Inflation jumps to 33-year high

Australian shares ended a five-day winning streak on Wednesday, and the Aussie dollar rose, after the markets learned that inflation in Australia had risen to its highest point since 1990, at an annual rate of 7.8 per cent in the December quarter, beating economist forecasts of 7.6 per cent.

Even the Reserve Bank’s preferred measure of “trimmed mean annual inflation,” which excludes large movements of increases and declines, hit its highest number since the government started publishing the figure in 2003, at 6.9 per cent.

The inflation data was seen as presaging further tightening by the RBA.

Headline CPI jumped 1.9 per cent over the quarter, while the trimmed mean figure rose 1.7 per cent. Bond yields and the Australian dollar rose as traders priced in a near-certain ninth consecutive rate rise at the RBA’s meeting on February 7.

Market mulls its next move

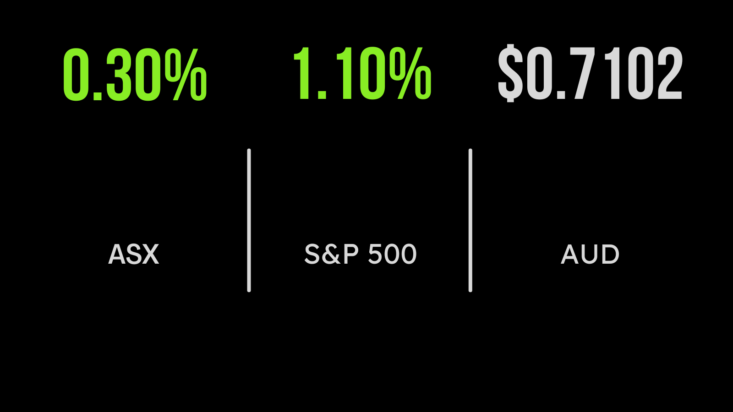

The S&P/ASX 200 fell 22.1 points, or 0.3 per cent, to 7468.3, while the broader All Ordinaries Index fell by a similar percentage, down 22.5 points to 7688.

In big mining, Fortescue Energy was down 3 cents to $22.48; Rio Tinto retreated 94 cents, or 0.7 per cent, to $126.50; and BHP lost 47 cents, or 0.9 per cent, to $49.24.

In lithium, Allkem gained 8 cents, or 0.6 per cent, to $13.88, while fellow producer Pilbara Minerals advanced 3 cents, or 0.6 per cent, to $5.11. Mineral Resources, which produces iron ore along with lithium, gave up $2.08 from the record high achieved on Tuesday, sliding 2.2 per cent, to $94.20; while IGO, which mines nickel and lithium, was up 5 cents at $15.89.

Rare Earths miner Lynas Rare Earths eased 3 cents to $8.97, while copper heavyweight Sandfire Resources gained 9 cents, or 1.4 per cent, to $6.39.

In energy, Woodside Energy dropped 44 cents, or 1.2 per cent, to $37.31 despite reporting a record output in the December quarter, courtesy of its merger with BHP’s petroleum business last June, which roughly doubled the size of the business. The company beat its guidance for full-year production, at 157.7 million barrels of oil equivalent (boe), and kept its guidance unchanged for output this year, at between 180 million and 190 million boe, with the figure boosted by a full year’s contribution from the BHP fields.

Meanwhile, Santos has been ordered by the offshore petroleum regulator to check for culturally significant sites across the pipeline route at its Barossa gas project in the Timor Sea just weeks before construction was due to begin. The stock slid 12 cents, or 1.6 per cent, to $7.24.

Of the big banks, Commonwealth Bank rose 78 cents, or 0.7 per cent, to $108.83; National Australia Bank was up 14 cents, or 0.4 per cent, to $31.48; and Westpac eked-out a 2 cent rise to $23.67; but ANZ slipped 2 cents to $24.60. Investment bank Macquarie gained 7 cents to $185.13.

News Corp jumped $1.76, or 6.3 per cent, to $29.93 on news that Rupert Murdoch has scrapped plans to merge the company with Fox Corporation because the combination “is not optimal for shareholders.”

CSL gave up $1.69, or 0.6 per cent, to $296.12, while Telstra was one cent weaker, at $4.08.

Earnings a difficult read on Wall Street

The quarterly earnings season is getting into full swing in the US, and investors are trying to get a handle on the general theme. So far, almost one-fifth of S&P 500 companies have reported fourth-quarter earnings, with 68 per cent of them posting stronger-than-expected results, according to FactSet.

The blue-chip Dow Jones Industrial Average advanced 9.9 points to 33,743.8 overnight, after falling more than 460 points earlier in the day, while the broader S&P 500 was virtually flat, easing 0.7 points to 4,016.2. The tech-heavy Nasdaq Composite slid 0.2 per cent, or 20.9 points, to 11,313.4, after dropping as much as 2.3 per cent at one point.

European markets closed lower on Wednesday, despite data showing improved business sentiment in Germany and a lift in eurozone services and manufacturing activity.

On the commodities front, gold is up US$8.76, or 0.5 per cent, to US$1,945.90, while the global benchmark Brent crude oil grade gained 31 cents, or 0.4 per cent, to US$86.44 a barrel, and West Texas Intermediate added 43 cents, or 0.5 per cent, to US$80.56 a barrel. The Australian dollar is buying 71.05 US cents this morning, close to yesterday’s close at a five-month high of 71.09 US cents.