FPA and AFA members vote an overwhelming ‘yes’ to merger proposal

Advisers have voted conclusively in favour of combining the two major industry associations, with the union between the Financial Planning Association and the Association of Financial Advisers set to be legally completed in a little over a month.

After years of declining membership bases and growing frustration with disparate representation to policymakers, 96.5 per cent of AFA members and 96.7 per cent of FPA members voted to merge the two groups at an extraordinary general meeting held in Sydney Tuesday afternoon.

The proposal required 75 per cent of the votes in the affirmative in order for it to proceed.

“Our members have recognised the importance of having a strong, single voice representing them to government, regulators and other stakeholders,” commented Sam Perera, AFA president. “A merged association gives us a united voice at a crucial turning point for our profession, including the proposed changes from the Quality of Advice review.”

The respective boards of the two associations voted unanimously in favour of the merger, which was first proposed in September, 2022.

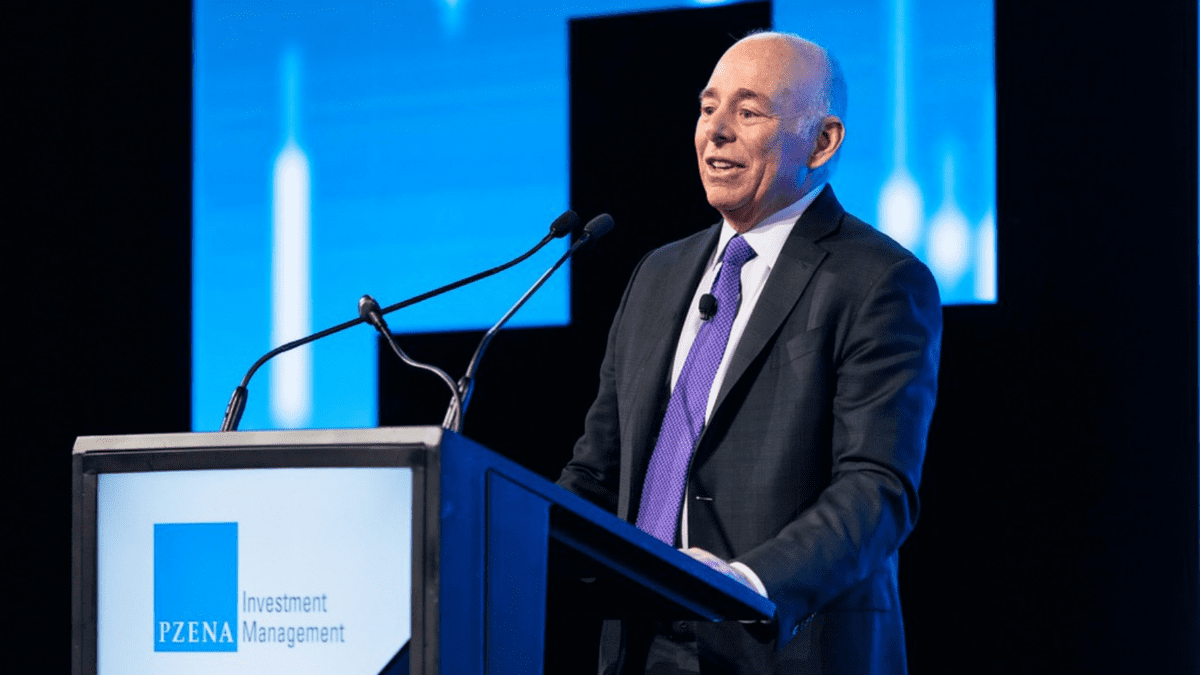

“The boards developed the proposal as they believed a merger for the two associations was in the best interests of all members, and of the financial planning and advice profession as a whole,” commented FPA chair, David Sharpe. “We saw substantial benefits from a merger, and it is clear from the vote that the vast majority of members also recognise these benefits.”

The vote marks an “historic” day for the industry, Sharpe said, adding that approximately 3,000 members across the two organisations participated in the vote.

“We are coming together at a critical time, when we have a real opportunity to drive much-needed change to strengthen and grow the profession of financial advice. I want to thank all members of the AFA and FPA who have engaged with us, asked many great questions along the way and taken the time to make their voices heard. You have put your trust in us to create a larger and stronger association to represent you, and we will be doing our utmost to deliver.”

The new merged entity will be called the Financial Advice Association of Australia. A transitional period between the two groups will run between April and June, with a new brand and logo to be completed in the span.

FPA CEO Sara Abood will retain her position as leader of the merged entity.

The AFA’s education offering, the Fellow Chartered Financial Practitioner (FChFP) designation, will be discontinued while the FPA’s Certified Financial Planner (CFP) designation will continue.

The transition is expected to be complete by 1 July 2023.