocks led the market higher. After yesterday’s 18 per cent surge, fast-food operator Collins Food jumped a further 69 cents, or 7.5 per cent, to $9.94. Collins Foods operates or franchises KFC, Sizzler and Taco Bell in Australia, Germany, the Netherlands, Thailand and Japan: the company said its same-store sales growth was strong since the start of May. Fellow fast-food stock Domino’s Pizza closed up $1.66, or 3.8 per cent, to $45.41.

But dairy business Bega Cheese plunged 29 cents, or 8.5 per cent, to $3.11 as the market continued to digest its confirmation on Tuesday that its 2022-23 profit would be at the low end of its guidance range.

Also pushing the consumer discretionary index higher were JB Hi-Fi, which was up $1.04, or 2.5 per cent, to $43.19; and Premier Investments, whose stable of retailers includes Smiggle, Peter Alexander, Just Jeans and Portmans. Premier gained 59 cents, or 3 per cent, to $20.35. Harvey Norman was up 16 cents, or 4.9 per cent, to $3.41, despite the electronics retailer warning that it was on track for a significant fall in earnings as higher living costs bite into consumer spending.

In resources, BHP gained 31 cents, or 0.7 per cent, to $45.42; Rio Tinto advanced $1.15, or 1 per cent, to $115.79; and Fortescue Metals rose 6 cents, or 0.3 per cent, to $21.95. Copper leader Sandfire Resources advanced 7 cents, or 1.2 per cent, to $5.95, while rare earths producer Lynas Rare Earths eased 9 cents, or 1.3 per cent, to $6.95.

In the lithium space, producer Allkem gained 22 cents, or 1.4 per cent, to $16.12; IGO, which mines nickel and lithium, strengthened 23 cents, or 1.6 per cent, to $15.08; and Mineral Resources, which produces iron ore as well as lithium, gained 7 cents, to $70.85.

Among the lithium developers, Lake Resources firmed 1.5 cents, or 5.2 per cent, to 30.5 cents; Liontown Resources weakened 2 cents, or 0.7 per cent, to $2.86; and after yesterday’s 8.5 per cent surge, battery minerals company Cobalt Blue gained one further cent, or 3.9 per cent, to 26.5 cents.

In coal, Whitehaven Coal added 15 cents, or 2.3 per cent, to $6.72; New Hope Corporation put on 4 cents, or 0.8 per cent, to $4.80; Yancoal Australia gained 6 cents, or 1.4 per cent, to $4.46; Coronado Global Resources advanced 1.5 cents, or 1 per cent, to $1.54; and Bowen Coking Coal lifted 1 cent, or 6.9 per cent, to 15.5 cents.

In energy, Woodside Energy jumped 37 cents, or 1.1 per cent, to $34.33; Santos strengthened 9 cents, or 1.2 per cent, to $7.41; Beach Energy moved 2.5 cents, or 1.9 per cent, higher to $1.34; and Brazilian-based producer Karoon Energy lifted 5 cents, or 2.6 per cent, to $1.945.

Interest rate rises to come in US

In the US, investors mulled Federal Reserve Chair Jerome Powell’s latest comments about the tightening cycle. Speaking at a forum sponsored by the European Central Bank, Powell said more restrictive policy is still to come as the Fed continues to fight inflation, including the possibility of interest rate hikes at consecutive meetings.

The blue-chip Dow Jones Industrial Average slid 74.08 points, or 0.2 per cent, to 33,852.66, and the S&P 500 closed virtually flat, up 1.55 points at 4,376.86. The tech-heavy Nasdaq Composite Index advanced 36.08 points, or 0.3 per cent, to 13,591.75.

On the bond market, the US 10-year yield lost 5.5 basis points to 3.712 per cent, while the 2-year yield, which is considered more sensitive to policy changes, retreated 17.1 basis points, to 4.716 per cent.

Gold walked back US$5.61, or 0.3 per cent, to US$1,909.93. The global benchmark Brent crude oil grade jumped US$1.77, or 2.5 per cent, to US$74.03 a barrel, and US West Texas Intermediate crude retreated 33 cents, or 0.5 per cent, to US$69.23 a barrel.

The Australian dollar is buying 66 US cents this morning, down about 1 per cent on the local close yesterday.