Good time to buy quality semiconductor companies, say experts

For investors looking to build positions in quality technology firms, the US computer chip giants are trading at attractive price levels, with many brokers now rating them as a buy, according to data from the Wall Street Journal.

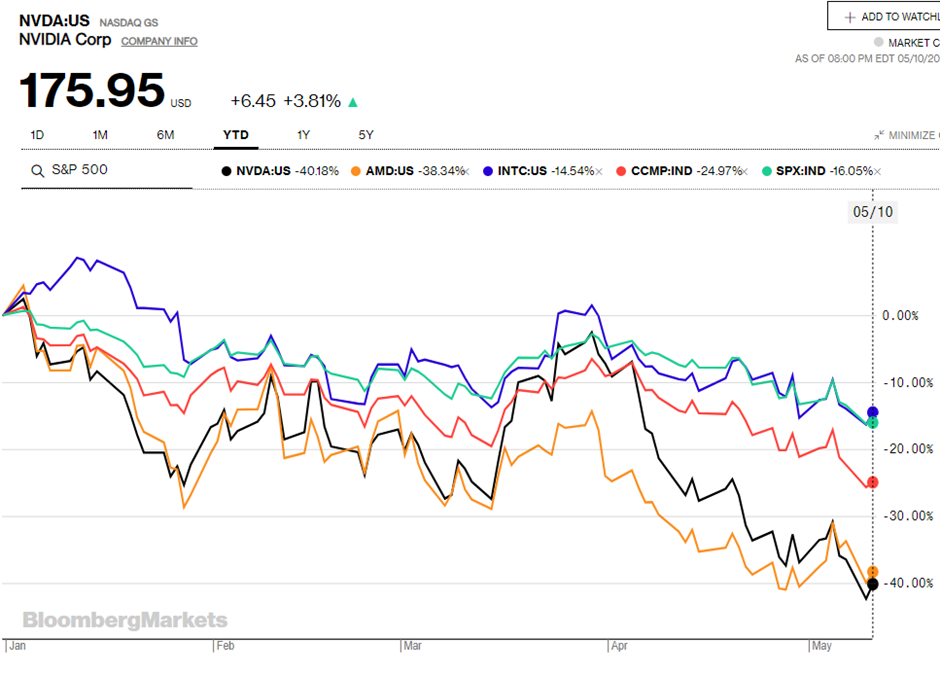

The prices of semiconductor companies have dropped sharply this year amidst a broader sell-off in technology stocks on fears of quickly rising interest rates and higher bond yields. As the chart below shows, semiconductor stocks have dropped much more than the S&P 500 or Nasdaq Composite over the calendar year to date.

Yet over the five years to 11 May, the story is vastly different. Nvidia shares have gained 480 per cent and AMD 660 per cent, easily outperforming the FAANGs and the Nasdaq Composite Index, which has risen 98 per cent and the S&P 500 by 73 per cent. Intel had risen just 25 per cent as its market share gets eroded from younger companies such as AMD. Computer chips are now being used in a huge variety of goods, which makes the semiconductor market more stable than in days past when they were just used in computer.

Many analysts have buy recommendations on both Nvidia and AMD. According to Wall Street Journal consensus data, of the 45 analysts recently surveyed, 37 rate Nvidia as Buy or Overweight, while 25 out of 40 analysts rate AMD as a Buy or Overweight.

The Wall Street Journal’s Heard on the Street column recently ran this headline after AMD’s first-quarter earnings results. “AMD Gets Bigger, Better and Cheaper”. The drop in AMD’s share price “has made AMD something it hasn’t been in years—cheap,” WSJ columnist Dan Gallagher wrote.

“At around 22 times forward earnings, the stock now trades at a 25 per cent premium to the [benchmark] PHLX Semiconductor Index after averaging a 96 per cent premium over the past three years. Fellow high-growth chip maker Nvidia also has lost about a third of its market value this year in a sector-wide selloff, but it still carries a premium of 93 per cent to the broad index,” Gallagher wrote.

AMD said its sales jumped 71 per cent in the first quarter and its US$6.5 billion in sales was well ahead of analyst expectations of US$6.38 billion. With Nvidia due to report on May 25, we could see similar impressive results.

The well regarded semiconductor analyst Bernstein analyst Stacy Rasgon recently put an outperform rating on AMD with a $150 price target. “At this point AMD’s operating margins are substantially higher than their larger peer [Intel], their cash generation potential is more powerful, their road maps appear more reliable, and their gauge of near-term risks appears far better,” Rasgon reportedly said.

AMD’s market share for laptop central processing unit (CPU) chips had reportedly climbed to nearly 20 per cent in the third quarter of 2021 from a low of under 5 per cent six years ago, Bernstein says, citing data from Mercury Research and his own analysis. “The quality of AMD’s portfolio continues to improve … AMD’s desktop CPU are now, on average, on par with Intel’s,” he said.

AMD shares have ballooned from roughly $2 when Bernstein last had an “outperform” rating on them in 2012 to a high of about $160 in 2021 today and around $90 today, an ascent Rasgon called “the absolute biggest missed call in our entire Wall Street tenure.”

Zach columnist Derek Lewis also favours AMD over Nvidia. He says AMD shares have displayed a higher level of defence throughout the tech meltdown than Nvidia. “The company is trading at more attractive valuation levels, has higher forecasted earnings growth, and has a higher overall VGM score. Additionally, AMD’s long-term earnings growth is forecasted to be much higher than Nvidia’s,” he said.